As a business owner, you need to track, organize, and record your business transactions. Having accurate financial records will help you leverage your resources and make more effective short- and long-term business decisions.

Unfortunately, many new or small businesses don’t have the budget to pay for a bookkeeping service, or even for bookkeeping software. Spreadsheets rarely have the features to synthesize financial data into useful and digestible information. And for busy entrepreneurs that already wear a lot of hats, tracking and categorizing every single transaction on a spreadsheet is a waste of time given the alternatives.

Here are our top picks for free bookkeeping and accounting software. This software makes it easy for even busy sole proprietors to track financial information.

Best Free Bookkeeping Software

| Software | Best For |

|---|---|

| ZipBooks | Small businesses whose expenses and earnings come from different projects that need to be categorized |

| Akaunting | Business owners and entrepreneurs that need to work offline, or who need to assign user roles |

| Wave | Freelancers, sole proprietors, and very small businesses that need to track financial data from more than one account |

| ProfitBooks | Small business owners with a sizable inventory and beginners at accounting |

| GnuCash | Users with knowledge of software development and double-entry bookkeeping that need highly customized reports |

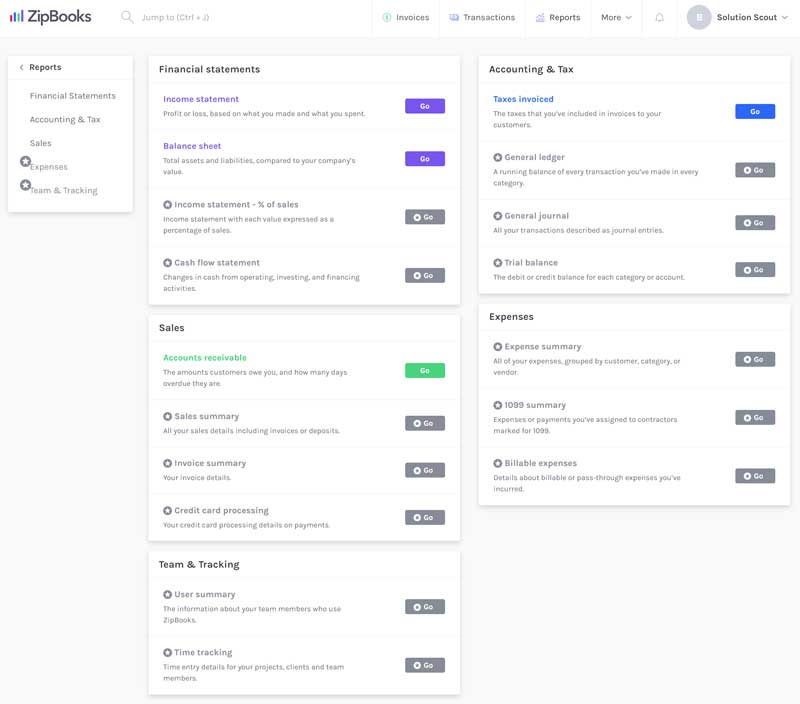

Best for small businesses whose expenses and earnings come from different projects that need to be categorized.

Like Wave, ZipBooks is a web-based platform that will sync with your bank account and automatically import your transactions into the software. The ZipBooks Starter plan is completely free and covers basic bookkeeping activities, including customer invoicing and categorizing expenses.

ZipBooks Features

The auto synching with a bank account will help you keep up with daily transactions. ZipBooks is unique because it offers project tracking, which is invaluable to those businesses that want to know which projects are netting the most loss or income. ZipBooks even allows you to put customizable tags on each transaction for easy keyword searching.

The ZipBooks software integrates with other popular software including PayPal, Square, and Asana (note that you will pay standard rates for PayPal and Square transactions). Unlike Wave, with ZipBooks you can manually track Accounts Payable and other unpaid bills.

ZipBooks Highlights

- The ZipBooks Starter plan includes a time tracking tool, which is useful for invoicing for hours worked.

- ZipBooks allows you to switch between cash and accrual accounting. Accrual accounting is a rare functionality, even among paid bookkeeping software.

