Between fintech platforms and traditional banks, you’ve have never had more options for free business checking accounts. But not all free checking accounts are created equal.

To choose the best free business checking accounts, we evaluated dozens of banks and services while considering factors like transaction limits, interest rates, and fees. Ultimately, the best free business checking accounts offer a combination of flexibility and affordability.

Best Free Business Checking Accounts

1. Bluevine

Not only is their standard business checking account free, but you can actually earn up to $5,000 in interest each year with Bluevine. While the majority of checking accounts––both business and personal––pay little or zero interest, Bluevine Standard pays 2.0% APY interest on balances up to $250,000.

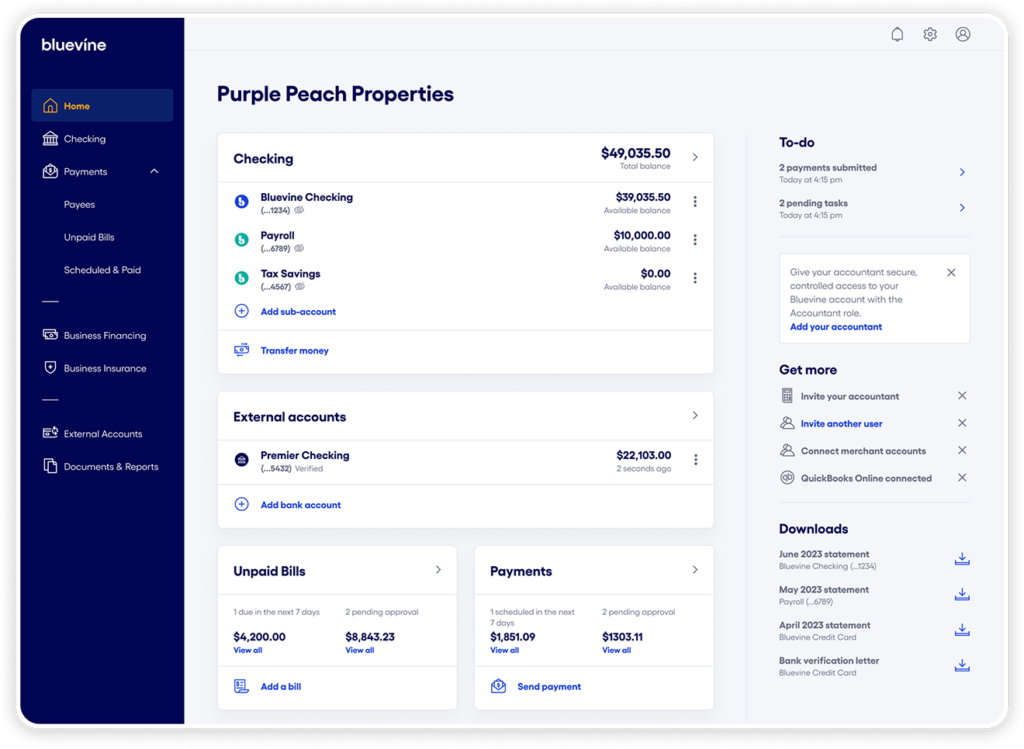

Currently, Bluevine offers two options for business checking: Bluevine Premier offers higher interest rates and exclusive benefits for a $95 monthly fee. Their free option, Bluevine Standard Business Checking, gives you everything you need including free access to ACH, incoming wire transfers, and two free checkbooks each year.

Clients with a Bluevine Business Checking account can now issue a maximum of four extra debit cards to individuals they have authorized to use their account. This feature is accessible via the Bluevine dashboard, and accommodates both new and current authorized users.

Account admins have the ability to oversee all associated debit cards through their primary dashboard. Additionally, admins will be informed via email notifications at each point during the process of issuing and managing debit cards. For improved transparency, transaction details will include specifics on who initiated each debit card transaction.

