Xero is a cloud-based bookkeeping software developed for small to medium sized businesses. It’s the bookkeeping solution of choice for over two million subscribers and 16,000 accounting firms.

Bookkeeping is an essential business activity, especially for those trying to scale and grow. But not all businesses can hire a dedicated in-house bookkeeper. If you’ve explored alternative bookkeeping solutions, chances are that you’ve heard of Xero.

Is Xero the best bookkeeping software solution for your business? In this article, we’ll give you a solid overview of Xero’s features, functions, and limitations. You’ll know if you should sign up for a free trial of Xero, or whether you should look into some other options.

Overview of Xero

Xero is a high performance bookkeeping software that makes it possible for business owners to manage their books without a professional bookkeeper. Xero was founded in 2006, and the company has offices in Australia, New Zealand, the United Kingdom, North America, Asia, and South Africa.

There are currently five editions of Xero (US, UK, NZ, AU, and Global). Most of Xero’s users are in Australia, although the software works for businesses anywhere in the world. In this article, we are focusing on the US edition of Xero.

In many ways, Xero is like the popular QuickBooks Online. The major differences is that Xero originally touted itself as a tool for independent bookkeepers, whereas Quickbooks has always been geared towards small businesses. Only recently has Xero started to offer itself as a primary solution for small business owners.

New and competing bookkeeping software is being developed every day. But Xero remains a highly competitive and visionary company. Xero stands out in its aim to build a software that does more than just manage books — it wants to build a platform that can manage all business data in one place. For this reason, every year Xero has added additional features that integrate external data.

How Xero Works

Xero automates much of the bookkeeping process by synching with your bank and merchant accounts. Whenever a transaction is made and recorded in your bank ledger, a read-only version of that transaction will import into your cloud-based Xero account. Basically, Xero replaces data entry with automatic data flow.

Once the data is in your Xero account, you sort that transaction into your customized chart of accounts. Xero gives you the option to create rules so that any recurring transactions will automatically go to the appropriate account.

Xero also lets you send invoices and capture payments within its software. These transactions are trackable and kept in the same place as your bank data.

At the end of the month, Xero sends a reminder for you to reconcile the accounts. This ensures that you didn’t miss any transactions, and it will help you look out for fraudulent spending and bank errors.

Setting Up Xero

Setting up your Xero account will take about one to two hours. Xero has instructional videos, which help to make the entire setup process go smoothly. If you watch all the instructional videos beforehand, you’ll have a good foundation of knowledge about the rest of the Xero features.

We can break the Xero setup process into seven easy-to-follow steps:

- Connect your bank and merchant account feeds to Xero. That way, you’ll get all of your data uploaded to your Xero account right away. This process only takes a few minutes, as long as you have all of your login information on hand.

- Add organization details. In this step, you’ll add your business name, EIN, employees, contact information, and customize your invoice template. You can upload a logo which will populate on the invoice. You should also integrate a payment service.

- Customize the chart of accounts. A chart of accounts is essentially a list of the categories that your business uses to distinguish assets, liabilities, and transactions. Xero comes with a default chart of accounts, but chances are that you’ll need to tailor it to fit the needs of your business. If you already have a chart of accounts you’ve been using, you can import it straight into Xero as a PDF.

- Add customers and suppliers. When you have your customers and suppliers added, you can attribute each transaction to a customer. This is super helpful when you want to calculate which suppliers you spend the most money on, or who your best customer is. Just like with the chart of accounts, you can import an existing list in a PDF.

- Assign user roles. Decide which employees should have access to your Xero account. Each user will have their own login. You can grant users permissions to manage specific functions within Xero.

- Connect with your bookkeeper or accountant. If you already have a bookkeeper or accountant, you can grant them access to your data. They’ll have a separate login and password, and can change your data entries.

If you need help with your books and don’t have a bookkeeper, you can find a Xero certified advisor at xero.com/advisors.

- Connect apps. Xero integrates with over 800 apps that handle everything from inventory to payroll. Be sure to explore apps that apply to your industry.

How Xero Saves Time

- Xero is a one-stop-shop to gather and organize all of your financial data. No more scrolling through messy bank feeds to check up on a transaction. View the data from all of your accounts in one place.