ZipBooks Upgrades

ZipBooks offers three paid plans: ZipBooks Smarter ($15/month), Zipbooks Sophisticated ($35/month), and ZipBooks Accountant (custom pricing). All paid plans allow connection with multiple bank and credit accounts, and the Smarter plan allows up to five users.

ZipBooks software can be integrated with Gusto if you’d like to outsource payroll. Gusto payroll starts at $39/month with an additional $6 per paid employee and contractor.

ZipBooks Downsides

The main downside with ZipBooks Starter is that it limits you to only one bank or credit card account and to only one user. You’ll have to upgrade to the ZipBooks Smarter account if you want to sync any more data. ZipBooks also falls short in its ability to generate a cash flow statement.

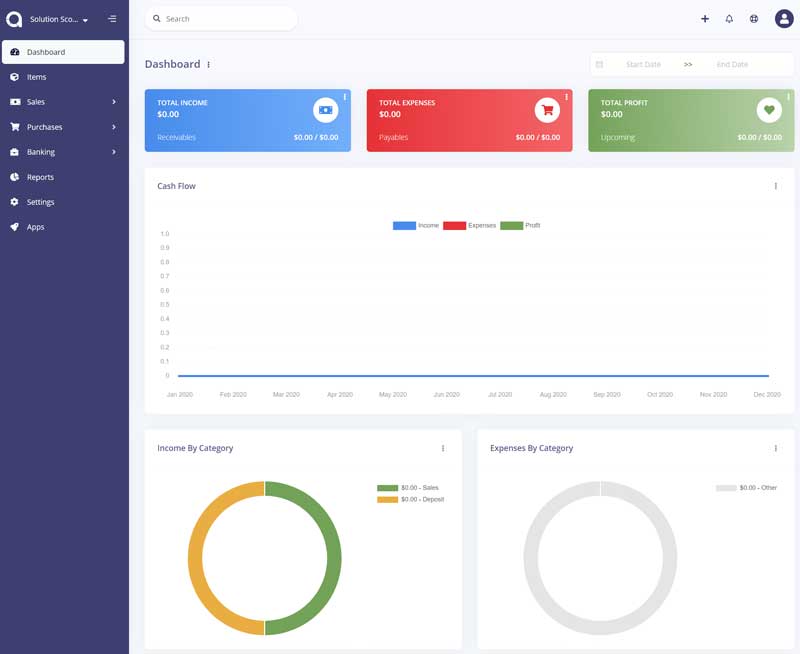

Best for business owners and entrepreneurs that need to work offline, or who need to assign user roles.

Akaunting is an open-source bookkeeping system that differs from Wave, ZipBooks, and SlickPie in that it is both server-hosted and cloud-based. This means that you can install Akaunting on your laptop and work offline, then it will update when you have internet access.

Akaunting has a free plan and third-party apps are available for purchase. Their paid Premium Cloud service offers automations and integrations to help your business.

Akaunting Features

Akaunting has an impressive host of features available entirely for free. Notably, both the desktop as well as the online version allow single-entry accounting. As with the other bookkeeping software, Akaunting will generate financial reports, create invoices, track income, and categorize expenses.

Rather than generating the three standard financial reports (balance sheet, income statement, statement of cash flows), Akaunting generates helpful income, expense, income vs. expense, and tax summaries. The dashboard is also easily customizable.

Akaunting Highlights

- Supports multiple users.

- Users can be assigned custom roles and permissions.

- The desktop feature is excellent for those that don’t always have internet access and need to work offline.

- Because Akaunting is open-source, updates are always free.

- Add multiple taxes when creating invoices or bills.

Akaunting Downsides

The free version of Akaunting lacks the automation of other accounting software. It does not pull data from bank and credit accounts. Rather, you have to download your bank statement via OFX files and import it into Akaunting.

There is also no designated customer support on the free plan. If you need help while using the free plan, you’ll need to rely on the document library and customer forum.

Akaunting Upgrades

Akaunting Premium Cloud is $24 per month. It includes helpful features to help automate repetitive tasks and an enhanced support ticketing system to keep your bookkeeping system on track.