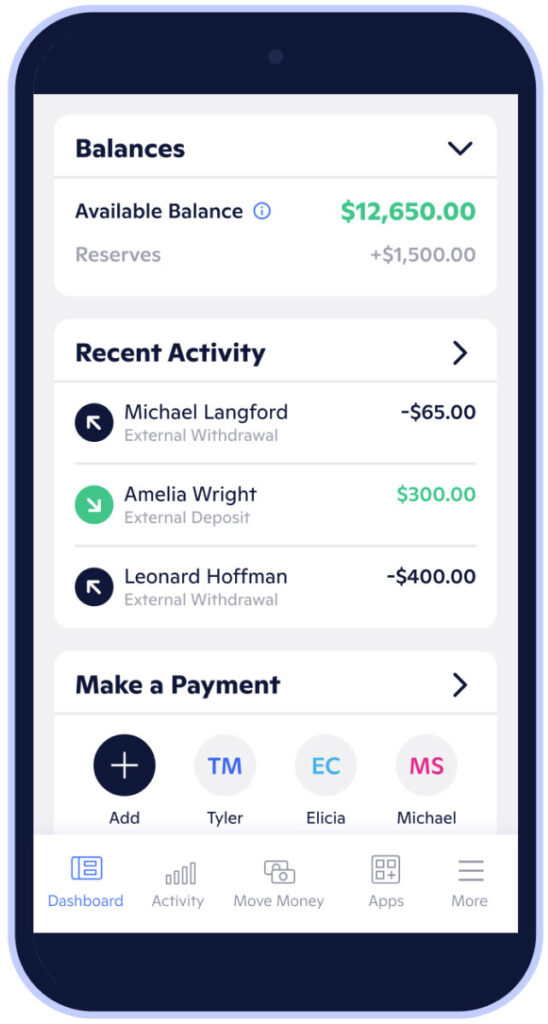

In addition to one-time payments, a Bluevine checking account also allows you to set up recurring payments or use a credit card for payments. With the Bluevine mobile app, you can also make mobile check deposits, set up transfers, and monitor your account.

Similar to our runner up, Grasshopper, Bluevine has no physical branches; however, between its expansive ATM network and cash deposit capabilities, you might find yourself no longer requiring visits to brick-and-mortar locations.

Bluevine also offers unique business lines of credit that you may find beneficial for your organizational needs. With the ability to provide up to $250,000 in extra funding, Bluevine could become your go-to for fiscal support. It stands out in its speed of service, delivering credit decisions in as little as five minutes, enabling swift access to funds with minimal disruption to your operations.

A line of credit from Bluevine functions like a revolving credit account, allowing continuous access to additional funding up to your approved limit. As you pay off your debt, you are free to borrow more. Further simplifying the process is the automatic debt repayment system, which deducts payments from your account weekly, over a term of six to 12 months.

Bluevine Business Checking Features

- No monthly, insufficient fund, or ACH transaction fees

- 2.0% APY on balances up to $250,000

- Cash deposits up to $7,500 per month

- Mobile check deposits and recurring, one-time payments

- QuickBooks, Wave, PayPal, and Stripe compatibility

- Shared account access

- Includes up to additional 5 sub-accounts (6 total)

- FDIC-insured up to $3,000,000

Bluevine Downsides

While Bluevine’s business checking offers many compelling features such as high-interest rates, unlimited transactions, and no monthly fees, it’s not without potential downsides.

Bluevine doesn’t operate physical branch locations, which can be a drawback for businesses preferring in-person banking services. Additionally, cash deposits can be inconvenient since they require the use of third-party services like Green Dot.

That means that businesses with frequent cash transactions or those needing comprehensive traditional banking services might find Bluevine’s free checking offering less attractive.

Bluevine Fees and Terms

Bluevine’s Standard checking account eliminates many of the common fees, including monthly service fees, minimum balance requirements, minimum deposit requirements, insufficient fund fees, transaction fees, and ATM fees (provided the ATM is in the MoneyPass network). Note that there are some fees for certain transactions, such as outgoing wire transfers, check payments and international payments.

2. Grasshopper

Ideal for small businesses, Grasshopper checking accounts allow you to digitally manage just about all of your banking needs. From their quick 5-minute online application process to their impressive lack of traditional fees, this fintech solution can help your business begin to transact more efficiently.

With your Grasshopper account, you can send digital invoices, automate bookkeeping processes, monitor your cash flow, and schedule payments through check or ACH. All of these functions can be accomplished through your smartphone. All of these processes come with no limits or fees, and you can even accept incoming wires at no extra cost.

Grasshopper also comes with some great rewards. Depending on the balance of your account your business can earn up to 2.25% APY. You’ll also earn unlimited 1% cash back when using your free Grasshopper debit card. Finally, Grasshopper offers an array of lending solutions, including access to SBA loans that can be used for acquisitions, expansions, or debt refinancing.

Like many other fintech companies, Grasshopper does not currently support cash deposits; however, its plethora of money management features combined with a stark lack of fees make this company a top choice for small to medium-sized businesses.

