Factoring companies can provide you with the cash your need to cover expenses and keep your business running. When your business relies on steady cash flow to purchase inventory and pay employees, clients taking their time paying invoices could make you worry about making ends meet.

We understand these are not easy times. To help, we interviewed dozens of factoring services and evaluated them based on market share, advance rate, funding speed, industries served, and customer service reputation. Let’s get into our top picks of the best invoice factoring companies.

Best Invoice Factoring Companies

| Factoring Company | What We Like |

|---|---|

| Riviera Finance | Friendliest customer service and true non-recourse |

| OTR Solutions | Best for freight factoring |

| altLINE | Low rates |

| eCapital | Quickest funding |

| SMB Compass | Variety of funding options |

| Porter Freight Funding | High advance rate |

| Factor Funding Co. | Caters to women- and minority-owned businesses |

1. Riviera Finance

Riviera Finance prides itself on its speed of funding, reliability and flexibility. Riviera Finance services a range of industries, including trucking, wholesalers, staffing, and manufacturing.

Riviera emphasizes the stability of their own business as a selling point, claiming to have turned a profit every year since 1969 — and is still under their original ownership. With decades of experience, their team is extraordinarily knowledgeable while still being friendly and easy to talk to.

Expect Riviera’s contract to be shorter and easier to read than most factoring companies.

| Advance Rate | 95% |

| Discount Rate | Starts at 2%, volume discounts available |

| Recourse or Non-Recourse | Full-service, non-recourse factoring |

| Speed of Funding | Within 24 Hours |

| Revenue Requirements | No minimums, up to $2 million in monthly sales |

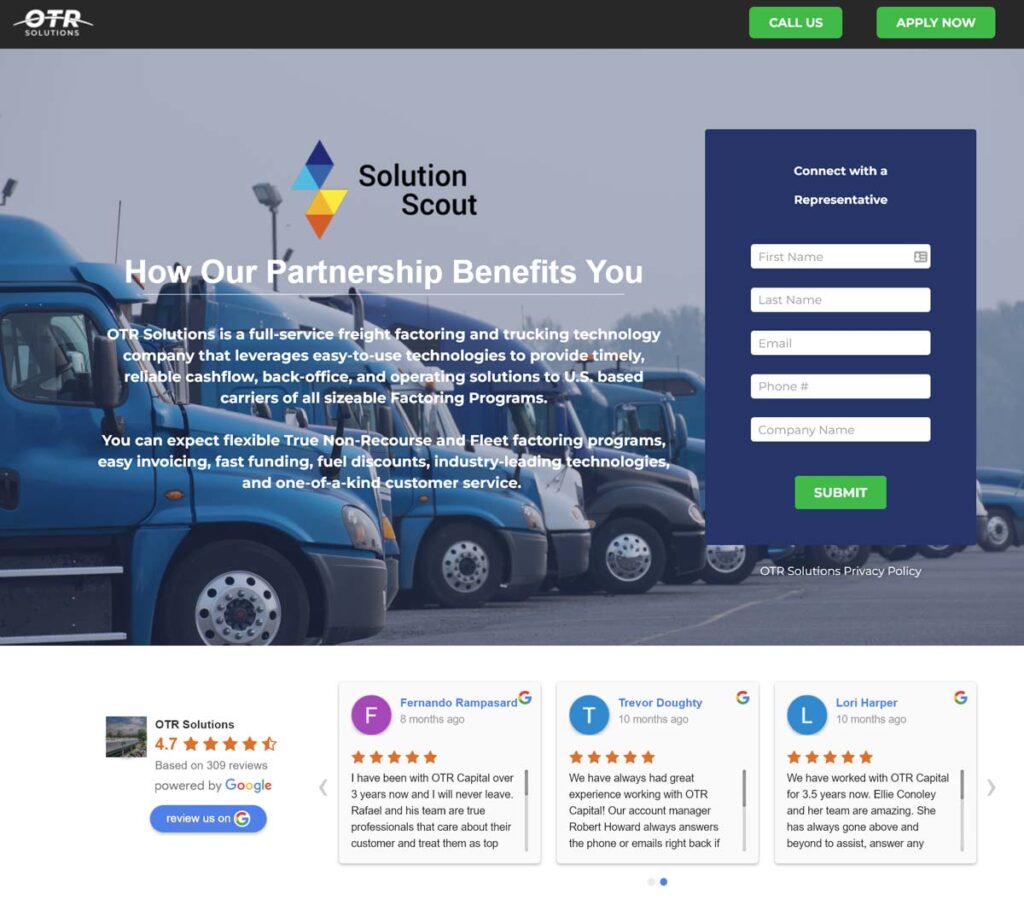

2. OTR Solutions

OTR Solutions (formerly OTR Capital) is our top choice for freight factoring. They have a portal that makes it easy to check your customer’s credit. It’s available online 24/7, and it’s as simple as entering your customer’s MC number. OTR also offers a wide range of services including fuel cards, tax assistance, equipment financing, and insurance.