- Seamless customization. Transactions will fit into their category, and your numbers will line up. Xero is like a well-fitting glove for your business. It makes everything easier.

- File taxes efficiently and accurately. Your data from the entire year will be ready to send over to your accountant, making for a headache-free tax season.

Xero Features

Now that you understand what Xero is, let’s get down to the specifics. Xero offers most of the standard features found in bookkeeping software, and a few supplementary tools.

Pay Bills

This is one of Xero’s coolest features. By putting your bills and accounts payable into clear and helpful charts, you can tell which need to be paid first. It takes the guesswork out of managing cash flow.

You can also make scheduled and batch payments, so you won’t accrue interest because you forgot about a bill.

Claim Expenses

Xero helps you monitor spending throughout your entire business. Within Xero, your employees can submit their spending and upload photos of receipts. Then, you can approve and reimburse these expenditures. Because you have access from anywhere, you can approve expenses right away.

Accept Payments

Xero has a “pay now” feature that you can add to your invoice, making it easy for your customers to pay you back in a timely manner. With this feature, you connect with a payment processor like Stripe, which accepts debit and credit cards, and Apple pay. This cuts down on the time you spend chasing down payments.

Project Tracking

The project tracking feature is rare and truly exceptional. With this feature, you create estimates and quotes on jobs, track time and costs, and basically keep track of the profitability of projects. Project tracking makes it easier to see the full picture of where your resources- including human capital- are being allocated.

Bank Reconciliation

Bank reconciliation is a standard feature. Xero stands out a bit in this category because you can reconcile every day, whereas most other bookkeeping solutions use monthly reconciliation.

Internal Contact Storage

By saving contacts internally, you can see the full financial history with each of your customers and suppliers — including all past invoices, payments, bills, notes, and email correspondence.

- Share selected emails with staff.

- Make your contacts list even more useful by sorting your contacts into customized groups.

- The contact list also includes a “deep archive” state in which transactions are visible, but the contact can’t be seen.

Document Storage

Store important files within Xero so you can see the data alongside its corresponding document. This way, you can compare the recorded data with the original and keep an eye out for discrepancies. Documents can also be sent in real-time to your bookkeeper, accountant, or employee.

The document storage feature is also useful for organization. Xero lets you create folders sorted any way you like (they can be based on the year, job, client, etc.). You can capture physical documents with the smartphone scanning app and then dragged into the correct folder.

Sales Tax

Calculating sales tax is famously annoying. Luckily, Xero lets you automatically calculate sales tax on transactions, which are then added to a report for when you’re ready to file sales tax return.

Sales taxes are different in every city and state, so they need a lot of customization. Xero lets you add in a sales tax rate by location, and by component and account type. Sales tax can be included or exclusive, and you can set default rates for your contacts, inventory items, and accounts.

Send Quotes

You can send professional-looking quotes to clients, and when the client accepts, convert the quote into an invoice. Particularly useful is how you can send quotes from your phone or desktop and clients can receive a PDF or email.

Your customer can accept a quote with a single click or give an explanation why the quote was declined. And on your end, you can tell if the quote was viewed, revised, accepted, or declined. This reduces the consuming back-and-forth involved in sales.

Basic Inventory Tracking

This is a relatively new feature, and is an extremely welcome addition to Xero’s lineup of features. Xero’s inventory tracking lets you keep count of up to 4000 finished items and see the total value of the stock of each item, so you know how much cash is tied up in inventory.

With the inventory feature, you can see what’s selling and highlight the best- and worst-selling. When inventory is loaded in Xero, your goods and services can populate on the invoices along with the product description, price, and sales tax.

You can import existing lists of inventory using a PDF or CSV file.

High-Level Security

Xero has multiple layers of protection for all of their users. These include multi-factor user authentication, data encryption, network protection, secure data centers, and security monitoring. Xero is transparent with its security initiatives, and you can read more about cloud security here.

For your convenience, Xero has a record of 99.7% uptime. Their system performs at scale with redundancies within its high performance servers, networks, and infrastructure. With minimal downtime, you know that you can always access your valuable financial information.

