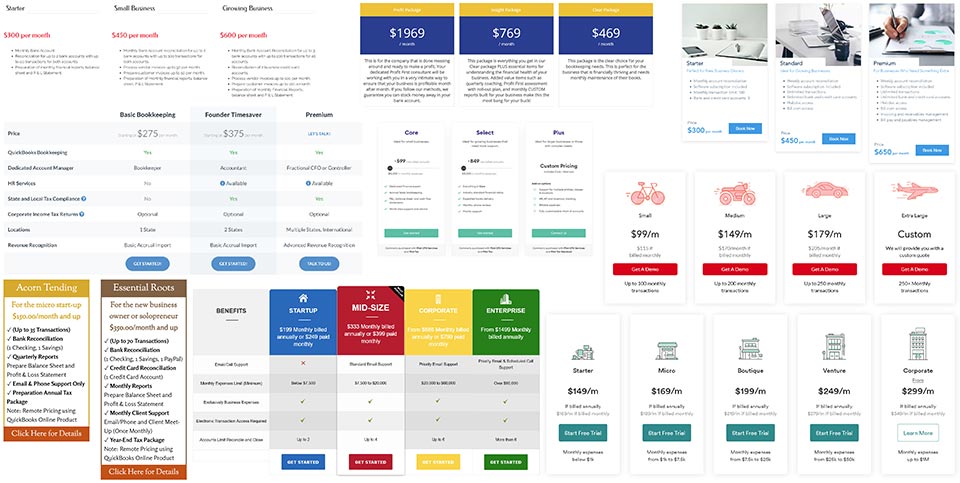

Bookkeeping services use a combination of factors to estimate the time and complexity your books will take to maintain, which is reflected in their pricing packages.

When searching for bookkeeping packages for your business or when forming a new business, there are three primary factors that impact pricing:

1. Number of Accounts

How many bank accounts and credit cards do you use? This also includes payment processing accounts like Stripe or Square.

2. Number of Transactions

How many bank and credit card transactions does your business usually have in a given month?

3. Monthly Expenses

What are your average monthly expenses? How much does your business usually spend on inventory, services, and payments?

Every business requires some form of bookkeeping to keep track of transactions and safeguard cash flow. Accurate bookkeeping is critical to monitor your business expenses and streamline taxes. No matter your budget, you can find a bookkeeping pricing package that works for your business.

If you’re looking for a reputable service with the lowest cost, check out Maxim Liberty. They’ve been in business since 2005 and give you options for monthly, weekly, or daily updates

Bookkeeping Pricing Packages Overview

Sort the table below to compare popular outsourced, virtual, and online bookkeeping services that offer pricing packages. Below the table you can find details about each service including information about their add-on services, such as payroll processing and tax returns.

| Transactions | Cost per Month |

| 165 | $195 |

| 250 | $299 |

| 400 | $449 |

| 1,000 | $999 |

Acuity is an online accounting and bookkeeping firm that provides small businesses with financial clean-up, bookkeeping, tax and accounting services to small businesses. Acuity’s bookkeeping pricing packages also include basic tax support with the option to include add-ons to customize your services. Acuity’s plans also include 30 minutes of advisory service with a CFO each month.

Add-on Services

Personal and Business Tax Returns

Support for individual and business taxes start at $150 per month, which includes a federal and one state tax return. Each additional state costs $50 per month.

Historical Bookkeeping Clean-up

Retroactive clean-up for business finances can be added to your services for a rate of $125 per hour.

Bill Pay

Get assistance with your business’s bill payment starting at $200 per month.

Payroll

Payroll services for small businesses starts at $250 per month depending on the number of employees and complexity of business needs.

Invoicing

Assistance with customer invoicing for small businesses starts at $250 per month.

Collections

Get additional collections support for a starting rate of $50 per month.

| Bench Plan | Includes | Price |

|---|---|---|

| Essential | Monthly Bookkeeping | $299 |

| Premium | Bookkeeping & Taxes | $499 |

Bench is the largest online bookkeeper. They offer a powerful and user-friendly bookkeeping platform. Their new pricing packages are differentiated by the optional inclusion of tax support from an in-house professional. Both plans include virtual support from a professional bookkeeper as well as reporting functionality for better insight into business financials.

| Accounts | Transactions | Cost per Month |

| 2 | 100 | $140 |

| 4 | 200 | $305 |

| 8 | 400 | $485 |

Beyond Paper Profit Advisors offer both bookkeeping and administrative services for small businesses. In addition to bookkeeping services, Beyond Paper Profit Advisors offer a number of add-on services to customize your pricing package.

Add-on Services

Accounts Payable and Receivable

Get assistance with vendor payments and customer invoicing with a starting rate of $100 per month.