OTR has a mobile app to help with factoring services while on the go. Within the app, uploads, data, notes, and paperwork can all be managed. OTR’s technology based approach makes it easy to streamline processes and get work done while you’re out of the office.

Funding with OTR Solutions is usually within 24 hours, but there’s also an instant funding option. A bonus is the ability to get deposits even on most bank holidays.

| Advance Rate | Up to 100% |

| Discount Rate | From 1% to 4% |

| Recourse or Non-Recourse | Recourse and non-recourse are both available |

| Speed of Funding | Within 24 hours, or instant funding option is available |

| Revenue Requirements | No minimums |

3. altLINE

altLINE is the invoice factoring side of The Southern Bank Company, a community bank based in Alabama. Since altLINE sources its funds directly from its parent bank, rather than a 3rd party lender or source of funding like many factoring companies, factoring funds are sourced directly from altLINE to you. This helps keep costs low, and with FDIC secured funds, gives you an extra level of financial protection.

It’s important to note that altLINE does NOT work with trucking, transportation or freight companies, which is a massive departure from most other factoring companies. We don’t see this as a negative though, as it gives altLINE focus and the ability to offer great rates in other industries.

| Advance Rate | 90% |

| Discount Rate | Between 0.5% and 3% for the first 30 days. If the invoice is still outstanding after 30 days, the discount rate increases incrementally, capping out at 5%. |

| Recourse or Non-Recourse | altLINE is a recourse factor |

| Minimum Credit Score | 500 |

| Speed of Funding | Proposal within 24 hours of application approval, and then receive funds within 24 hours of proposal agreement |

| Revenue Requirements | $15,000 to $4 million a month |

4. eCapital

eCapital offers the quickest funding of all the factoring providers we reviewed. They offer immediate funding on new invoices and a revolving line of credit through their partnership with Visa — allowing for instant access to funds.

Unlimited credit checks are available for both recourse and non-recourse factoring. eCapital’s database contains information on over 40,000 companies. It’s a great way to check out clients beforehand and mitigate risk.

eCapital works when you do and their back office support is available even on weekends. They also have an onboarding process to walk new clients through their platform.

To make your choice easier, they currently offer a 90 day trial period.

| Advance Rate | Up to 100%, one of the highest in the industry |

| Discount Rate | Between 1% and 5% |

| Recourse or Non-Recourse | Non-recourse factoring is available |

| Speed of Funding | Immediate funding and revolving line of credit |

| Revenue Requirements | Rates and fees may be determined based on income |

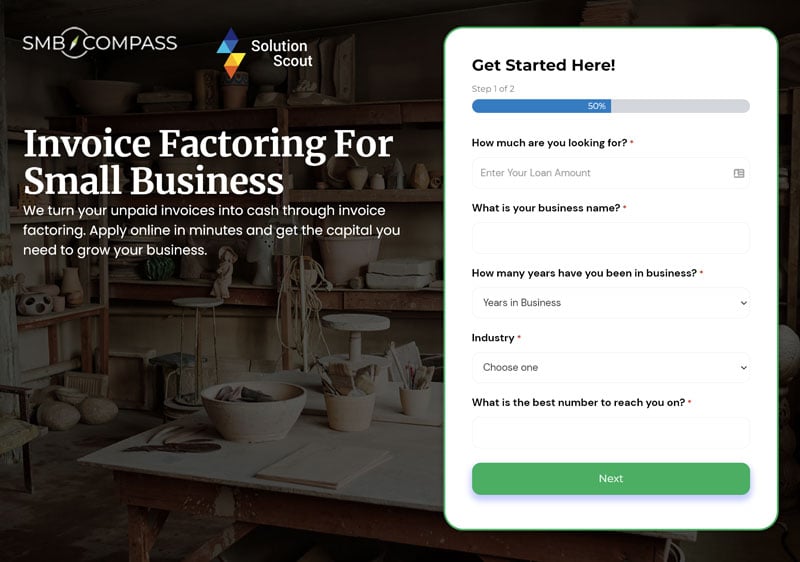

5. SMB Compass

SMB Compass is our top choice for construction factoring. A benefit of working with SMB Compass is that you’ll be able to access all types of capital including invoice factoring, bridge loans, and equipment financing.