Customer Support

Xero has a full suite of well-planned instructional videos for users. Xero recommends that anyone who needs help initially look at support articles in Xero Central. But if you don’t find what you’re looking for on Xero Central, you can click the “Get in Touch” button at the bottom of any support article.

Xero will respond to your query by email, typically within one day. If you provide your phone number, Xero will call you back at your preferred time (you must disclose your time zone as well). Xero does not publish its phone number, so you can’t call directly. Instead, you have to wait for a call.

On the bright side, Xero customer support is totally free. If you need additional support, you can hire a Xero certified advisor. It’s a good idea to hire a professional to set up your Xero account and walk you through how it works if you’re unfamiliar with bookkeeping practices. The free Xero support may not do this for you.

Xero also has a live chat feature, although this is mainly for sales purposes. The support on the live chat will not be as helpful with in-depth questions, but they can answer most queries about Xero features.

Xero’s Best Features

With so many options for bookkeeping software on the market, you must want to know what makes Xero really stand out.

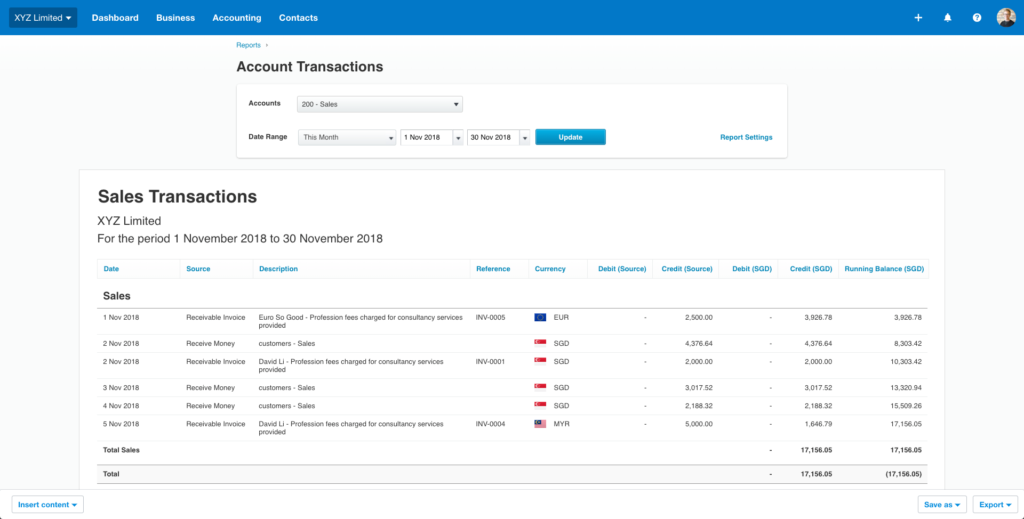

Multi Currency Accounting

Seeing that Xero has offices all over the world, it’s not surprising that it offers multi currency accounting. For any businesses that operate internationally, or for those which have customers in other countries, Xero’s multi-currency accounting feature may be the deciding factor.

With Xero, users can pay and get paid in over 160 different currencies. Better yet, Xero instantly converts international transactions for you. Because the software is cloud-based, there are no lags in currency conversion updates. Rates are updated hourly, so you can see your total foreign currency exposure and how the currency markets are affecting your cash position.

Xero is set up so that to an extent, you can operate in a foreign currency outside of your own. A limited number of foreign currency reports can be made so that you can see profit and loss in a non-native currency.

One powerful feature is the ability to convert an invoice, quote, bill, or purchase order to a foreign currency, and then edit the numbers so that they reflect the difference in exchange rate. To save time, you can assign a currency to a vendor or client, and invoices to that party will populate with the correct currency automatically.

Cash and Accrual Accounting

Quite notably, Xero runs on a primarily accrual-basis accounting rather than cash accounting. Most bookkeeping software either defaults to cash basis accounting, like Bench or QuickBooks, or doesn’t include accrual-basis accounting at all.

If you don’t know the difference between cash and accrual accounting, here’s a quick summary:

Cash basis accounting only recognizes money when it has physically changed hands. So your cash-basis books won’t reflect any unpaid invoices, bills, or expenses until they’ve been settled. It’s the simpler method of bookkeeping, and gives a better picture of the cash that you actually have on hand.