Additional Bank Accounts and Credit Cards

Add additional bank accounts and credit cards to an existing bookkeeping package for a per-account rate of $15.

Addition Transactions

Add one or more blocks of 100 transactions to extend existing bookkeeping packages for $25 per block.

Money Market Reconciliation

Get additional reconciliation support for a money market account for $30 each.

| Transactions | Cost per Month |

| 100 | $99 |

| 200 | $149 |

| 250 | $179 |

Bookkeeping Zoom combines bookkeeping services with robust reporting functionality to give business owners better insight for business decision-making. All Bookkeeping Zoom pricing packages include payroll import, projects profitability tracking, annual or quarterly budgets and accounting software set-up.

| Accounts | Transactions | Cost per Month |

| 2 | 100 | $469 |

| 5 | 250 | $769 |

| 5 | 500 | $1,969 |

Clear Accounting is a Washington-based firm offering bookkeeping services along with business consultation and tax preparation support for small and medium sized businesses. Bookkeeping service packages include payroll for employees and/or contractors.

Add-on Services

Business Consulting Services

Business consulting services include cash flow management, business valuation, strategic business planning, and new business formation for an hourly rate of $150. Small business accounting services start at $95 per hour.

Tax Services

Tax services include tax preparation and planning, back taxes owed, payroll tax troubleshooting, IRS payment planning and IRS wage garnishment for a rate of $150 per hour.

| Accounts | Transactions | Cost per Month |

| 2 | 50 | $300 |

| 2 | 50 | $450 |

| 5 | 200 | $600 |

| 5 | 300 | $1,000 |

CMW Tax Services provides tax preparation, IRS tax resolution, bookkeeping and payroll services to individuals and small business owners. In addition to bookkeeping services, CMW Tax Services also offers add-on services to help you get on top of your business finances.

Add-on Services

Payroll Processing

- 1 to 10 employees: $150 per month

- 11 to 20 employees: $200 per month

- 21 to 25 employees: $300 per month

- 26 to 40 employees: $500 per month

- Payroll setup: $250+ per month

Quickbooks Subscription

- Simple Start: $25 per month

- Plus: $80 per month

- Advanced: $180 per month

Payroll

Clean-up bookkeeping services are also offered at an hourly rate of a flat fee, based on needs.

| Accounts | Transactions | Cost per Month |

| 3 | 250 | 235 |

Custom Accounting is a New York based accounting firm offering bookkeeping services to small business owners. In addition to standard bookkeeping services, Custom Accounting offers enhanced services for an additional hourly rate, as well as tax preparation services.

Additional Services

CPA Consultation

Get advice from a certified public accountant at a rate of $185 per hour.

Bookkeeping Consultation

Get additional support from a bookkeeping professional for $95 per hour.

Payroll

Payroll services are also available at a variable rate depending on business needs.

Tax Preparation

Tax preparation services start at $159 for basic through to corporate and partnership returns.

| Accounts | Transactions | Cost per Month |

| 2 | 25 | $125 |

| 3 | 100 | $300 |

| unlimited | unlimited | $450 |

Infinity Bookkeepers is an Arizona-based firm specializing in bookkeeping services for start-ups, small businesses and non-profit organizations. Clients can add services to their standard bookkeeping packages at an additional monthly rate.

Add-on Services

Invoicing & Receivables

Invoicing and receivables add-on services include online invoicing through Bill.com, including invoice creation and delivery. $150 per month.

Bill Pay & Accounts Receivable

Bill pay and accounts receivable services include paperless payables through Bill.com, including custom bill payment processes based on business needs and synchronization with your accounting system. $150 per month.

Project Management

Project management services provide greater insight into your business’s financial health with income and expense tracking on a per-project basis and specialized profitability reports for each project to see which projects are most profitable. $100 per month.

| Transactions | Cost per Month |

| 100 | $425 |

Innovative Accounting offers virtual bookkeeping and accounting services to small business owners nationwide. All bookkeeping pricing packages include a personal CPA advisor, personal and business tax returns, and monthly bank and credit card reconciliations.

| Accounts | Transactions | Cost per Month |

| 2 | 300 | $575 |

| 3 | 500 | $675 |

| 4 | 700 | $775 |

Juanita Bookkeeping Group uses a simplified, remote bookkeeping system to streamline your business financials. Beyond standard bookkeeping services, Juanita Bookkeeping Group also offers a 20% discount for clients who set up AutoPay for their monthly payments.