SMB Compass primarily helps a broad range of industries which includes commercial construction, trucking and logistics, staffing, wholesale, distribution, manufacturing, and government contractors.

In addition to their friendly and helpful customer service, one thing that stands out is that factoring with SMB Compass is very flexible. Their invoice factoring programs include both notification, non-notification, and revolving line of credit options.

Other features include:

- Same day funding

- No minimum monthly volume commitments

- No long term contracts

- Fuel cards with average savings of 45¢ per gallon

| Advance Rate | Up to 97% |

| Discount Rate | Starting at 1% |

| Recourse or Non-Recourse | Non-Recourse and Recourse Available |

| Speed of Funding | Same Day |

| Revenue Requirements | $10,000 per month |

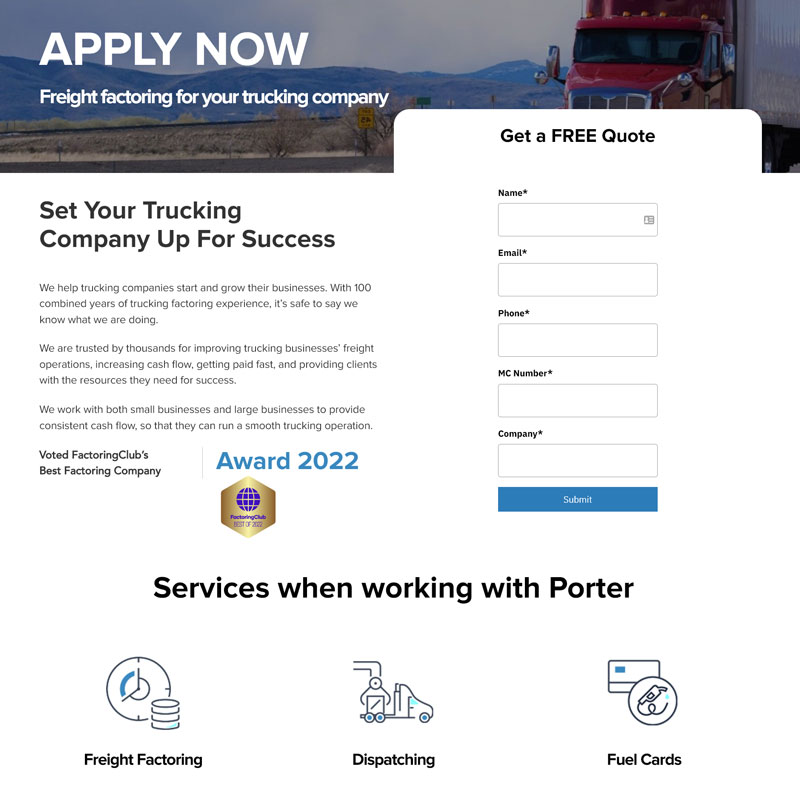

6. Porter Freight Funding

Porter Freight Funding works exclusively with trucking companies and owner-operators to offer funding solutions, such as freight factoring and fuel advances. Porter can also bill your non-factored loads at no cost, which lets you keep all your paperwork in one place.

Unlike many freight factoring companies, you don’t need to sign a long-term agreement with Porter Freight. They also offer free online credit checks for brokers and shippers.

Other features include:

- Funding via same-day wire or next-day ACH.

- Automated weekly payments, so you do not have to request funds.

- TripPak and Translo services provided at no additional cost.

- Flat rating pricing, so your costs will not increase if a customer takes too long to pay.

- Discounted fees for signing a six-month or one-year agreement.

- Online account access.

- Benefit from strategic partnerships including dispatching, insurance, compliance, and discount fuel cards.

| Advance Rate | Up to 100% |

| Discount Rate | Usually between 1% to 3% |

| Recourse or Non-Recourse | Both are available |

| Speed of Funding | Same day funding through ACH, wire, or fuel card |

| Revenue Requirements | No minimum on 1-2 trucks |

7. Factor Funding Co.

Factor Funding Co. can help you get cash advances on invoices ranging from $10,000 up to $10,000,000 per month.

Factor Funding is accredited by the BBB and carries an A+ rating with zero customer complaints. They specifically cater to small-to-midsize businesses, particularly those that are women- and minority-owned, making it a great resource for companies who may not meet the revenue requirements of other factoring companies.