Accrual basis accounting recognizes income and expenses before they’ve been settled. It gives a better picture of your overall cash position, allowing you to make financial decisions with more confidence.

With Xero, you can toggle between cash and accrual accounting. Cash accounting is fine for smaller and more simple businesses. But if your business deals with a lot of invoicing and outstanding payments, the accrual-basis accounting will give a better overview of your true financial position.

App Integrations

Xero has an awesome API, allowing users to integrate the software with over 800 third party apps — and the list is always growing. With so many options, you can find an app in the Xero app marketplace which will make the software even more powerful and relevant to your business.

Compared to QuickBooks, which has a limited API and integrates only with other QuickBooks-developed apps, Xero allows a much deeper level of customization.

Apps on the Xero marketplace include those for invoicing, payment processing, workflow, CRM, payroll, and inventory. But there are a lot more industry-specific apps solutions as well, such as project management for the construction industry.

Most of the apps cost a monthly fee, so make sure that they’re worth your while before you sign up.

Xero’s Missing Features

No Payroll

One major complaint about Xero is that the company removed its internal payroll feature. Today, the company pushes its integration with Gusto, a popular virtual payroll solution. While Gusto is a high-quality payroll solution, the major issue is that any user who wants to hire out payroll now has to pay more than they originally did when payroll was included.

Gusto offers full-service payroll support. The service allows you to pay employees, calculate pay and deductions, simplify compliance, and seamlessly updates your Xero accounts.

| Gusto Plan | Per Month Fee | Additional Per Employee |

|---|---|---|

| Simple | $40 | $6 |

| Plus | $80 | $12 |

| Contractor Only | $0 for 6 months, then $35 | $6 |

Price Hikes

Xero has increased it’s pricing a lot over the past few years. It’s already gone up by two dollars in 2020 alone. In light of the COVID pandemic’s negative effect on businesses, Xero has promised to give at least a 90 days notice before any future price hikes.

However, we believe that these price increases are mirrored by the addition of new and helpful features. But if the cost is already an issue for your business, keep an eye out for future increases.

No Catch-Up Bookkeeping

If you’re brand new to bookkeeping, you probably don’t have very orderly records of past business transactions. What do you do if you want to get started with Xero, but your historical records are a complete mess?

Because Xero doesn’t offer virtual services, you’ll either have to sort through old financial documents and records yourself, or outsource this time consuming task to a bookkeeper.

Xero is a software and not a virtual bookkeeping service, so we don’t really hold this against them. But it is important to keep in mind that your setup process may become a lot more extensive if your books aren’t organized beforehand.

Xero Pricing

So how much does this all cost? Well, that depends on the features that you need. Xero offers three monthly subscription plans: Early, Growing, and Established.

All plans include the following features:

- Bank connection for automatic bank imports

- Inventory tracking

- Financial report generation

- Accepting payments

- Purchase orders

- File storage

- Contact and smartlist storage

- Calculating sales tax

In this section, we’ll go over what they include in each plan.

Xero Early Plan

Xero’s early plan costs $12 per month and is a good option for new and small businesses.

Extras that the plan includes:

- The ability to send 20 invoices and quotes per month. If you send over 20 quotes or invoices, you’ll need to upgrade to the Growing plan.

- Enter five bills per month. You can track, schedule, and pay up to five bills per month.

- Reconcile bank transactions. The Early plan allows 20 bank reconciliations each month. Unfortunately, cash coding — which lets you save time by reconciling transactions in bulk — is not available with the Early plan.

- Capture bills and receipts with Hubdoc.

- Unlimited users and user roles.

Pro Tip: Most businesses deal with over five bills every month. Some businesses are hesitant to try the Early plan because of the limited number of bills they can schedule. There’s a chance that you can get away with the early plan by processing bills as cash transactions.

Xero Growing Plan

Xero’s Growing plan costs $34 USD per month. It has fewer limitations on invoicing, quotes, and billing, so it’s a good option for mid size and — as the name implies — growing businesses.

- Send an unlimited number of invoices and quotes.

- Send, schedule, and pay an unlimited number of monthly bills.

