A small business collection agency ensures that past due accounts are collected quickly and efficiently. They can help you minimize the risk of bad debt and maximize your chances of successfully recovering money owed to your business.

Debt collection agencies help small businesses make attempts to contact the debtor and negotiate payment plans. They also have the ability to report to credit bureaus, track down debtor assets, initiate legal action, and more.

We researched dozens of companies to find the best small business collection agency. Our research looked at a variety of factors such as reputation, cost, customer service, and experience. We also read customer reviews, industry reports, and consulted with experts in the field.

Best Small Business Debt Collectors

| Debt Collection Service | Best for |

|---|---|

| The Kaplan Group | B2B debt collections over $10,000 |

| Rocket Receivables | Highly regulated industries |

| Atradius Collections | B2B debt collections under $10,000 |

| Prestige Services Inc. | Low rates and flexibility |

| IC System | Medical, utility, and government debt |

1. The Kaplan Group

Known to be one of the best options for commercial collections, The Kaplan Group boasts an 85% success rate, and businesses don’t incur any costs unless they collect. The company specializes in large claims, and they have decades of experience in the industry.

With a thorough and effective debt collection process, their services entail background investigations, skip tracing, credit analysis, and settlement agreements, to name a few. Their services offer much more than that, and they have an in-house law firm in case legal action is needed for debtors who don’t pay.

Standout Points

Offering a step-by-step process for the most cost-effective outcome for small businesses, The Kaplan Group relies on a blend of traditional debt collection practices and legal action.. It all starts with a consultation, and they’ll discuss catered solutions on the best way to collect, given your particular situation.

Consider This

The Kaplan Group doesn’t usually accept claims under $1,000. It’s also required that your first claim is $10,000 or more.

The company doesn’t accept claims pertaining to rent, alternative financing loans, or if you’ve sued the debtor and already got a judgment.

Fees & Terms

Although The Kaplan Group can handle small accounts, their services are set up to handle larger claims, and this reflects in the rates they provide. The company mentions they may not be the best choice if most of your claims are under $1,000. They also have an entry requirement of a claim worth $10,000 or more.

| Claim Value | Fee |

|---|---|

| $1,000 or less | 50% |

| $1,000 to $5,000 | 25% |

| $5,000 to $50,000 | 20% |

| $50,000 to $500,000 | 15% |

| $500,000 or more | 10% |

| Debtor outside USA | 30% |

2. Rocket Receivables

With a focus on a simple, two-stage debt recovery system, Rocket Receivables is well renowned for their easy to use platform and one-fixed fee promise. With the help of TSI, a full-service accounts receivable management system, Rocket Receivables provides customers with cash-flow solutions, data analytics, and courteous service.

Rocket Receivables has experience managing debt collections in a wide range of industries, and they’ve simplified the process by acting as an extension to small business operations with the help of their two-stage process.

You either have the option of up-front fixed fee pricing of Stage 1 or the contingency pricing of Stage 2. Although both options come with a variety of debt collection services, Stage 2 is the better option for accounts that pose a bigger challenge.

With their contingency collection services, they’re a bit more thorough by combining written demands, negotiation with debtors, phone calls, and legal action when needed.

Standout Points

Their customers won’t have to face any set-up fees or minimums when it comes to their claims accounts. Their online portal is an easy way to submit and manage accounts, while also allowing you to monitor their progress.

Rocket Receivables takes a diplomatic approach that protects your relationship with your customers while clearing up your unpaid invoices within an efficient timeline.

More Notable Features

- Dispute resolution, diplomatic approach, and debt validation

- Free screenings for bankrupt and recently deceased debtors

- Sent reminders in your name to help maintain customer relationships and brand image

- Free consultations

Consider This

Although Rocket Receivables takes a fairly hassle-free approach to debt collection, their services aren’t as flexible as some others, as you’re limited to the services included in their two-stage system

Your business may require a more customized approach to your debt collection needs. With Rocket Receivables, there’s a chance you may not need every feature of their two-stage system. Regardless of which stage you choose, you’re subject to the deliverables that come included.

It’s also important to note that any account in Stage 1 will expire twelve months after the purchase date.

Fees & Terms

No matter which collection strategy you choose, you’ll benefit from no hidden costs, an online portal for account management, and enhanced reporting. Rocket Receivables is transparent about how its pricing structure works. Below is a breakdown of how their pricing structure works for Stage 1.

| Number of Accounts | Cost per Account |

|---|---|

| up to 25 | $21.95 |

| 25 to 50 | $17.95 |

| 50 to 100 | $14.95 |

| 100 or more | Contact for a custom quote |

If you end up choosing their Stage 2 services, you’ll only be billed if they collect on the debtor’s account. They also give you the option of transferring unresolved accounts from Stage 1 to Stage 2 at no additional cost.