Additional Services

Catch-up Bookkeeping

Get help with your bookkeeping clean-up on a yearly basis for a fee of $1975.

| Accounts | Transactions | Cost per Month |

| 1-3 | 100 | $395 |

| 4-6 | 200 | $595 |

| 7-9 | 300 | $795 |

KPMG Spark uses a robust bookkeeping platform to facilitate online, on-demand bookkeeping support. Each pricing package includes a dedicated account representative that is available to provide bookkeeping help whenever you need it. KPMG Spark includes features for payroll, tax preparation, invoicing and payments.

| Expenses | Cost per Month |

| < 15k | $325 |

| 15k – 30k | $395 |

| 30k – 50k | $485 |

| 50k – 80k | $600 |

| 80k – 120k | $750 |

Kruze Bookkeeping only provides virtual bookkeeping services for funded start-ups. In addition to bookkeeping, Kruze offers HR support, CFO services, financial modeling services and tax support.

Additional Services

CFO Services

Start-ups requiring additional financial consultation and support can get expert advice and support from experienced, part-time CFOs.

Tax Services

Start-ups can choose from four tax service tiers starting at $1,500 per month for small start-ups with no major fundraising through to later-stage startups who have completed at least 3 rounds of fundraising for $5,000 per month.

| Accounts | Transactions | Cost per Month |

| 2 | 25 | $250 |

| 2 | 100 | $500 |

| 4 | 200 | $950 |

| 4 | 300 | $1,450 |

Ledgers Online is a virtual bookkeeping service offering four pricing tiers for small to medium businesses. All bookkeeping pricing packages for Ledgers Online include payroll services, accounts payable, sales and payroll tax filing, check preparation, Help Desk access and LedgerDocs access.

| Maxim Liberty Plan | Features | Monthly Price | Additional Hours |

|---|---|---|---|

| Monthly Updates | Up to 5 hr/mo | $50 | $10/hr |

| Weekly Updates | Up to 10 hr/mo | $100 | $10/hr |

| Daily Updates | 20 hr/mo, AP/AR, Sales Tax & Payroll | $200 | $10/hr |

| CPA Plan | 30 hr/mo, Unlimited Clients | $225 | $7.50/hr |

Maxim Liberty Bookkeeping Services is an experienced virtual bookkeeping service provider catering to businesses and accounting firms. They support cash or accrual accounting on all plans and offers options for monthly, weekly, or daily updates.

Each Maxim Liberty plan comes with a dedicated supervisor as well as a named bookkeeper. The supervisor acts as your main point of contact and oversees the work of the bookkeeper, ensuring quality.

All Maxim Liberty plans include:

- Cash or accrual accounting

- Unlimited accounts

- Data entry

- Categorization

- Bank reconciliation

- Financial reporting

| Accounts | Transactions | Cost per Month |

| 2 | 35 | $150 |

| 4 | 70 | $350 |

| 7 | 130 | $585 |

| 9 | 250 | $1,100 |

Oak Tree Owl Bookkeeping offers bookkeeping packages at fixed monthly fees for entrepreneurs and small business owners. All remote bookkeeping packages use Quickbooks Online and include yearly tax preparation support.

| Accounts | Transactions | Expenses | Cost per Month |

| 3 | 100 | < 100k | $200 |

| 5 | 150 | 100k + | $360 |

| 5+ | 225 | 100k + | $500 |

Peace of Mind Accounting is a virtual bookkeeping service supporting small business owners nationwide. In addition to bookkeeping packages, Peace of Mind Accounting also offers 1-to-1 training and consultation along with add-on bookkeeping services.

Additional Services

PayPal

Get additional bookkeeping support for PayPal transactions for an additional fee of $50 per month.

Personal Bookkeeping

Combine your small business bookkeeping needs with personal accounting support for an additional $100 per month.

Training and Consultation

Get expert support and training on how to use Quickbooks, or speak with an Accountant about office systems and financial processes for $100 per hour.

| Accounts | Expenses | Cost per Month |

| 4 | < 30k | $599 |

| 4 | 30k – 60k | $649 |

| 4 | 60k – 100k | $719 |

| 4 | 100k – 150k | $809 |

| 4 | 150k – 200k | $899 |

Pilot Bookkeeping is an online bookkeeping service that offers standard bookkeeping packages as well as custom packages for businesses with unique bookkeeping needs. In addition to bookkeeping, Pilot offers CFO and tax services for businesses looking for enhanced consultation and support.

Additional Services

CFO Services

Offered in both monthly and annual packages, Pilot CFO services are available as a monthly engagement or an annual package. Enhanced annual support includes revenue projections, COGS budget, headcount budget, payroll budget and non-payroll budget services.

