As a new real estate investor, it is crucial to know if your investments make sense. Bookkeeping is the process that tracks all the money coming in and going out of your business. By following these simple tips, you will be able to rely on your bookkeeping system to make educated decisions and know exactly how your real estate investments are performing.

Key benefits of maintaining an organized accounting system:

- See how much cash flow your real estate is generating

- Know which rentals are performing best

- Make educated decisions to buy or hold properties

- Track your NOI and CAP rate to benchmark your performance

- Use historical performance data to measure new strategies

- Recognize all expenses to maximize your deductions

- Avoid stress and IRS penalties for miscategorized or undocumented expenses

Real Estate Bookkeeping Tips

- Business Bank Account

- Keep Personal Expenses Separate

- Keep Receipts

- Categorize Expenses

- Reconcile Monthly

- Review Financial Statements

- Find a CPA With RE Experience

- Use the Latest Software

1. Open a Business Bank Account

Many new investors wonder if they need a separate bank account for their rental property. The answer is a resounding, YES!

There are many reasons a business account is necessary. It will help you save time and money. A business account will help protect your personal assets (if you follow Tip #2). And it will help you maintain better books and run a better business.

5 Properties, 5 Accounts?

Long ago, separate accounts made it easier to keep track of transactions for different properties, but could become unmanageable as the portfolio grew. Nowadays, accounting software can accurately track the expenses for multiple properties all within a single bank account.

So, do you need a separate bank account for every property? It’s probably unnecessary, unless you’re holding your properties in separate LLCs (in which case you should have a bank account for each LLC). Talk to your lawyer or CPA if you’re unsure.

One caveat exists with security deposits. Check your local laws as they may require you to hold security deposits in separate accounts.

Using a business bank account creates a solid foundation for your real estate business. It reduces your risk, makes bookkeeping easier and more accurate, and helps ensure you keep all your personal and business finances separate.

2. Keep Personal Expenses Separate

This is important: Keep your personal and real estate expenses completely separate. We’re talking separate bank accounts, credit cards, and debit cards.

If you’ve never owned a business, you might wonder, “Why is this such a big deal?” There are two primary reasons:

- Tax Liability

- Asset Protection

Using a single account for business and personal transactions is known as commingling funds. Blurred lines between business and personal finances are a red flag for the IRS, which could cause an audit.

An LLC is meant to safeguard your personal assets (limiting your liability) if your property gets sued. Liability protections don’t exist for commingled accounts. If you are being sued and your account is frozen, your personal funds will be considered part of the business.

A track record of strict separation should prevent creditors from seeking your personal assets, also known as piercing the corporate veil. It’s best to talk with your lawyer about how to maximize the protection of your LLC.

Having separate personal and business accounts provides protection. It also makes it easier to claim every possible deduction, which will reduce your tax burden – saving you money.

3. Keep Copies of All Receipts

This is easier than it sounds since you’re not required to keep hard copies. We recommend photos or scans of receipts since they are much easier to work with.

Most accounting software can scan receipts, making them searchable. The software can also link receipts to your bank and credit card transactions, helping you stay totally organized and ready to defend your expenses.

Related: Best Receipt Scanning Apps

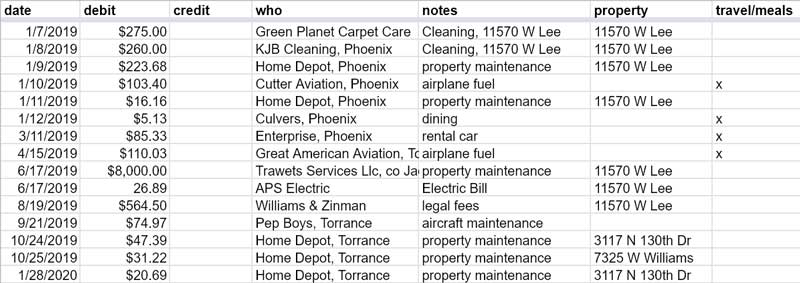

Make note of which property the receipt is for and what the purpose of the expense is. This will make categorization much easier.