Grasshopper Features

- 2.25% APY on balances of $25,000 to $250,000

- 1.51% APY on balances less than $25,000 and over $250,000

- Unlimited 1% cash back on card purchases

- Open an account in little as 5 minutes

- 46,000 in-network ATMs

- No monthly fees or transaction limits

- Intuitive mobile app

- Digital invoice platform

- Instant check deposits

- QuickBooks integration

- FDIC-insured up to $250,000

Grasshopper Downsides

- No cash deposits

- No in-person customer service

Grasshopper Fees and Terms

Grasshopper business checking accounts come with zero monthly fees, transaction fees, incoming wire fees, outgoing ACH fees, or minimum balance requirements. You can also use MoneyPass and SUM ATMs with no additional charges.

3. Novo

For small and medium-sized enterprises, Novo offers business checking solutions that are quick to set up. Novo charges no monthly service fees, no fees for wire transfers, and––while they don’t have their own ATM network––they’ll refund all ATM fees incurred by your enterprise.

Novo also offers integrations with widely used payment apps, business software, and accounting tools. These include Shopify, Google Pay, and Stripe, among others.

Your Novo checking account can serve as the locus of your financial system, whether you access it through the Novo app or browser edition.

If your business needs a cost-effective solution for checking services, then Novo is one of the simplest and most digital-friendly ways to get started. The application takes under fifteen minutes, and approval often happens within the same day.

Novo Payment Options

Offering multiple payment options can be an advantage because it reduces friction during the payment process, enhancing customer experience and improving cash flow. Novo let’s you give your customers many options to pay invoices, which has been shown to increase on-time payments by nearly 250%.

Invoices can be paid by:

- ACH

- Apple Pay

- Google Pay

- Stripe

- Square

- PayPal

- Venmo

- Mailed Check

Novo also offers editable recurring invoices — perfect for subscription services.

Novo Features

- Unlimited transactions with no fees

- Ten-minute application process

- Shopify, QuickBooks, and Square integrations

- Unlimited one-off and recurring invoices

- FDIC-insured up to $250,000

- Refunds on all ATM fees

- Create, send, and manage invoices on your phone or computer

- Intuitive mobile app

Novo Downsides

Unlike some other banks, Novo does not offer interest on your account balances. Additionally, the process for depositing cash can be a bit cumbersome, requiring you to purchase a money order.

- Limited support for cash deposits

- No support for outgoing wire transfers

- $27 overdraft fees

- No interest-bearing accounts

Novo Fees and Terms

In most cases, Novo’s claim of “no hidden fees” rings true. Novo levies no monthly fees, transaction fees, ATM fees, or minimum balance requirements. The only fees you’ll find here are $27 for overdraft charges.

4. Mercury

With a combination of business checking and business savings accounts, Mercury’s online banking platform provides highly customized ways to manage your business financials––all with no fees.

Designed with startups in mind, each Mercury account comes with read and write API access, giving your team the power to create your own financial dashboards, automate payments, and reconcile transactions.

With Mercury, you can digitally send and receive payments, track transactions, and monitor your spending. In addition to your physical debit cards, Mercury also allows you to create virtual ones which can be added to your Apple wallet.

Another feature we appreciated with Mercury is its multi-user access. On both Mercury’s browser edition and app, you can invite an unlimited number of team members to access your account and create individualized permissions for each of them.

If your business has a balance of $250,000 or greater with Mercury, then you can upgrade to Mercury Tea Room. This service tier gives your business free domestic wire transfers, as well as rewards and discounts with various software services. For example, Tea Room members currently can receive 30% off a QuickBooks Online subscription, 30 free days of a ShipStation subscription, or a $100,000 credit to Amazon Web Services.

Mercury Features

- No minimum balance requirements

- No monthly fees, transaction fees, or transaction limits

- FDIC-insured up to $250,000

- Read-write API access

- Checking and savings accounts

- Simple integration with QuickBooks, Xero, PayPal, and others

- Streamlined application process

Mercury Downsides

- No support for traditional cash deposits

- No accounts for sole proprietors

- Low APY on savings accounts

Mercury Fees and Terms

Mercury business checking and savings accounts have no monthly fees, transaction fees, minimum opening deposits, and minimum balance requirement. Mercury also offers fee-free access to Allpoint ATMs, as well as no overdraft fees, incoming wire fees, or fees to send or receive checks.

The only fees you’ll have to worry about are those for outgoing wires: $5 for domestic wires and $20 for international wires. Both of these fees, however, are free for Mercury Tea Room members.

