Bookkeeping is an essential practice for recording income and expenses and measuring the financial performance of a business. Business owners primarily use bookkeeping to stay organized and make informed decisions. In this article, we will discuss what bookkeeping is, why it’s important, and how to get started.

What is Bookkeeping?

Bookkeeping is the process of recording and organizing financial transactions for a business.

A bookkeeping service maintains accounting and financial documents including ledgers, journals, and financial statements that help you keep track of your income and expenses.

Bookkeeping also organizes your financial information so your CPA can file quarterly and year-end tax returns. Clean and organized books will help in the event of an audit.

Why is Bookkeeping Important?

Bookkeeping is the fundamental task that allows an owner to get the pulse on what’s happening with their business. Accurate bookkeeping tells if your business is winning or losing (and shows what’s hurting your bottom line).

Whether you handle bookkeeping in-house or outsource with a reputable provider, the service a bookkeeper provides will only add value to your business.

If you don’t give bookkeeping the attention it deserves your financial records can quickly become a terrifying mess. What are the consequences of inaccurate financial statements when filing taxes? What happens if you don’t do any bookkeeping at all? Here are a few of the risks and ways to avoid them.

Avoid Cash Flow Issues

A bookkeeper should help you stay on top of cash flow issues by sending you reminders to maintain healthy account balances.

Maintaining healthy cash flow and account balances over time shows that your business is well run. A consistent track record of cash flow and account balances are often the deciding factors when seeking funding.

Accounts Receivable

If your clients and customers aren’t breaking down your door to pay, you’re like most businesses. Regularly updated financial records track your receivables showing you who has your money and exactly when it’s due.

Some customers won’t pay until you force them. Other customers might not know whether they have to pay, or what amount to pay if they never received an invoice or lost the last one you sent. It’s easy to see how a lack of proper records can cause cash flow issues.

Most online bookkeeping services offer integrated invoicing and tracking. Although invoicing can be an add-on service, it’s often worth it. The software can automatically send invoices while also keeping track of payments.

They then send reminder emails at regular intervals to ensure clients are aware of their responsibility. With regular notifications, you’ll find that most of your customers will pay on time.

Accounts Payable

Expenses are another area where you can quickly get into trouble if you neglect your bookkeeping service. Things can quickly spiral out of control without up-to-date information. A good bookkeeper can highlight unusual expenses and help ensure recurring payment amounts are accurate and on-time.

It’s easy to get distracted and forget about bills that need to get paid. Late payment penalties sting, so it’s best to avoid them entirely. A bookkeeper can keep track of everything and give you the confidence that they have done everything on time.

Errors and Omissions

If you handle your bookkeeping and accounting in-house your business faces an increased risk of errors and omissions. You can mitigate the risk by implementing a proven workflow and having staff check each other’s work, but for a small business with limited resources this can be a challenge to maintain.

Bookkeeping services offer a team of professionals to handle each client’s accounts. They also have built-in checks and balances, ensuring they are accurate and efficient.

Internal Fraud, Wage, and Tax Issues

If you think you’re safe from fraud, check tampering, skimming, or misappropriation of funds because you only hire hardworking employees, you need to pay more attention to the facts.

According to a report from the Association of Certified Fraud Examiners, small businesses (those with fewer than 100 employees) suffered a median monetary loss of $150,000 per incident. Since small businesses have fewer anti-fraud controls in place, they suffered the same median monetary loss as companies with 10,000+ employees.

On the other side of the financial spectrum, improper wage payments, incorrect tax deductions, and inaccurate tax reporting can lead to fines and legal judgments. No quantity of pleading ignorance will protect your company from being penalized.

Non-Compliance

Businesses that put all their focus on turning a profit may fall behind in safeguarding their financial success because of non-compliance.

Bookkeeping and maintaining clean financial records is not an area to skimp. Non-compliance repercussions can be severe and costly. Non-compliance leaves your business at risk to lawsuits, forced dissolution, audits, fines, and penalties.

Poor Decision-Making

If you are not reconciling accounts and maintaining financial records, your business decision-making is at a significant disadvantage from a lack of information. Our gut can help guide us, but if you rely on partial or false information, you will make poor business decisions. Weak or absent financial information will stop growth and add unnecessary risks.