The IRS requires you to keep all receipts over $75 as documentation for your expenses. While it’s best to scan all your receipts, pay particular attention to meals and travel, since they usually get the most scrutiny by the IRS in reviews and audits.

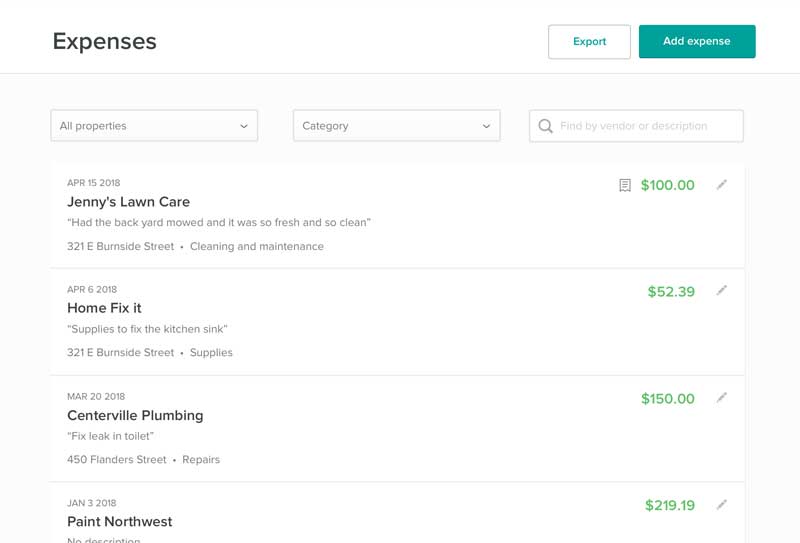

4. Categorize Expenses

Ok, so you’ve got a business bank account and are keeping all your personal finances separate. Great!

You’re keeping digital copies of all your receipts and staying organized. Good job!

Expense categorization should be relatively straightforward, especially if you are keeping all of your receipts.

If you’ve only got a few units, you could manage your bookkeeping using a simple spreadsheet. But there’s a ton of great software that can help you manage your finances (and your properties).

The point of documenting income and itemizing expenses for your real estate is so you can determine your taxable income. The lower your taxable income, the less you pay in taxes.

