As a small business owner, bookkeeping and accounting can seem daunting — especially if math isn’t your strength. Bookkeeping is a key part of running a business because accurate financial records are necessary to make decisions that will help your company succeed.

Whether you’re just getting started or looking to refine your existing processes, these bookkeeping tips will help you develop a streamlined system that can grow with your business.

1. Keep All Personal and Business Expenses Separate

When you first start your business, it might seem more convenient to use your existing personal bank account for everything, or you might use your business credit card to make an occasional purchase for yourself.

Either of these will cause major issues in your business and in your bookkeeping. Not only will it result in wasted time from having to separate everything out down the line, but the tax liabilities for you and your business are inherently different.

One of the primary reasons to incorporate is to separate your personal liability from that of your business. If a judge finds that you have commingled your personal and business finances you could lose liability protection, a phenomenon referred to as piercing the corporate veil. Keeping all your finances separate protects your personal assets from plaintiffs.

Besides a business checking account, you should open a business savings account to set aside funds to cover major expenses that come up – with or without warning. Often, business accounts operate under slightly different rules from personal ones, for example with different fees and different requirements for minimum balances and transaction totals, so make sure to confirm the terms of your account to avoid the possibility of unexpected charges.

2. Keep Your Receipts

While it may seem like a tedious chore, it’s important to keep all your receipts. Receipts are necessary to categorize expenses and serve as documentation to support your deductions. Organized and well documented receipts will also save you during an audit.

The IRS requires receipts for all business expenses of $75 or more – and they should be kept for six years. Be sure to ask your CPA for any tax advice.

Fortunately, there are many systems for scanning, organizing, and keeping your receipts. Our current favorites are:

- Quickbooks Online

- Wave Accounting

- Evernote

- Expensify

- Smart Receipts

- Genius Scan

- Clear Scan

- Fitfin Budget App

- Zoho

- Neat

The best tools feature OCR (optical character recognition) and AI machine learning. These features help automate the data entry, reducing errors, and the time you need to spend. Just take a picture of the receipt, verify the details, and move on.

3. Account for Cash Payments Properly

Alongside keeping your receipts, accounting for cash payments is an important factor in accurate bookkeeping. Inaccurate accounting of cash transactions is a major risk for you and your business. If you are audited, the IRS will penalize you for missing transactions or those that are improperly categorized.

Accounting for your cash transactions doesn’t have to be difficult. Most bookkeeping software also provides the ability to track cash coming in and going out. Make sure that you understand how to track cash in whatever software you’re using, and stay on top of those transactions, to save yourself trouble down the line.

4. Learn to Read Your Income Statement and Balance Sheet

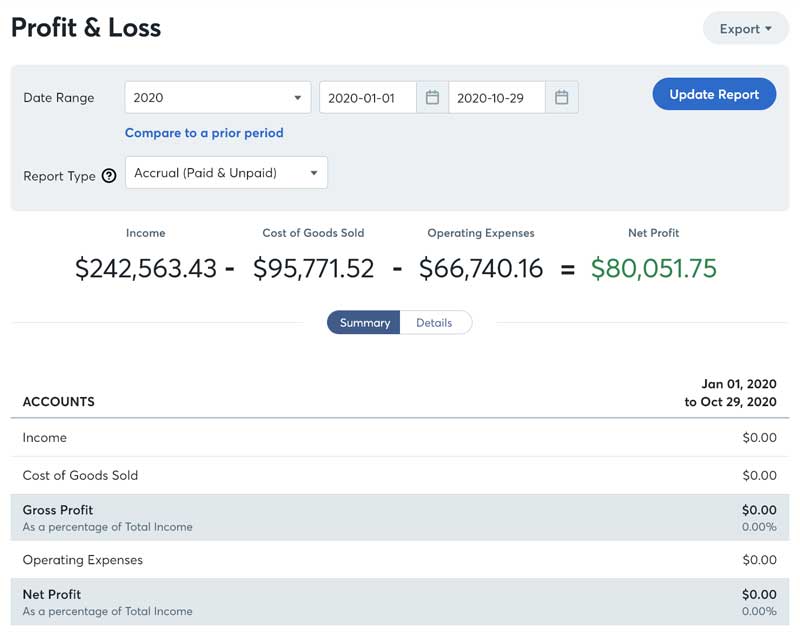

Your income statement documents the money coming into and going out of your business.

A balance sheet shows a company’s assets and liabilities (what the business owns and owes) at a specific point in time. Use the balance sheet to help determine if you can meet your financial obligations.

