Drafting debt collection letters can be tricky and intimidating, but doesn’t have to be. For business owners looking for guidance on how to draft a collection letter, this article provides helpful instructions and templates you can use to help collect on past due accounts.

What Is a Debt Collection Letter?

A debt collection letter is a written communication from a business to a customer that notifies them of an outstanding debt and demands payment of that debt. The letter typically includes the amount of debt, the date it was incurred, and consequences for non-payment like legal action or late fees.

Debt collection letters are often the first step in the debt collection process. They initiate contact and provide customers with an opportunity to pay before more aggressive collection methods are taken.

Drafting a Letter for Debt Collection

When you’re writing a debt collection letter, remember to keep the tone kind, but firm. Convey professionalism and seriousness, but don’t appear threatening.

There are some things you always need to include in order for the letter to be successful. You must always make clear what is owed. If you can, include an itemized receipt including any late fees will be helpful.

Be sure to include clear payment options, as well the deadline before you will initiate legal action. Make the action you intend to pursue explicit as the consequence of not paying.

Key Points to Include

- What is owed

- Itemized breakdown of the debt

- How to pay the debt

- Date to you intend to escalate the situation

- The consequences of this escalation

What to Avoid

Never make your debt collection letter personal. That will both make it unprofessional, and destroy any chance you have of maintaining a working relationship with your customer.

Don’t use vague language. In order for your letter to be effective, it needs to be crystal clear what is owed and how to pay. Any amount of ambiguity makes it easier for your debtor to ignore the debt.

Never make any threats, explicitly or implicitly. Not only is this an unprofessional and unbecoming way of collecting debt, it is plainly illegal. It is illegal to threaten or harass a debtor when collecting debt, or make any false statements regarding the situation.

Always Avoid

- Threats of illegal acts

- Threats of action you will not take

- Any false statements

- Harassment of the debtor

Two Types of Debt Collection Letters

- Reminders

- Formal Notices

Reminders

The first kind of debt collection letter you should send are reminder letters. The purpose of these is simple, yet they are incredibly important. Remind your customer that they owe you and make it clear how they can pay.

Send your first reminder letter a couple days after payment is due. Importantly, you don’t want to wait too long after payment is due. You want to get this resolved quickly.

The second reminder letter should be sent a few days after the first. You want to allow for the time it takes for your debtor to receive and react to the first letter, but not too long that the urgency of the situation slips away.

Formal Notices

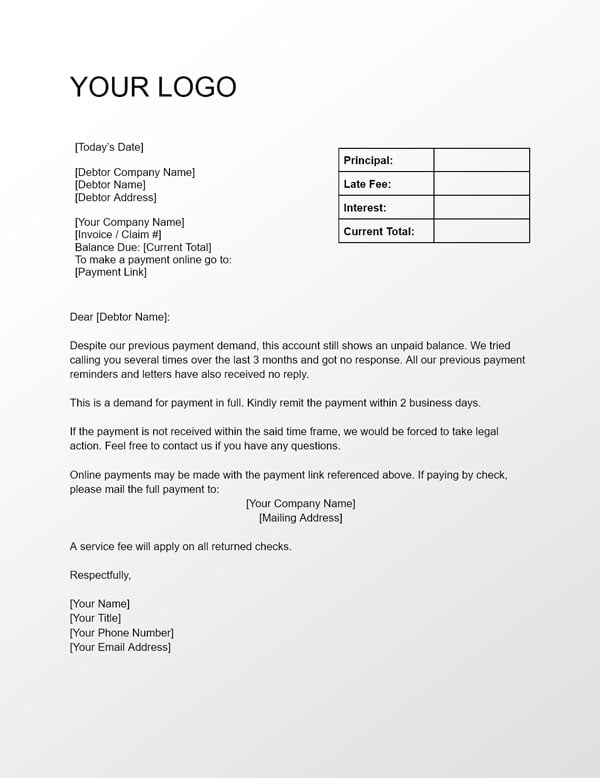

Formal notices, or pre collection notices, are the next type of letter to use.

A formal notice informs your debtor that you are taking legal action, usually sending them to a collections agency. It is the last correspondence before legal action begins.

Imagine the situation where a client has not paid their account. You’ve sent the first reminder, to no response. You waited a few days before sending the second reminder. Still, there is no response. This is when you’ll turn to a formal notice.

It’s important to send the formal notice before the date you initially said you would pursue legal proceedings. This maintains credibility and professionalism in your debt collection process.

Hiring a Collection Agency

Sometimes, it doesn’t make sense for a business to try and collect the balances it’s owed. It may be too difficult, too time consuming, or take away too dramatically from the value the business generates. As a small business owner, you may just want the burden of collections to be taken off your plate. In these situations, it may make sense to hire a debt collection agency.

Debt collection agencies will work to collect the debt you’re owed, usually for either a flat fee or a percentage of the debt. Utilizing a debt collection agency can be an incredibly effective way to collect, and can relieve your business from being bogged down.

We researched dozens of agencies to choose the best small business debt collectors. We looked at a variety of factors such as reputation, cost, customer service, and experience. We read customer reviews, industry reports, and consulted with experts in the field.

Benefits of Debt Collection Agencies

- Professional expertise

- Takes the burden of collections off your mind

- No fee unless they collect

Issues With Collection Agencies

- Lack of control over their process

- Could damage customer relationship

Most Useful Collection Letter

Debt collection letters are useful because they are the most resource efficient debt collection strategy. The ratio between the amount of your effort you expend and the likelihood you will collect is better than most debt collection methods.

Debt collection letters communicate that you mean business. When done well, they convey professionalism, clarify the situation, and most importantly get you paid without lawyers or collection agencies.

Strengths of Debt Collection Letters

- They create a sense of urgency

- They help avoid costly legal action

- They set expectations

- They create a clear record of communication

Final Thoughts on Collection Letters

When you need to collect debt, begin with reminders. They require the least amount of energy and resources, and more often than not will get the job done.

When reminders don’t work, then send a formal notice. This amplifies the situation, and hopefully will spur your customer to take action.

Then, if your customer still doesn’t pay, you are left with two choices:

- Legal action

- Or seek help from a debt collection agency

Each approach has its own merits, and could make sense depending on your particular business situation. Luckily, with debt collection letters, you should be able to collect on most overdue invoices.