Before hiring an employee, it’s essential to ensure you can afford to pay them. If you don’t have an accurate cash flow forecast, you won’t know if it’s safe to hire. You could be at risk of hiring someone that you can’t afford.

The same problem occurs in acquiring tools and investing in marketing. Without a clear picture of your financial situation, it is not possible to tell if your actions are helping or hurting the business.

How to Get Started Bookkeeping

First decide which bookkeeping software you will use. QuickBooks is probably your best option, but Wave is a free bookkeeping software that very small businesses should consider.

Once you decide which program you’ll use, create a chart of accounts which are categories for your transactions. The categories cover both income and expenses.

The last step is to connect your bank accounts and credit cards to the software, which allows you to import your transactions. If you have any questions while getting started, it’s best to ask your CPA.

Maintaining Your Books

It’s good to update your books every month. By keeping track of your finances on a regular basis, you can identify trends and take action to ensure that your business is financially sound.

Categorize Transactions

Categorizing income and expenses helps keep track of your finances. Looking at categories allows you to see discrepancies or changes more easily than all transactions jumbled together.

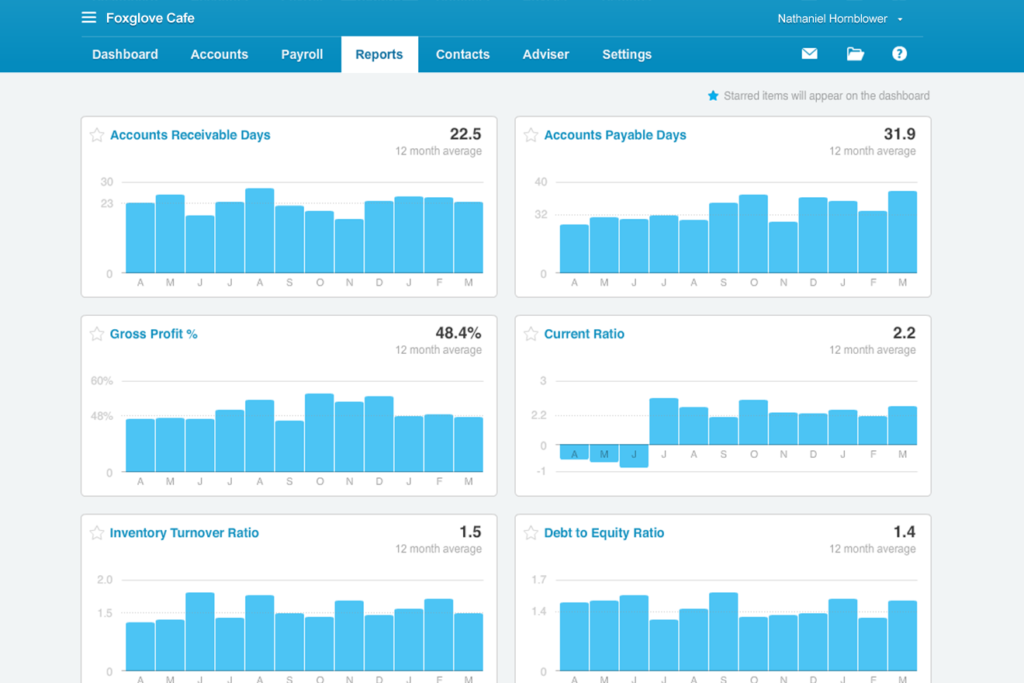

Generate Financial Statements

Once you have categorized your transactions, it’s good to generate reports. These are meant to give you an overview of the financial health of your business. Financial statements include the Balance Sheet and Profit & Loss Statement.

Profit & Loss Statement

The Profit & Loss Statement (also known as the Income Statement or P&L) is one of the most important financial statements for a business. It shows your total income, total expenses, and net income. This statement will help you understand the profitability of your business and make decisions to increase your profits.

When to Use a Bookkeeping Service

If you are overwhelmed with bookkeeping tasks, you may want to consider using a bookkeeping service. They can help you categorize transactions, generate financial statements, and plan for taxes.

Final Thoughts

While bookkeeping is an essential operation for all businesses, it is especially important for small businesses. You need to track the money coming in and going out so you have detailed information for tax filings, profit and loss reports, and more.

A bookkeeping service for small businesses is an advantage. Instead of a traditional bookkeeper, virtual and online bookkeeping services save time, money, and effort by streamlining the process.