- Reconcile an unlimited number of transactions. Cash coding is available with this plan.

- Capture bills and receipts with Hubdoc.

- Unlimited users and user roles.

Early and Growing subscriptions have the option to add on Xero Projects for project tracking and Xero Expenses for expense claims for an additional monthly cost. They include both the project tracking and expense claims in the Xero Established plan, so make sure it’s not just a more cost effective option to upgrade.

Xero Established Plan

The Established plan is Xero’s most full-suite subscription and costs $65 per month. It is good for established businesses of all sizes, and especially for those which operate internationally.

With this plan, you can enjoy all the features that make Xero stand out, including multi-currency accounting.

Xero’s Established plan includes:

- Send an unlimited number of invoices and quotes

- Enter, send, schedule, and pay an unlimited number of bills

- Reconcile an unlimited number of transactions

- Cash coding is available with this plan

- Capture bills and receipts with Hubdoc

- Multi-currency accounting

- Project tracking

- The ability to claim expenses

- Unlimited users and user roles

It is a rather large price jump from the $34 per month cost of the Growing plan to the $65 per month of the Established plan. But the Established plan includes significantly more features,

Remember that if you need payroll, adding Gusto to any of Xero plan will cost an additional $39 per month, as well as $6 for each employee.

Xero’s Payment Policy

A subscription to a Xero plan can be canceled with one month’s written notice. You’ll have to pay your fees up to the month of termination, even if you are no longer using Xero. So if you decide that you want to cancel your membership, make sure to plan ahead.

Remember that if you paid for an annual subscription and choose to cancel, Xero will not give you a prorated refund. If you do not cancel your subscription, Xero will continue to bill you. You must give written notice that you want to terminate your Xero account.

Discount Opportunities

Xero offers a 50% discount on the first two months of your subscription, regardless of which plan you choose. With the free trial — which you should definitely take advantage of — the first three months of using Xero can equal out to a single month at the regular price. This is an excellent opportunity to test out the platform and make sure it will work for your business.

Xero also offers a multi-business discount of 5%. So if you have a second business, whichever plan you subscribe with for that business will receive the discount. You can use different plans for each business. For example, if you use Xero Early for your first business, you can still enroll in Xero Growing for your second business and receive the discount.

The Xero Interface

Xero is extremely responsive to user feedback, judging by the timely responses to customer queries and complaints on Xero Central. The company occasionally updates its navigation based on this feedback, and based on its own testing and the addition of new features. Usually, Xero will post a video summary of any changes to navigation that it makes.