Akaunting Premium Cloud Features

- Bank Feeds

- Address Autocomplete

- Double Entry Bookkeeping

- Unlimited Users

- Billing Calendar

The free version of Akaunting also has integrations with over 65 third-party apps you can use to increase functionality. Most apps have a onetime fee and you may incur ongoing subscription fees depending on the services you connect with. Examples include Nexmo for invoicing, Slack for collaboration, and Documents for storing bills and receipts. There are Akaunting apps available for almost any requirement.

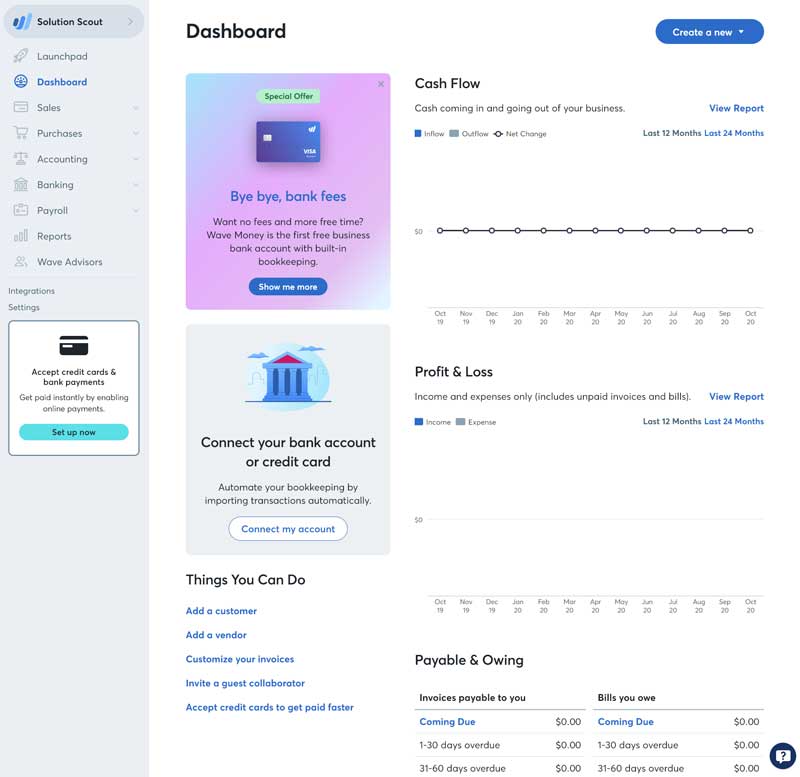

Best for freelancers, sole proprietors, and very small businesses that need to track financial data from more than one account.

Wave has earned a spot on this list because of its features that are available entirely for free on their Starter Plan. Wave uses a cloud-based online bookkeeping software that has a clean, user-friendly layout.

The functionality of Wave is similar to the basic subscription of QuickBooks, the industry standard accounting software. Wave creates real-time financial statements that are always available on your account.

Wave Features

Wave offers bookkeeping and accounting software with no set-up fees, no hidden charges, and no monthly fees.

Wave goes beyond basic bookkeeping by sending reminders when you have a bill due, or when you need to need to collect a payment.

Wave Highlights

- The main highlight of Wave is that can be used as a payment service provider. Accepting payments on the free Starter version of Wave has a relatively high cost of 2.9% plus $.60 per-transaction, but this is still a good option for businesses that don’t have enough sales for a traditional merchant account.

- Wave has two apps: one for invoicing and one for scanning receipts (both available on iOS and Android). These apps automatically sync with your Wave account. Attaching receipts directly to transactions makes tax prep simpler and will save you in case of an audit.

Wave Upgrades

Wave offers a Pro Plan which includes additional features like automated transaction importing, discounted credit card fees, and receipt capture for $16 per month.

If you have employees, it’s good to know that Wave has a payroll service available starting at either $20 or $35 per month, depending on the state in which your business operates. You pay an additional $6 for each active employee and independent contractor.