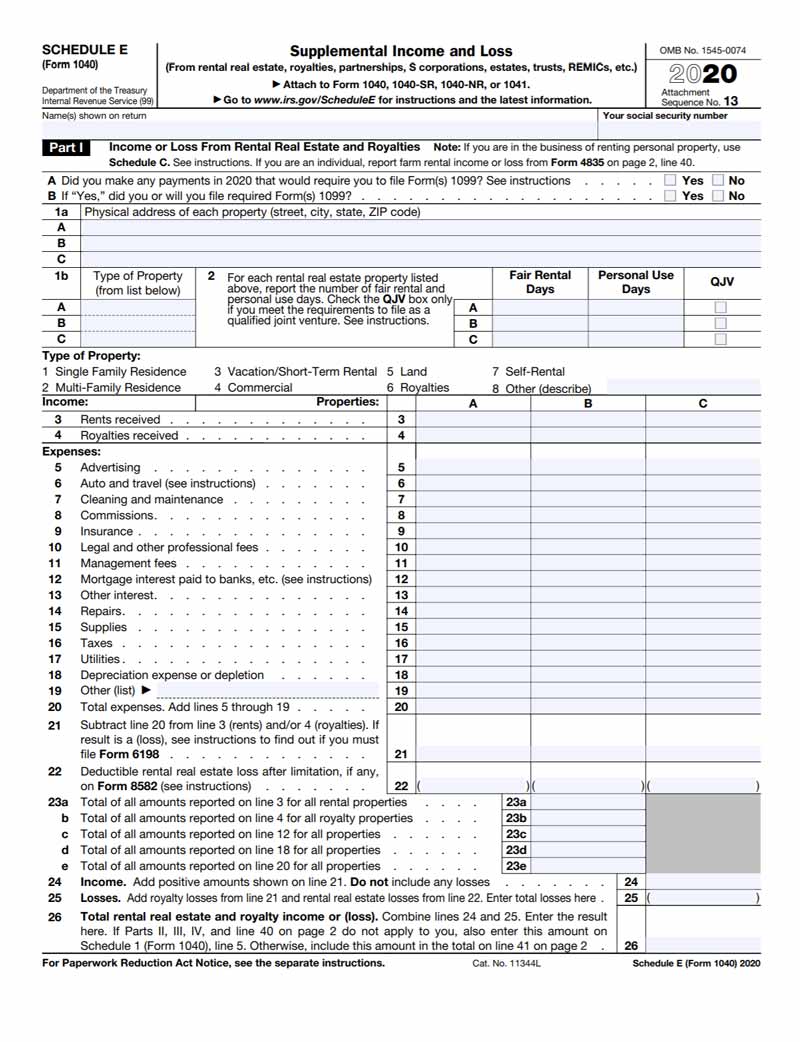

Rent (plus any additional income) is your revenue. Subtract relevant expenses from your revenue, and the result is your taxable income. This is all reflected on the Schedule E that you file with the IRS.

To maximize your allowable deductions, organize your expenses using the same categories the IRS lists on the Schedule E:

- Advertising

- Auto and travel

- Cleaning and maintenance

- Commissions

- Insurance

- Legal and other professional fees

- Management fees

- Mortgage interest paid to banks, etc.

- Other interest

- Repairs

- Supplies

- Taxes

- Utilities

- Depreciation expense or depletion (capital improvements)

- Other

You might consider waiting to categorize expenses, but this increases the chance for errors. If you are categorizing expenses manually, it’s best to update your records as you pay bills.

5. Reconcile Accounts Monthly

Reconciling your accounts is the process that double checks that the recorded transactions match your actual. When everything aligns the accounts are balanced. If you are using technology, this should be a relatively quick process and might happen automatically.

Not long ago, when every transaction needed to be entered manually in a paper ledger, there was a much higher chance of errors. Still, reconciliation remains a fundamental practice of bookkeeping because ongoing accuracy is so important.

Most of the bookkeeping software we’ve recommended can reconcile your accounts in real-time using the connection with your bank account. Although a direct connection should eliminate most data entry errors, it’s still recommended to double check.

Balancing your books monthly will help you discover problems near to when a transaction took place, so the circumstances should still be fresh in your mind. This makes it much easier to resolve any issues that come up.

Aim to reconcile your accounts at least every month. An organized approach to your bookkeeping tasks will help you understand how each of your properties is performing.

6. Review Financial Statements

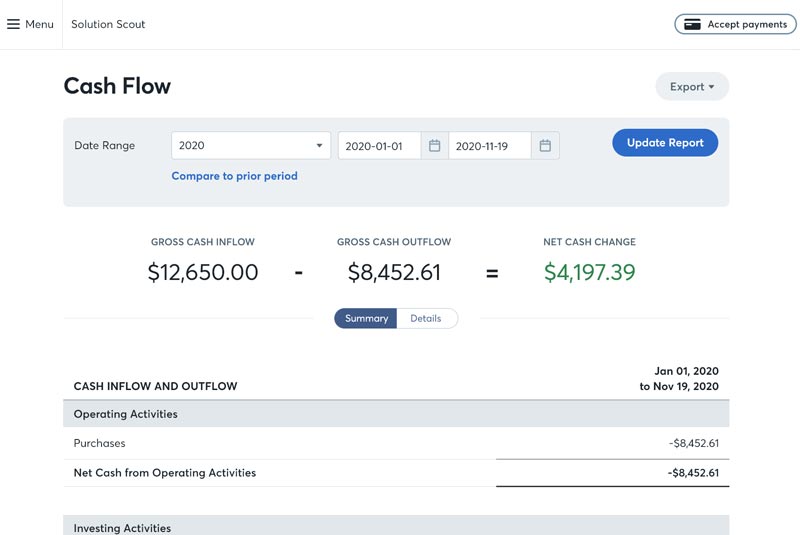

Reviewing your financial statements will help you make better decisions. They will also show you exactly how your real estate investments are performing.