The income statement (also called a Profit & Loss or P&L) shows your revenue and expenses by profit center or category over a period, usually a month. This statement compares your current figures to both your historical performance and budget. Reviewing your P&L is one of the best ways to check if there are problems that need to be corrected.

There are great resources available to help you learn how to read general purpose financial statements. Learn Accounting for Free has several lessons complete with quizzes to check comprehension, along with a glossary and other resources that make it easy to get a firm understanding of the two most important financial statements.

Analyzing your financial statements will help you recognize the patterns of your business. Once you understand the trends and trajectories, you can forecast future needs and take advantage of opportunities for growth.

Pay Attention to These Trends:

- Seasonality – Understanding the rise and fall throughout the year can help you to allocate resources and make decisions about staffing levels and other budget items.

- Change in cycles of your business – Businesses have life cycles, and it’s valuable to understand where your business stands in its life cycle: if you’re growing, it’s good to know when you can take advantage of opportunities.

- Debt service obligations – An important factor in maintaining your credit and solvency.

- Expense creep or budget bloat – Without careful analysis, you could miss the early signs that your expenses are creeping up in ways that need to be corrected leading to long-term losses that will be much harder to recoup. Especially recurring subscriptions!

5. Regularly Review Your Information

Consistency is a major contributing factor to any type of success, and it’s especially essential when it comes to bookkeeping. It is not only important to maintain your records, but also to review them in a routine fashion.

Reviewing the financial statements has to be done regularly in order to notice details about your performance and to figure out if you’re hitting the budget.

The best way to ensure that you remain aware of everything going on with your business is to set aside specific times to review your books and the various reports that go along with them. Monthly, quarterly, and annually, you should be going over the information to make sure you know where you stand.

Most bookkeeping services will have a deadline to send the previous month’s reports (example by mid-February they send the January statements).

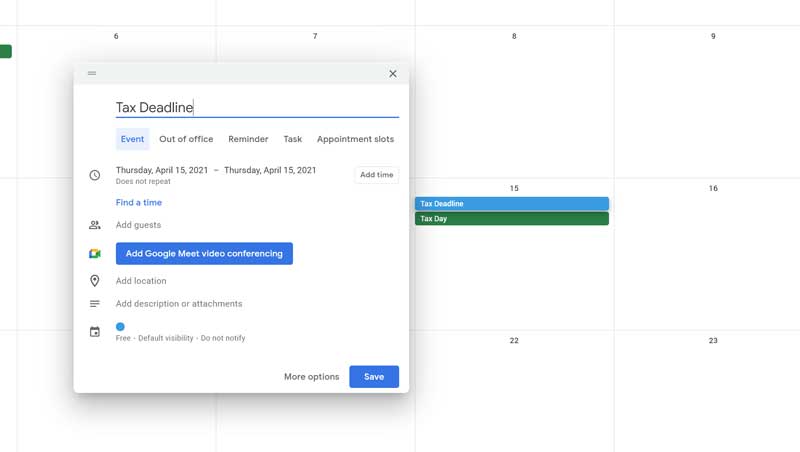

6. Always Remember Tax Deadlines

Missing tax deadlines can result in time-consuming audits, fines, and penalties. In addition, the stress of trying to get everything done in the last minute can take your eye off the ball while you take care of your taxes.

One of the most basic bookkeeping tips is to set reminders. Pick dates about a month in advance to allow enough time to get your paperwork in order. In addition to the reminders, it’s a good idea to keep money set aside to cover your tax obligations.

7. Outsource Your Payroll

For many bookkeeping tasks there is a solution that allows for business owners to handle things in-house, and often by themselves. But when it comes to payroll solutions, it is well worth the cost to outsource.

We did the research and found the best small business payroll services, so go choose one to start saving time while reducing compliance issues.

Ensuring that your employees – including yourself – get paid consistently and on time is vital to keeping your business going. By outsourcing the process you can ensure that your hands are clean of the most problematic risks.

8. Share Information Where Possible

It can be tempting to keep costs low by having a single person handle your bookkeeping. But restricting the number of people who handle your bookkeeping can be dangerous. If you unexpectedly lose a key person, their information disappears with them.

Creating a situation in which your whole system relies on one person creates a single point of failure, which is never an ideal situation. In addition, there are many circumstances in which outside input from trained professionals can help give a better perspective on issues in a business, as well as potential solutions to those issues.