5. First Internet Bank

Founded in 1999, First Internet Bank is a pioneer in the world of online banking. In addition to its personal banking services and lending options, the company also offers business checking accounts with minimal fees.

Their small business checking account, while somewhat limited in features, offers a convenient way for new enterprises to begin transacting.

For starters, First Internet Bank has no minimum balance requirement or monthly service fees. Additionally, if your average daily balance is $10,000 or greater, you’ll earn a 0.50% APY.

And while First Internet Bank doesn’t have its own ATMs, the company will reimburse up to $10 in ATM fees per month on small business checking accounts. They’re also one of the few fintech institutions that supports cash deposits.

For larger businesses, First Internet Bank offers Commercial Checking accounts. This account tier comes with all of the features of their small business checking with the additions of sweep services, wire transfers, payment processing, and remote deposit capture. Commercial Checking customers also get access to First Internet Bank’s Commercial Deposits team for more in-depth financial guidance.

First Internet Bank Features

- FDIC-insured up to $250,000

- No-fee cash deposits

- Up to 0.50% APY on checking accounts

- ATM fee reimbursement

- No transaction limits

- QuickBooks integration

- SBA loans and lending products available

- Savings accounts available

- Same-day ACH payments

First Internet Bank Downsides

- No physical branches or ATM networks

- $100 minimum opening deposit

First Internet Bank Fees and Terms

The account comes with no monthly fees, no minimum balance requirements and unlimited deposits. Small business checking accounts with First Internet Bank require a $100 deposit minimum, though no minimum balance is required. And while First Internet Bank won’t charge any ATM fees, they have no partner ATM network, meaning you’ll have to pay the individual ATM’s fees if you surpass the monthly $10 reimbursement amount.

6. Lili

Built for freelancers and independent contractors, Lili offers a mobile-based checking account that allows you to offload the stress of managing budgets, payments, and taxes. Lili also requires no minimum balances and no hidden fees.

The first thing to note about Lili is that the service is completely mobile. While other providers on this list offer browser-based banking or in-person services, Lili lives completely on either your iOS or Android device. This service also requires you to apply for an account with your Social Security number––as opposed to an EIN––further driving home the point that Lili is meant for contractors and sole proprietors.

Once your account is up and running, you can use Lili to categorize your expenses, transfer funds from third-party apps, integrate online platforms, connect external bank accounts, and track your income versus expenses.

Lili also provides users with a Visa business debit card with neither service nor transaction fees. You can use this card to withdraw funds at any MoneyPass ATM without incurring fees.

Lili offers a premium service, Lili Pro, that offers invoicing features, overdraft protection, and a savings account with a 1.00% APY. This service, however, costs $4.99 per month.

So while Lili is certainly not the right fit for businesses with more than one employee, this intuitive, app-based service can help freelancers and contractors regain control of their finances.

Lili Features

- No monthly or transaction fees

- Early payments on direct deposits

- Cashback rewards on the Lili debit card

- Expense management and tax prep tools

- FDIC-insured up to $250,000

- Integration with PayPal, Venmo, and Cash App

- Overdraft protection on Lili Pro

Lili Downsides

- $6,000 monthly check deposit limit

- Maximum of six check deposits per month

- $500 daily and $1,000 monthly transfer limits

- No sending or receiving of wire transfers

Lili Fees and Terms

The Lili bank account has no monthly fees, no minimum balance requirements, no minimum opening deposit requirements, and unlimited fee-free transactions. There are, however, some caveats. Lili users can only deposit up to $6,000 in checks per month or six total checks. Additionally, transfers are limited to $500 per day and $1,000 per month.

7. Ramp

We know this is a guide about free business checking accounts, but thought Ramp deserves to be included. Unlike the other companies on this list, Ramp does not offer checking accounts. Ramp provides a business credit card that earns cash back on all spending and offers a robust suite of bookkeeping-related benefits that goes beyond what a traditional business credit card typically offers. The card also doesn’t charge an annual fee, regardless of how many employees you have.

Running on the Visa network, the Ramp card requires neither a personal guarantee nor annual fees on either the primary cardholder or additional employee cards. Credit limits will vary based on your company’s cash flow, but no matter what, you’ll earn 1.5% cash back on every Ramp card purchase, as well as additional discounts on services from the likes of Slack and AWS.