A Profit and Loss (P&L) statement gives you a summary of your revenue and expenses. It’s important because it shows you how much profit you made.

A Balance Sheet is a snapshot of the assets your business owns and what you owe to others. It shows you how much equity you (and any partners or investors) have invested in your business.

If you’re like Robert Kiyosaki and most real estate investors, you’ll also want to focus on the Cash Flow report. Similar to the P&L statement, a Cash Flow report shows all the cash coming in and going out, but also includes payments for loans and taxes. The Cash Flow report shows your current operating profitability.

Key Performance Metrics

Tracking key performance metrics with your bookkeeping system can help you optimize your performance and make better decisions. Other metrics you should track for each of your properties:

- Net Operating Income (NOI): Total income for the year minus expenses. Note that NOI does not include mortgage or taxes. Net operating income is used to compare the performance and profitability of properties.

- Capitalization Rate (Cap Rate): Divide annual NOI by the cost of the property (or its current value). A higher cap rate shows an investment is risky. A low cap rate shows high value and strong demand for properties.

- Cash-on-Cash Return (CCR): Calculated by looking at the annual pre-tax cash flow divided by the total cash invested. The CCR measures the investment’s performance.

Real estate accounting and property management software can calculate these metrics for you. They will be displayed on your dashboard so you get a continuous overview of your performance.

7. Find a CPA With Real Estate Experience

Tax is one area where it’s not recommended to go it alone. A tax professional with real estate experience can offer advice and strategies that could save you thousands of dollars and help you optimize your bookkeeping workflow.

Working with an experienced tax professional ensures your return is accurate and that you’re claiming every allowable deduction. As your real estate business grows, a CPA that understands your business can offer advice on future investments. Most importantly, they can help you structure your investments in a tax efficient manner.

Our Top Pick

When looking to retain a CPA, be sure to check their qualifications first and ask them how long they have been practicing. Determine how much experience they have with real estate and ask if you can speak to any references.

8. Use The Latest Technology

The latest tools make it easier than ever to manage your finances and your real estate investments. They can automate repetitive tasks like data entry, saving you time while improving accuracy.

There are a few types of technology to help you manage various aspects of your real estate bookkeeping.

- Business Accounting Software

- Rental Property Accounting Software

- Property Management Software

Business Accounting Software

The most obvious tool to assist you is accounting software. It will help you stay organized and store your receipts and supporting documents.

The key features to look for are:

- Connects to your bank account and automatically imports transactions

- Automatic expense categorization (you still need to check it)

- Receipt management

- Late payment notifications

Popular Accounting Software

Quickbooks is the most popular small business accounting software, and Xero is known for its ease of use. Both come loaded with features, like automatic import and categorization of transactions.

Unfortunately, neither can track multiple projects (or properties) on the basic plan. Quickbooks gains project tracking on their Plus plan for $70 per month. The Established plan from Xero has project tracking for $60 per month.

Free Accounting Software

There is free accounting software that works for real estate bookkeeping. Wave is great to help you track basic financial data. Akaunting is better if you have multiple units.

Related: Best Free Bookkeeping Software

While the price might seem right with free accounting software, there are some limitations. Wave can’t tag transactions by property, and Akaunting doesn’t have automatic bank account reconciliation.

Accounting software is primarily targeted at small businesses. It can work for real estate, but specialized software has additional features – and could cost less.

Rental Property Accounting Software

Rental property accounting software is the best bet for residential or multi-family investors. All the features and workflows are designed with real estate in mind. This also makes learning and using the software easier, since there will be fewer distractions.