Wave also has a bookkeeping service ($149 per month), tax service ($129 per month), and accounting coaching ($199 onetime fee) available. This is very convenient should you elect to outsource your bookkeeping and want to stick with the same software.

Wave Downsides

Wave is designed for freelancers and very small businesses. Some online reviews say that Wave will freeze your account if you make large or frequent deposits. If your business earns $200k or more, you should consider upgrading to a software that is equipped to handle more transactions.

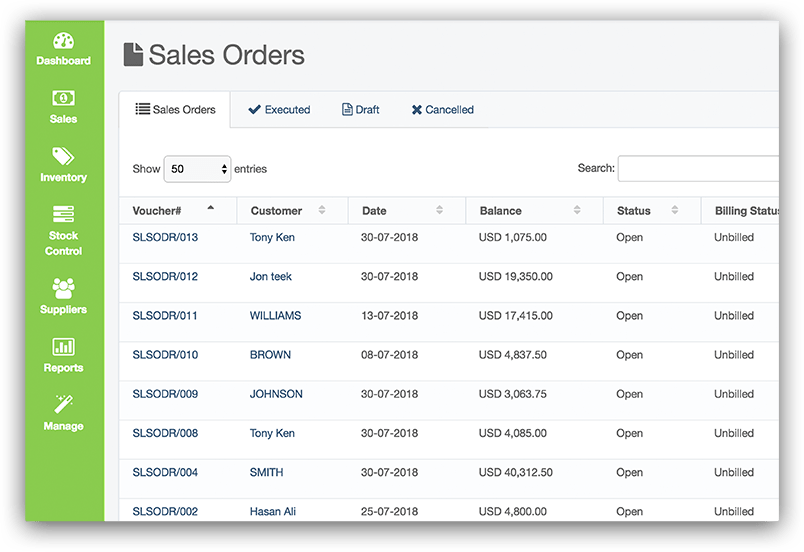

Best for small business owners or sole proprietors with a sizable inventory and for beginners at accounting.

ProfitBooks is a cloud-based bookkeeping platform that prides itself on its user-friendliness. With a clean and simple user interface, it’s ideal for entrepreneurs who are less knowledgeable about accounting and want a streamlined experience that allows you to focus less on crunching numbers and more on running your business.

ProfitBooks Features

ProfitBooks offers a robust host of features for free, particularly for inventory. With a focus on automation, ProfitBooks helps streamline your inventory management with features like one-click purchase order conversions. It can even automatically monitor your inventory and alert you if any supplies run low.

Their invoice software is much more powerful than other free softwares, with one of the main perks being automatic tax calculations. This can save you from being blindsided by a huge bill or an audit come tax time.

ProfitBooks invoices are highly customizable, letting you add a logo and industry-specific categories. They also show at a glance invoice due dates and their payment status, so you can have a more accurate picture of your company’s cash flow.

ProfitBooks Highlights

ProfitBooks offers iOS and Android apps, so you can access your inventory through any device, and invoice on the go. ProfitBooks has functionality in virtually every country across the globe, with GST and VAT support, as well as customizable tax options.

ProfitBooks Downsides

ProfitBooks doesn’t connect with bank or credit card accounts, so you’ll need to manually enter all transactions.

The free version of ProfitBooks has a limit of 50 invoices a month, which might not be enough for some companies. ProfitBooks does not offer payroll services, so there is a definite ceiling for functionality if your business expands.

ProfitBooks Upgrades

For $15/month, ProfitBooks offers ProfitBooks SMB, which lets you send unlimited invoices, and add unlimited users. You can also assign users to different roles with different accesses, allowing for a more secure user experience.