The primary benefit of Ramp comes from its native analytics tools. By connecting your business’s cards, bills, accounting, and other financial data in one place, Ramp allows you to more quickly and efficiently track your expenses and close your books. These same tools can also analyze your spending habits and identify ways in which your business can save. For example, if you’re currently subscribed to duplicates of a program, Ramp can flag this and help you consolidate. Alternatively, it could even identify a similar service that comes at a lower price.

The main downside of Ramp would have to be its entry requirements. To qualify for a Ramp card, your business will have to have a minimum balance of $75,000 in a U.S. bank account. Additionally, this card functions as a charge card, meaning businesses that wish to carry a rolling balance might want to consider other options.

Ramp Features

- 1.5% cash back on all card spending

- Detailed, automated financial reports

- No annual fees or foreign transaction fees

- Automated accounts payable services

- Integrations with QuickBooks, Xero, and Sage

- Free and unlimited virtual employee cards

Ramp Downsides

- Cannot be used by sole proprietors

- Minimum account balance of $75,000 required to apply

Ramp Fees and Terms

The Ramp card requires no annual fees, and it earns 1.5% cash back on every purchase. It also offers fee-free foreign transactions.

8. Digital Federal Credit Union

Based in Massachusetts, Digital Federal Credit Union (DCU) offers a business checking account that is both free and interest-bearing. Particularly for businesses based in the northeast, DCU can combine the remote capabilities of fintech with the human touch of in-person services.

For starters, DCU business checking accounts require no maintenance fees or minimum balances, and they also offer a 0.10% APY. DCU will also provide up to four Visa debit cards for your account and unlimited check writing with no additional fees.

If your business is in the Northeast, you’ll also have access to their proprietary ATMs, as well as their handful of branches in both Massachusetts and New Hampshire. Beyond DCU ATMs, you can also make use of free access to Allpoint, SUM, and CO-OP ATMs.

You can manage your DCU business checking account through either the DCU website or their mobile app. In addition to business checking services, DCU also offers business savings accounts, money market accounts, and certificates of deposit, as well as lines of credit and business loan options.

DCU Features

- In-person locations and proprietary ATMs

- Savings and investment account offerings

- No monthly maintenance fees

- Business credit card options

- Unlimited check writing

- DCU Visa debit cards available

DCU Downsides

- Fees for over 20 daily deposits

- Membership limited by region and organizational affiliation

DCU Fees and Terms

DCU requires no minimum amount to open a business checking account, and they also charge no maintenance or other transaction fees. The exception to this rule, however, is a 10-cent fee per transaction after you’ve exceeded 20 daily deposits.

9. Capital One

Capital One business checking is a fit for small-business owners who are looking for comprehensive banking from a brick-and-mortar bank. The company offers two business checking accounts, Basic Checking and Unlimited Checking. Both include fee-free in-network ATM access, the ability to send and receive wires, as well as online and mobile banking.

For small business, however, we find that Basic Checking provides a cost-effective way to get up and running. With unlimited digital transactions, a basic account from Capital One allows you to remotely deposit checks from your smartphone, as well as obtain real-time account information 24/7. This account also allows you to send electronic payments to vendors for free.

The main drawback of the Basic Checking account would have to be its monthly fee of $15. That said, if your account has a regular balance of at least $2,000, then this service fee is waived. As your business grows, you can always use Capital One to transition to the Unlimited Checking account, giving you no-fee cash deposits and free domestic wires.

Currently, Capital One business checking accounts are available in Connecticut, Delaware, Louisiana, Maryland, New Jersey, New York, Texas, Virginia, and Washington, D.C. To apply for one, you must visit your local branch in person.

Capital One Features

- Unlimited digital transactions with no fees

- 70,000 fee-free ATMs throughout the U.S.

- Scalable checking account options

- Free cash deposits up to $5,000

- Free electronic payments to vendors

- Mailed and mobile deposited checks

- Free Capital One debit cards

- Overdraft protection

Capital One Downsides

- $250 minimum opening deposit

- Requires minimum balance to be free

- Available only in a handful of states

Capital One Fees and Terms

Both Capital One business checking accounts have a monthly fee, $15 or $35, though they can be waived if the minimum balance is maintained ($2,000 for Basic and $25,000 for Unlimited). Additionally, the Basic Checking account charges $1 for every $1,000 of monthly cash deposits in excess of $5,000, as well as $15 and $25 for incoming and outgoing wires, respectively.

10. Chase Business

With more locations than any other bank in the U.S., it’s likely that Chase has a branch in your area. And between their three different tiers of business checking accounts, they have solutions for enterprises of any size.