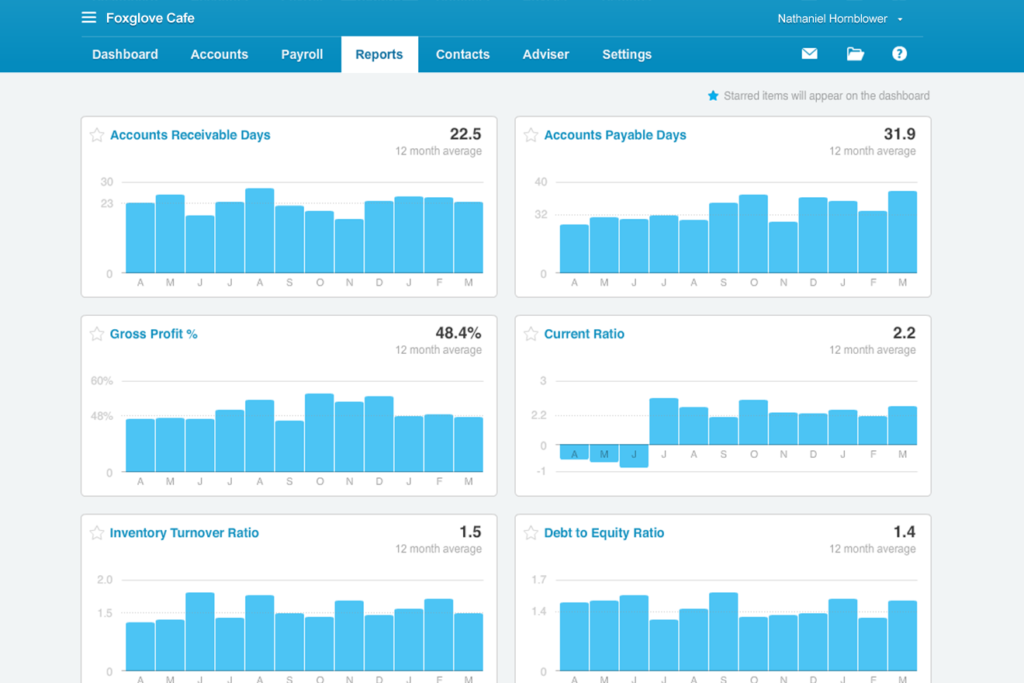

Overall, the interface is user friendly and customizable, though it may take a slight learning curve to get the most out of all the features. In this section, we’ll give a brief overview of how some of Xero’s most important features are laid out.

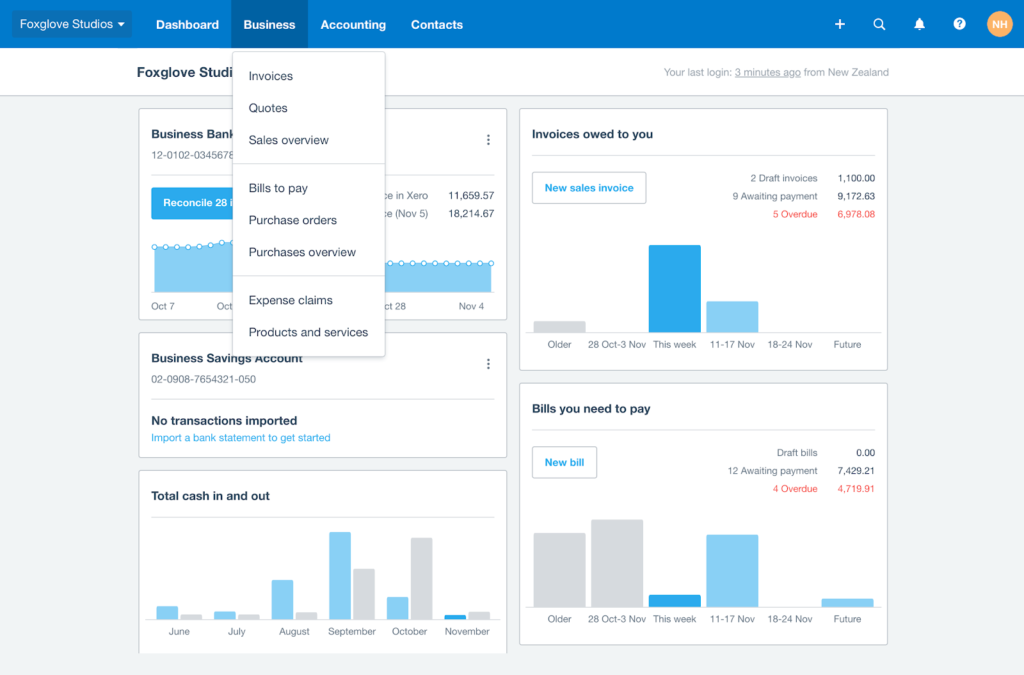

Dashboard

The dashboard is your home page. By default, the left side of the dashboard will contain a snapshot of your bank and credit card accounts, and a snapshot of your total cash in and cash out.

The right hand side displays snapshots of your chart of accounts, invoices owed to you, upcoming bills that you need to pay, and expense claims (if you are subscribed to the Xero Established plan).

Each snapshot is actionable, and you can click get a more detailed look. You can also customize the dashboard to display metrics that you find more meaningful to your business.

Main Menu

The main menu consists of six tabs. The first one is your dashboard tab, followed by a tab for business, accounting, payroll, projects, and contacts. This is a logical layout and each tab expands into a dropdown menu with more details about the topic.