Additional features to look for:

- Reporting by portfolio, legal entity, property, and unit

- Simple workflow for creating your Schedule E

- Automated mortgage accounting

- Lease tracking

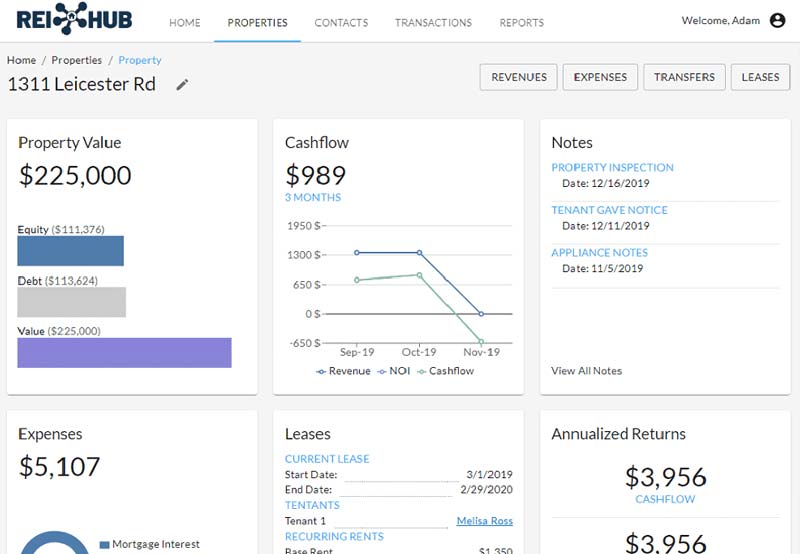

With REI Hub, long-term rentals, short term or vacation rentals, and flips are all supported. The software links to all your financial accounts and automatically imports transactions. Integrated document storage and lease tracking are just a few of the features that set REI Hub apart from standard accounting software.

REI Hub is easy to set up. Just add your properties, then link your bank and credit card accounts. That’s it.

Since it’s usually best to try before you buy, they offer a 30-day free trial to help you figure out if the software is right for you.

| REI Hub Plan | Units | Cost |

|---|---|---|

| Essentials | 1 to 5 | $10 |

| Investor | 1 to 20 | $25 |

| Professional | unlimited | $75 |

*REI Hub Investor and Professional plans include multi-entity reporting.

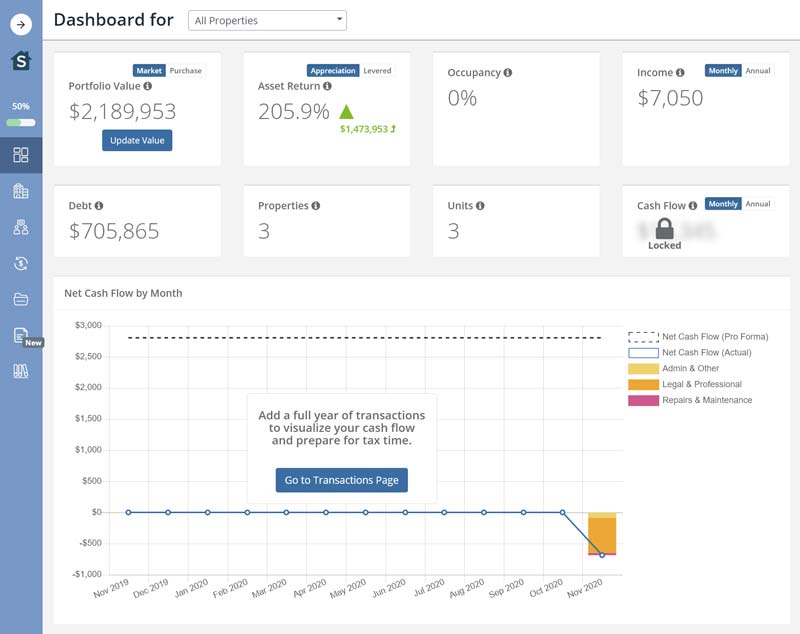

Stessa is 100% free rental property accounting software for single-family, residential multifamily, and short-term rentals. They offer optional fee-based services for rent analysis, mortgage financing, and market research.

Stessa was built from the ground-up with real estate investors in mind. Thoughtful dashboards make it easy to monitor and analyze the details. You won’t have to search through pages of reports to find the information you need to make decisions.