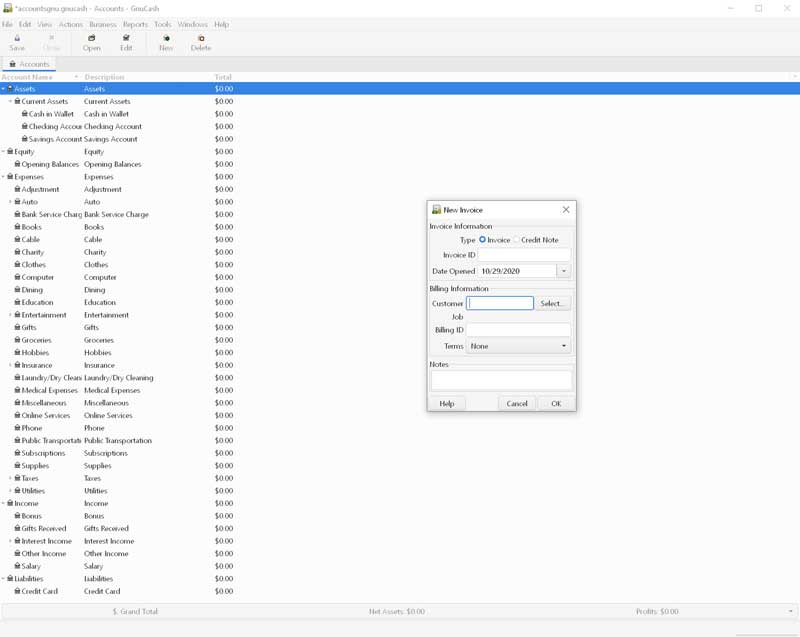

Best for users with knowledge of software development and double-entry bookkeeping that need highly customized reports.

Much like Akaunting, GnuCash is an open-source bookkeeping software that runs on Windows, macOS, and Linux operating systems. To use this software, you must install it on your computer. GnuCash’s layout is most similar to traditional paper books because it uses checkbook-style double data entry.

GnuCash was originally released in 1998, and while some users may find its components outdated, it has proven to be a dependable option.

GnuCash Features

Although GnuCash isn’t cloud based, it automatically backs up all of your data each time that the program is used. It has better report-generating capabilities than the other free bookkeeping software.

As well as the ability to produce the basic financial statements, users that are computer-savvy can create highly customized financial statements. This software is very powerful for those that know how to use it.

GnuCash Highlights

- GnuCash has the best Accounts Payable tracking ability of all the software in this list. Users can assign due dates and run A/P aging reports.

- Track bank accounts, stocks, income and expenses.

- All basic financial statements can be generated from GnuCash.

- Create customizable reports from scratch.

GnuCash Downsides

GnuCash does not have a server-based platform, so users will always need access to their desktop in order to use the program. There is no auto-sync from the bank, so statements must be manually uploaded to the software as HBCI, OFX, or QIF files types. GnuCash does not have dedicated customer service, although it has extensive online forums that users may find helpful.

GnuCash Upgrades

There are no upgrades available for GnuCash, although users can hire a developer to create customized reports.

What to Look For in Free Bookkeeping Software

At a minimum, bookkeeping software should assemble your financial data into basic financial statements such as statements of profit and loss, cash flow, and balance sheets.

It should also allow you to customize a chart of accounts into which you can categorize your expenses. Your categorized expenses and financial statements hold the information that your CPA will need to complete your taxes.

While many of the free software options in this guide offer add-ons that will cost you extra, the base services are all free so you can decide if you want to upgrade after getting started. As you choose your free bookkeeping software, pay attention to how easy it is to upgrade services or transfer your data to new software services, should you decide to switch.

When to Hire a Bookkeeping Service

As your business grows in requirements or budget, you may need to upgrade your software. Depending on your type of business, free software may not include necessary functionality, such as the ability to handle payroll or track accounts receivable. When manual work becomes overwhelming for the features that your free software lacks, it’s best to upgrade to an online bookkeeping service.

Some businesses might want to skip the free software altogether, especially those with unique requirements. For example, businesses that have income from various projects likely require a class tracking feature that is rarely available with free software. If your business does a lot of invoicing, go for a bookkeeping service that allows your clients to pay on that same platform.

Final Thoughts on Free Bookkeeping Software

You don’t have a lot to lose when it comes to free online bookkeeping software. So go ahead and try out one or all of the options from this guide. Be sure to keep in mind your current and future business accounting needs.

The sooner that you get your books in order, the better.