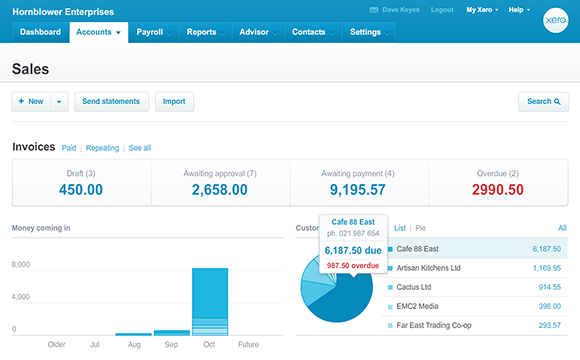

Sales Overview Page

On the sales overview page, you can search for and edit existing transactions, as well as create new ones. Of course, only designated user roles are able to make such changes.

The invoices tab features a bar graph of your approved invoices. Hover your mouse over the bar to see more details about the invoices. On the left side of the invoices tab is a summary of

your five customers that owe you the most. This serves as a helpful reminder to make sure you get paid.

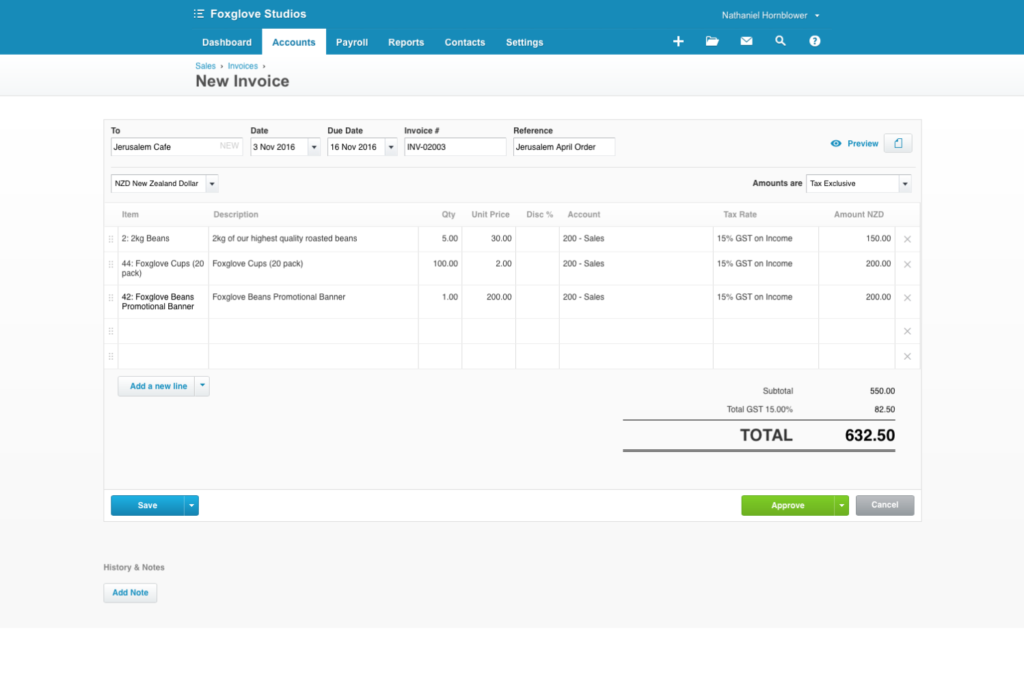

Creating a New Invoice

You can create a new invoice by navigating to the ‘create new’ icon at the top left corner of the screen. A box will expand, in which you enter your customer’s details, the date, and what you’re invoicing for. You can also add your logo and attach relevant documents.

More details about past invoices can be found under the business tab. As you may have noticed, there are multiple manners of navigating to different pages. At first this can be a little confusing. But with time, they’ll become shortcuts.