With a low $15 fee that’s easily waived (see below), we recommend Chase Business Complete Banking for most small business users. With this type of account from Chase, you’ll have access to unlimited:

- Electronic deposits

- ACH transfers

- ATM transactions

- Debit card transactions

- Internal transfers

- Mobile check deposits

With Chase QuickAccept, their payment processing platform, you can even accept credit card payments directly into your account. You can also request multiple business debit and deposit cards for team member use.

Requirements to Waive Monthly Fee

- $2,000 minimum daily ending balance

- $2,000 in eligible purchases from your Chase Ink Business Card

- $2,000 in eligible deposits from your Chase QuickAccept®

Additionally, upon opening your Chase Business Complete account, you’ll receive a $300 bonus for either depositing $2,000 or more into your account or completing five or more qualifying transactions, including ACH, wires, or QuickAccept deposits.

Chase Features

- No fees for ATM or debit card transactions

- No minimum opening deposit

- Unlimited electronic deposits and transfers

- $300 bonus for opening an account

- Access to 16,000 Chase ATMs and 4,700 branches

- Low-cost credit card processing

Chase Downsides

- $15 monthly fee (in some cases)

- Fees for cash deposits in excess of $5,000 per month

- No overdraft protection

Chase Fees and Terms

While Chase’s $15 monthly fee for Business Complete Checking is not ideal, this fee can be waived by maintaining a balance of $2,000 or greater or by purchasing $2,000 or greater on your Chase business cards.

Other Chase checking fees include cash deposits. Each month, after exceeding $5,000 in cash deposits, you’ll pay $2.50 per every $1,000 deposited. And while electronic deposits are unlimited, you’ll only get 20 fee-free physical transactions per month before being charged 40 cents per additional transaction.

Luckily, if these fees start to add up, implying your business is running a large number of transactions, you can always upgrade to Chase’s Performance Business checking account, which comes with 250 fee-free transactions per month.

Future of Free Business Checking

During the Covid-19 pandemic, when most in-person operations were halted, many business leaders learned the importance of a digital banking experience.

While fintech solutions for business checking had existed prior to 2020, their popularity has accelerated. As of 2021, almost 90% of Americans use fintech in one form or another.

Even traditional banks have hopped on board and streamlined their web-based banking operations, making it clear that the future of free business checking will be digital.

Mobile Apps

Even if your checking provider offers in-person services, you’ll likely find yourself accomplishing a variety of tasks through their mobile app.

Daily tasks like checking your balances, depositing checks, and transferring funds can all be accomplished from your smartphone, putting a company’s app at the center of their banking process.

Faster Decisions

In the same way that technology has decentralized banking processes once conducted in-person, tech solutions have also accelerated the nature of these transactions.

Investing funds, opening new accounts, applying for new lines of credit, and integrating accounting software have all become quick and simple processes.

Most digital banking solutions also allow for multi-user access, allowing other members of your team to participate in checking account processes.

Better Customer Service

You might assume that a shift to digital banking solutions might lead to impersonal or even nonexistent customer service, but both banks and fintech platforms alike are working to digitize exceptional customer experiences.

Chatbots and video calls work to improve remote communication, while digital analytics tools allow users to more efficiently track their expenditures and balances.

While these services are no replacement for an accountant (not yet, at least), they demonstrate the banking industry’s push to better help business owners manage their money and move it more efficiently.

Paid vs. Free Business Checking

While few banks and fintech platforms charge monthly fees for checking accounts––and these fees can usually be waived––the phrase free business checking can be a bit misleading. In lieu of monthly fees, many free business checking accounts come with other financial constraints:

- Minimum opening deposits: Some checking platforms require a minimum initial balance in order to open an account. In many cases, this amount is either zero or negligible.

- Transaction limits: Some platforms––large banks, in particular––charge fees after your account performs a certain number of transactions. For example, Bank of America charges nothing for the first 200 transactions and then levies 45 cents per transaction.

- Cash handling fees: If a platform accepts cash deposits, then they may charge you each time you put cash (as opposed to transfers or check deposits) into your checking account. Some platforms charge a set amount per cash deposit while others charge a rate based on the amount deposited.

- ATM fees: Most checking accounts will come with free access to an ATM network. If a checking platform has proprietary ATMs (a Chase ATM, for example), then they won’t charge fees for using them; however, you’ll also want to consider the fees for using out-of-network ATMs.

On the plus side, you’ll find that many free business checking accounts offer interest on your balance. Some even offer cash bonuses for opening an account.