When they collect on an account, Rocket Receivables will split the recovered amount with you 50/50.

3. Atradius Collections

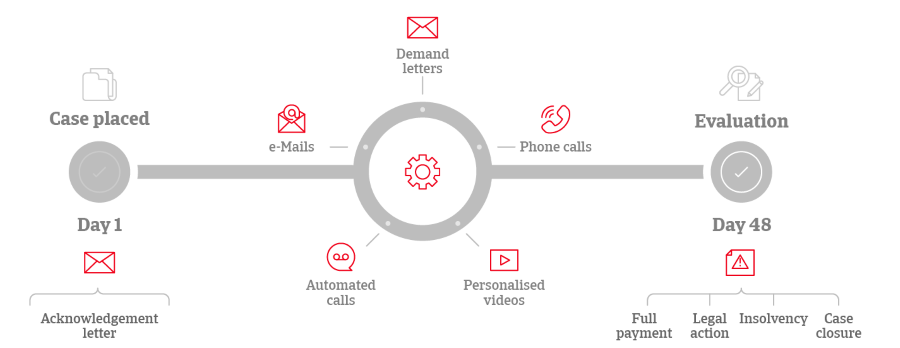

Atradius Collections is a collection agency for small business owners, but they are also known for their international reach and automated approach. From collections, insolvency services, and invoice checking, they offer numerous ways to ensure your invoices get paid.

Atradius also offers Collect@Net, a dashboard that gives you access to their network of multilingual debt collection specialists. The dashboard also allows you to monitor the progress of their collection activities.

Standout Points

Atradius provides each client with a dedicated account manager, so you’ll have a single point of contact throughout every step of the collection process.

They also allow clients to gain access to their debt collection services through other means. For example, those who sign up for their credit insurance get the benefit of their debt collection services at no additional cost. Moreover, they provide a transparent look at their process, so you can see every step they take before making a financial commitment.

Depending on the specific needs of your business, their processes include amicable debt collections, dunning letters, formal litigation, invoice checking, insolvency services, and more.

Businesses have the option of choosing one or more of their services based on the current status of their unpaid invoices. Regarding their collection timeline, expect the process to take 30 to 90 days.

Consider This

If they aren’t able to collect a debt in full, Atradius will consult a business on their other options, but they don’t mention if they waive fees. We recommend getting a quote for your specific case.

Fees & Terms

They only charge an introduction fee based on the location of the debtor, and they also charge a commission on successful collections. For example, an invoice of $1,000 will come with an introduction fee of $55 and a collection fee of $255, which adds up to $690 in collections.

The successful collection fee is based on the location of the debtor, and they also tack on an extra 2% commission for invoices that are 180+ days overdue. You should also know that Atradius requires a retainer from their clients if you want to pursue legal action on a debtor. They may also incur additional fees if you decide to withdraw a case against their recommendation.

4. Prestige Services Inc.

Prestige Services Inc. (PSI) has an excellent track record with pre-collection services, professional skip-tracing, accounts receivable management, and more. With a core focus on B2B debt collections, they rely on a proven multi-layered approach. This includes persistent collection efforts all the way to attorney forwarding and post-judgment debt collection if needed..

Prestige will also help your business keep track of delinquent accounts and you’ll have access to easily check the status of each claim.

Standout Points

Although PSI offers a comprehensive service, there are a few standout points that make them a top choice for businesses in a wide range of industries.

One of the best services they offer is professional skip-tracing, which gives them the ability to source personal information to find the debtor in question. You can also take advantage of their accounts receivable outsourcing, which takes some of the work off of your in-house staff. On another note, they can perform bank account searches on judgment accounts for an additional fee.

- Check and monitor claims on their website

- Accredited with BBB for over 10 years

- In business 27 years

- No fee if they don’t collect

- Attorney forwarding

- 65 years combined experience

Consider This

Prestige may offer average rates that are 5% to 10% lower than other agencies in the industry, but there are a few other caveats that you should know about.

- Minimum claim amount is $200

- Accounts requiring legal action have fees up to 40%

- Return of merchandise incurs a fee of half the normal collection rate

Fees & Terms

| Collection Amount | Standard Rate |

|---|---|

| Up to $3,000 | 25% |

| $3,000 to $20,000 | 22% |

| $20,000 or more | Lower, negotiable rates |

Businesses can benefit from flexible rates, as Prestige Services offers special collection rates for larger placements, regardless of the type or status of the account.

Recovery Timeline

Prestige normally makes 3 contacts with the debtor within the first 30 days. If the debtor ignores all attempts to contact, they begin attorney forwarding.