If you work with an outsourced bookkeeper, be sure to ask for a Standard Operating Procedure that outlines the basics of how the bookkeeping is performed and details the intricacies of their business. It also ensures you’ll be able to get answers to urgent questions even if your main contact isn’t available.

9. Assign Bookkeeping Tasks

It’s important to know which of your bookkeeping tasks should be delegated. The primary tasks include:

- Sending invoices to customers

- Recording customer payments received

- Depositing customer payments

- Recording vendor invoices received

- Issuing checks to pay vendors

- Recording credit card charges

- Reconciling credit card and bank account transactions to statements

- Closing books

- Producing monthly financial statements

Review each of the tasks and see where there is opportunity to delegate to internal employees or to an outsourced bookkeeper. Decide how often they should be done and establish a system of checks to ensure no task is overlooked or forgotten.

Bookkeeping services like FinancePal offer “CFO” level meetings where they sit down and give an update on the tasks they’re assigned, any outstanding Accounts Payable or Accounts Receivable, system issues, and/or interpreting the financial statements.

10. Automate the Process Where Possible

Many software solutions exist to collect and compile transaction data and create reports. Automating bookkeeping tasks tends to provide a more accurate picture of what’s happening in your business because financial statements are almost always up to date.

Automate things like:

- Recurring invoices

- Payroll direct deposit

- Emailing reports

- Bill reminders

- Bank reconciliation

Software such as QuickBooks have automation options built in, but there are also separate systems that can be added to software like Xero to help things to run even more smoothly.

11. Plan For Major Expenses

Whatever your business, there will always be the possibility of a piece of equipment needing to be replaced, a large inventory order, or some other big-ticket purchase. Planning for major expenses enables you to meet them without panic and with sufficient means to comfortably cover them without having to divert funds from other areas of your business.

The simplest way to be ready is to set it aside as a line item in your reports. Set up a specific savings account to put a set, steady amount of money into so it’s there for you when you need it.

12. Know Your Operational Costs

You may be surprised to discover how many business owners simply don’t know how much their business costs to operate. Knowing how much the different parts of the business require to operate helps you to recognize discrepancies, shortfalls, and other incidental problems that must be caught early to avoid larger losses.

Budget-setting and management tools will help in the process of establishing what your operational costs should be, as well as alerting you to discrepancies that deserve attention. Update your budget when you begin seeing consistent patterns that indicate that costs are going up naturally, or that sales are going up.

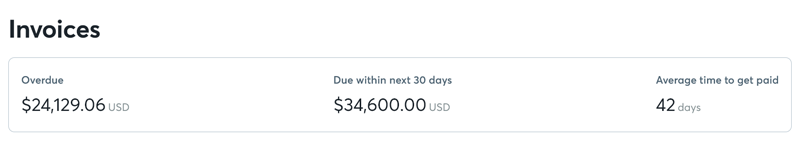

13. Pay Attention to Accounts Receivable

One of the major sources of difficulty for business owners is a breakdown in cash flow, and one of the most common causes of such a breakdown is late payments. In order to protect your cash flow, you have to pay attention to the time it takes your invoices to be paid.

Aside from assigning a due date on the invoice, it’s generally accepted to add terms (such as “Net 30”) as a memo that shows up on the invoice. That reinforces to customers that you expect payment within 30 days of receipt, delivery, etc.

Bookkeeping software has reports that help you monitor the length of time between sending an invoice and receiving payment. The report that monitors your accounts receivable is called an aging report.

14. Know When to Offload the Responsibility

While business owners are accustomed to having to wear many hats, there is a point beyond which no amount of persistence or enthusiasm will help, especially when it comes to bookkeeping.

Keep track of the time you’re spending and assign a dollar value to it. Compare that with the costs of outsourcing to determine if it’s worth the time and effort to make a change.

While local bookkeepers have been the norm for decades, they are no longer the only option. Virtual and online bookkeeping services provide all of the needed functions of the accountant’s office from a remote location, and many of them also have lower costs, and more flexible hours as a result.

Of course, a local bookkeeper is still an option and may be a better solution to your needs if you prefer in-person meetings.

Integrating Bookkeeping Tips Into Your Routine

Bookkeeping can often seem like a daunting prospect, and many of the tasks associated with the accounts for your business can at first look impossible for any one person to carry out.

But with a few bookkeeping tips and tricks, including knowing what you need to know to keep things going – and knowing when to bring in the professionals – you can ensure that everything runs smoothly.