Tax Services

Pilot Tax packages include federal corporate income tax filing, Delaware Franchise tax filing, electronic W-9 collection, W8 BEN and W8 BEN-E filing, 1099 Misc filing, email support and free tax extensions. Business owners can also opt for an enhanced yearly package that includes support for entities with foreign subsidiaries.

| Expenses | Cost per Month |

| < 25k | $200 |

| 25k – 150k | $400 |

| 150k + | $600 |

QuickBooks Live combines the industry-leading bookkeeping software with live support from a virtual bookkeeper. All plans include receipt capture, on-demand QuickBooks support and app integration with popular payment processing platforms like Square, PayPal and Shopify.

| Accounts | Expenses | Cost per Month |

| 2 | < 7.5k | $199 |

| 4 | 7.5 – 20k | $333 |

| 6 | 20k – 60k | $666 |

| 6 | 80k + | $1,499 |

New York-based Stilz Bookkeeping offers affordable bookkeeping solutions for businesses of various sizes. In addition to on-site and outsourced services for New York based businesses, Stilz also offers virtual bookkeeping solutions for growing businesses nationwide.

| Accounts | Cost per Month |

| 4 | $400 |

Top Notch Bookkeeping is a remote bookkeeping service for small and medium sized businesses offering monthly and quarterly bookkeeping options as well as payroll and year-end bookkeeping support.

Additional Services

Accounts Payable

Maintain vendor records, enter bills into Quickbooks, prepare checks for business bill pay and prepare the 1099 Misc form for year-end taxes for $300 per month.

Accounts Receivable

Maintain customer records, prepare invoices and process sales tax returns for $300 per month.

Payroll Services

Get additional support with employee payroll on weekly, bi-weekly, semi-monthly or monthly basis for $75 per pay cycle for up to 10 employees – plus $1.50 for each additional employee.

Quickbooks Training and Support

Get expert training on QuickBooks best practices for an hourly rate of $75 for remote and $85 for on-site.

| Accounts | Cost per Month |

| 3 | $109 |

| 5 | $269 |

| 7 | $399 |

VarStan offers complete bookkeeping services for small business owners across the country. VarStan’s bookkeeping services do not include Quickbooks subscription, but do allow clients to enhance their pricing packages incrementally at a cost of $39 per block of 30 additional transactions and $29 for each additional bank account.

| Accounts | Cost per Month |

| 1 | $350 |

| 3 | $650 |

| 3+ | $850 |

Virtual Bookkeeping USA offers online bookkeeping services to small business owners nationwide. Higher-tier pricing includes additional tax support, five hours of special projects support, consulting and bookkeeping clean-up. Additional services can be added on to customize each pricing package.

Add-on Services

Weekly Cash Flow Projection Calls

Get expert support and guidance with weekly consulting calls starting at $25 per week.

Payroll

Clients can add payroll services – including quarterly reports, payroll tax payments and W-2s at year-end – start at $150 per month plus $8 per employee.

| Accounts | Expenses | Cost per Month |

| 1 | < 500 | $75 |

| 2 | 1k | $120 |

| unlimited | 5k | $170 |

| unlimited | 25k | $395 |

| unlimited | 50k | $620 |

Wisconsin-based Westfork Bookkeeping offers bookkeeping services as well as tax and consultation support for small and medium sized businesses. All bookkeeping packages include bank reconciliations, entry adjustments, allocations and the option to enhance services with add-on options.

Add-on Services

Payroll

Get new employees set up for payroll for a flat fee of $175 and on-going payroll support for payroll based on the number of employees. All payroll services include payroll processing, tax deposits, federal and state quarterly reports filing, federal and state annual report filing, and distribution and filing of W-2 forms. Quarterly reports are offered at a flat fee of $200.

Account Catch-up and Clean-up

Based on business needs, account catch-up and clean-up is charged at an hourly rate of $125 including a non-refundable retainer that’s applied toward the hourly fees. Unused purchased hourly blocks are credited to the business owner’s account.

| Xendoo Plan | Features | Number of Accounts | Average Monthly Expenses | Cost |

|---|---|---|---|---|

| Essential | Weekly bookkeeping, Dedicated team | Up to 4 | Up to $50k | $395 per month |

| Growth | Cash or modified accrual, Tax consult | Up to 6 | $50k to $75k | $695 per month |

| Scale | Custom chart of accounts, Deferred schedules | Up to 12 | $75k to $125k | $995 per month |

Xendoo provides online bookkeeping and tax services to small businesses nationwide. Pricing packages are based on company expenses, and upper tiers include business and state tax returns. Xendoo uses either QuickBooks or Xero bookkeeping software and provides clients with access to their accounts via a mobile app. Xendoo also offers payroll (partnering with Gusto).

The Best Bookkeeping Pricing Package

Your business expenses, number of transactions, and number of accounts will determine the cost of your bookkeeping. Many bookkeeping services will allow you to customize your pricing package with add-on services, so consider this option when comparing prices from multiple providers.

Remember to carefully consider what is included in each bookkeeping pricing plan so you are sure to get the accounting, tax and financial consulting you need to grow your business.