Features that make Stessa a good choice:

- It’s free

- Track unlimited properties

- See performance at the portfolio and property level

- Automate expense categorization

- Organize and store all your real estate documents

- Export tax-ready financials

Stessa also offers iOS and Android apps to help you track expenses on the go.

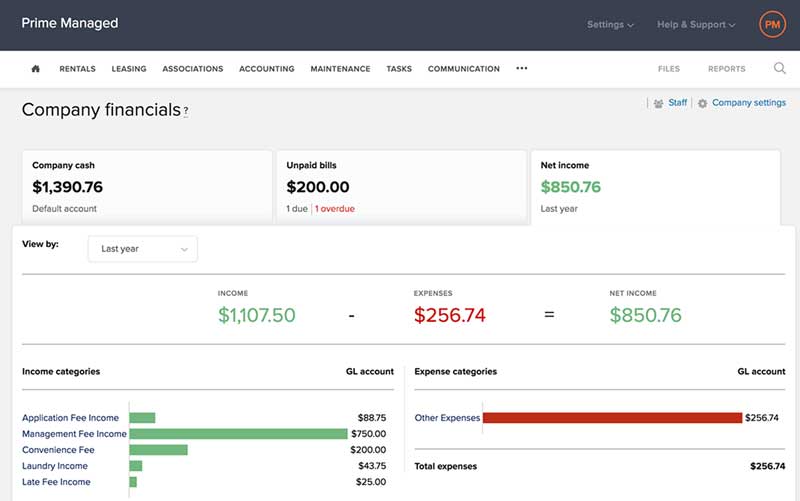

Property Management Software

Property management software can help with accounting, but it’s really designed for property managers and landlords. It could be the right solution for you if you own and manage your properties.

Property management software introduces many features like community association management, leasing tools, and maintenance tracking.

Buildium is a full-featured property management platform that could work just as well with five or 5,000 units. You’ll have the tools you need to keep your property-level bookkeeping complete and accurate. Their wide array of automated features are more tailored for property managers than investors, but with pricing starting as low as $50 per month, Buildium is worth checking out.

All accounts include financial reporting including:

- Balance sheets

- Income statements

- Cash flow statements

- Budget vs actual

- General ledger

Features that make Buildium an excellent choice for real estate bookkeeping:

- Automated bank account importing

- Task management

- Detailed maintenance management and reporting

- eLeases (sign and store leases online, no printing)

- Document and store property inspections

- Tenant screening (basic or premium options)

- Renters insurance

- 1099 eFiling

Cozy offers their core service for free to landlords with 20 units or less. They can offer the service free to landlords by charging renters for screening reports, credit card payments, and renters insurance. Cozy will become part of Apartments.com in mid-2021.

Cozy provides a portal to manage many common real estate activities. It also allows you to:

- Track multiple properties

- Collect rent payments

- Organize scans of important documents, like applications and leases

- Find renters

- Screen applicants

- Sign leases online

- Run monthly performance reports and cash flow statements

- Streamline communication with tenants about maintenance and rent collection

Regardless of which technology solution you choose and how automated it is, remember that you need to check on it from time to time. Log in and verify that transactions are being categorized correctly. Also, make sure your records match what’s in your bank account.

Final Thoughts on Real Estate Bookkeeping

You made it this far, so be sure to take the next step and put all you’ve learned into action. Treat your real estate like the business it is.

Keep copies of receipts and categorize your expenses. Link your bank and credit card accounts with accounting or property management software. Automate as much of the bookkeeping process as possible.

Reconcile your accounts monthly to ensure your books are balanced. At the same time, review your financial statements so you’re aware of your cash flow and can foresee any problems coming up.

A good CPA with real estate experience cannot be replaced by software (at least not yet). Find one, and use them to make sure you’ve structured your assets as efficiently as possible. You could realize huge savings.

Finally, be sure to open a business bank account and always keep your personal expenses separate.

Be good to yourself and others. I hope you have a great day!