5. IC System

Founded in 1938, IC System takes an ethical approach to debt collection and uses methods that maintain the relationship you have with your customers. They’re family owned and operated, which plays into their focus on upholding the relationship between you and your clients. You’ll also find multiple debt recovery plans available for small businesses in a range of different industries.

Standout Points

IC System has two programs to choose from, which are named Recovery Plus and Premier Collect. They also focus on a fast collection process that includes a variety of online tools that allow businesses to automatically send debts and view effectiveness reports.

When you submit claims online, they’ll appear in your inventory within one business day. Outside of the debt collection programs they provide, you’ll have access to additional services such as credit monitoring, non-litigation attorney referrals, settlement authority, and more. .

Two-Stage Recovery Plus

- Distinct letters-only and intensive collection treatments

- Clients keep 100% of collections during the letters-only phase

- Includes skip tracing and credit reporting

- Offered at a competitive flat rate

Premier Collect Contingency Plan

- Ideal for businesses seeking payment on past-due accounts

- Fees are adjustable based on your business needs

- Includes attorney referral services

- Litigation services are offered as well

Consider This

Client remittances are provided on a monthly basis via ACH transfer or by paper check. When you submit an account to them electronically, it takes around twenty-four hours for it to appear in their system.

Unfortunately, they don’t offer 24/7 support. Regular business hours are 8am to 5pm CT, Monday through Friday.

Fees & Terms

Their Recovery Plus program has a flat fee for each account, whereas Premier Collect only requires businesses to pay their contingency fee if debts are collected. If you’d like to review a specific dollar amount regarding their services, reach out for a quote or consultation.

When you submit your pricing request, IC System will provide you with a no-cost quote, sample IC System agreement, follow-up plan, and materials to help streamline your accounts receivable.

How Do Debt Collection Agencies Work?

Debt collection agencies work by attempting to collect overdue payments from debtors on behalf of creditors. Agencies typically contact debtors through phone calls, debt collection letters, emails, or other forms of communication to try and get them to pay the debt they owe.

If the debtor doesn’t respond, the agency may then take legal action such as filing a lawsuit or garnishing the debtor’s wages. The agency collects the payment from the debtor and gives it to the creditor. Debt collection agencies may also work with debtors to set up payment plans or negotiate settlements to help pay off their debts.

Skip Tracing

When a debtor is especially hard to find, skip tracing tactics are a common method to find out where they are. This is a multi-step process that starts with the information that’s provided in a claim and requires a good amount of detective research to develop accurate and reliable contact information.

Tracking Payments

When tracking payments received from customers, it is important for your bookkeeping service to keep accurate records of all payments. This includes noting the date the payment was received, the amount of the payment, and any applicable fees or interest associated with the payment.

It is also important to note any changes in the status of the account, such as when a customer’s payment is late, or when the account is sent to a collection agency.

Credit Bureau Reporting

When a collection agency reports a debt to a credit bureau, it’ll cause complications when the debtor tries to open a new line of credit. This makes it more difficult for an individual to apply for or use a line of credit. Most importantly, it’ll be an additional incentive to pay the debt they owe and clear their record.

Legal Action

If a debtor refuses to pay, many debt collection companies offer legal services. Legal action could pertain to attorney forwarding, collection litigation, or judgment collection. Services that include legal action can also be customized to the type of debt, and it’s generally used as a last resort in the collection process.

Choosing the Right Debt Collector

It’s essential to review how their debt collection process works, in addition to any pricing or fees that are included with their programs.

When looking to hire collection agency services, it’s vital you review their fee structure, timeline on collections, and what they require from their clients.

Get Multiple Quotes

In some cases, certain collection agencies’ fees could have adverse effects on the finances of a small business, especially when it comes to small claims. This is why it’s also important to get multiple quotes, as you’ll be able to discern which company provides the best deal for the services you need.

References

Ask for references to get an outside opinion on their debt collection services and always review a detailed contract before making a decision.

Verify Compliance

To make sure you don’t waste your time and money, it’s a good idea to request thorough information on their compliance standards. This is crucial regarding laws around debt collection, protecting your reputation, and the protection of the consumer as well.

Other aspects, such as discussing payment options and testing the quality of their customer service are equally important.

Final Thoughts on Small Business Collection Agencies

If you’re looking for a simple approach to debt collection services, Rocket Receivables would be the best choice. For companies that are dealing with larger unpaid invoices, The Kaplan Group can easily handle the workload.

By working with a collection agency that caters to your specific needs, your business will have access to a level of expertise that’ll speed up the debt recovery process. This also gives you a better chance of improving your revenue while retaining a strong relationship with each customer.