Factor Funding Co. refers to invoice factoring as “accounts receivable factoring,” but rest assured, you’ll still be receiving the same service.

| Advance Rate | Between 70% and 95% |

| Discount Rate | 0.5% to 3% |

| Recourse or Non-Recourse | Non-recourse factoring is available |

| Speed of Funding | Initial funding can take up to a week, and once your contract is established 24 to 48 hours is usual |

| Revenue Requirements | No minimum requirement |

What to Look For in a Factoring Company

Invoice factoring involves selling your client’s invoice to a factoring customer for an advance rate, or a percentage of the invoice amount upfront (most factoring companies have advance rates between 70% and 95%). Once the client fulfills the invoice, the factoring company then pays the remainder of the invoice to you, minus an agreed-upon finance fee (usually between 1% to 5%).

Rates and Fees

The most important rates to keep in mind while shopping for a factoring company are the advance rate and discount rate. You can use our Dollar Cost Calculator to compare proposals from competing factors.

The advance rate is how much you receive upfront from the sale of the invoices. This rate can vary between industries, with general B2B businesses having advance rates of 70% to 85%, construction factoring around 80% to 90%, and trucking companies as high as 90% to 97%.

The discount rate is the cut the invoice takes as payment after the invoice has been filled by your client and the remainder of the invoice is paid to you. These rates are generally between 1% to 5%, though some companies like altLINE advertise rates as low as 0.50%.

Most factoring companies use a variable rate structure, with rates raising the longer the invoice is outstanding. It is possible to negotiate a flat rate with your factoring company if your client has a proven track record of on-time payments, but the overall rate can end up being a bit higher.

Some invoice factoring companies roll all fees into their discount rate, but it’s important to double check just what additional fees you may be signing up for. For example, most invoice factoring agreements have some form of early cancellation fee.

Some companies have an initial setup fee, which can be pricey (as much as $2,000), but is a one time charge, while other companies have regular maintenance fees outside of the discount rate. If your business relies on physical documents or wire transfers, there may be additional fees to accommodate any extra steps taken by the factoring company to handle these processes.

Related: Invoice Factoring Rates, Fees & Costs

Recourse vs Non-Recourse

Invoice factoring works on the assumption that the client will fulfill their invoice within a certain timeframe, generally between 30 and 90 days. However, if your client ends up not paying their invoice, whether that financial responsibility falls on your company or the factoring company depends on whether you have a recourse or non-recourse agreement.

We have a full breakdown on recourse and non-recourse factoring, and the pros and cons of both options, but here is the main difference between the two: recourse factoring agreements mean that if the invoice goes unpaid, your business is responsible for recouping the funds and buying back the invoice; non-recourse agreements means that the factoring company with assume the loss of any revenue, and you won’t be required to buy anything back.

With non-recourse agreements, it’s important to keep in mind that if your client does default on payment, you will not receive the discount rate.

Since non-recourse factoring is far riskier for the factoring company, they come with higher discount rates and more stringent credit checks and requirements. While about 80% of factoring companies offer some form of recourse agreement, companies that offer non-recourse can be few and far between, but are usually more established and have more capital to work with.

Funding Guidelines

One of the advantages of invoice factoring opposed to traditional business loans is that, since the responsibility for payment is not on your business, but on your client, the minimums for approval are not nearly as stringent. Invoice factoring companies generally just want to see that your business is not in dire financial straits and has a little bit of history behind it.

Most invoice factoring companies run credit checks, with minimum scores ranging from 500-600, and require proof that your business has been operational for 3-12 months on average. This usually means sending over your most recent bank statements. These bank statements are also used to determine revenue requirements, which vary based on the industry the factoring company specializes in.

Some invoice factoring companies will run credit checks on your client’s business to determine terms, since ultimately, it is the client that will be responsible for the factoring company being paid.

Since invoice factoring is generally used by businesses that require funds fast, most companies pride themselves on speedy applications and fund deliveries. Most invoice factoring companies have applications that take less than ten minutes, mainly asking about the type of business you run and how much your monthly revenue tends to be.

After approval, most companies advertise being able to get funds to you within 24 hours. Some may require you to approve a proposal before funds are distributed. Some invoice companies may take a few days to set up the first payment, but subsequent payments generally will arrive on time with little hassle.

Choose the Best Factoring Company

Invoice factoring remains one of the most popular financing options for B2B businesses. It can be an important resource in keeping your company’s revenue consistent, even if your clients are slow to fulfill invoices or have run into economic issues of their own.

With their lower barrier of entry compared to traditional business loans, invoice factoring can be a great resource to keep your cash flow steady and your team members paid, but it’s not for every business.