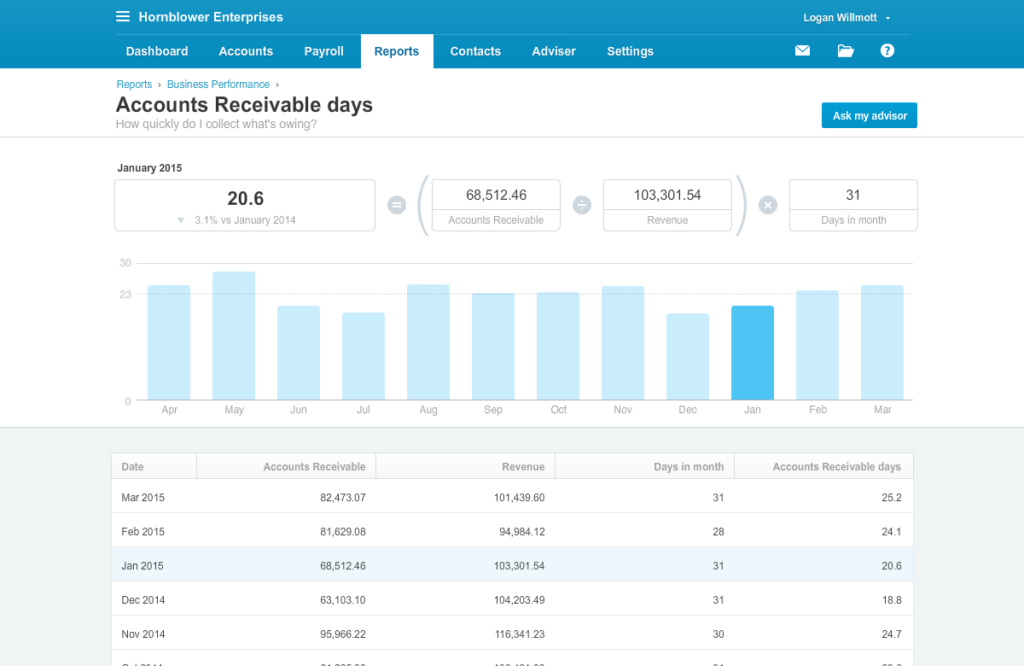

Creating Custom Reports

One of the most important pages – your reports – can be found under the accounting tab. This page lists some default financial reports, including a profit and loss statement and a balance sheet. But if you want to add new reports to this page for easy reference, scroll to the ‘search reports’ bar to find other reports.

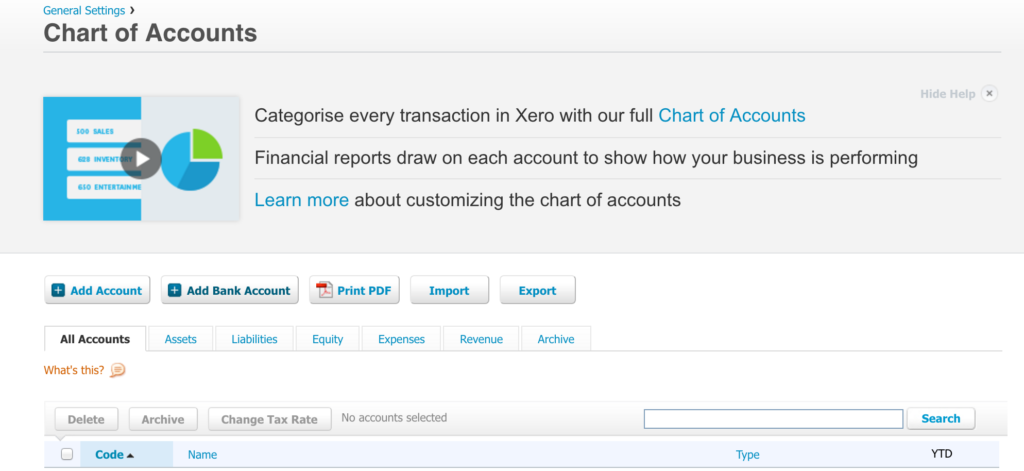

Chart of Accounts

Your chart of accounts is found under the accounting tab. This page features a table that lists the name of the account and its respective account type and the amount of money that you have in that account.

The heading of the chart of accounts table lists buttons for printing the table as a PDF, or for importing a new chart of accounts. You can also sort the table by assets, liabilities, equity, expenses, revenue, and archived accounts.

Overall, the chart of accounts is very well laid out, and arguably easier to navigate than the chart of accounts found on QuickBooks Online.

Search Shortcuts

To navigate Xero even faster, use search shortcuts. Click the forward slash (/) and the search box will open, then type a single letter to get to popular tasks. For instance ‘i’ lets you access all invoices and ‘b’ leads to all bills. Here are the most popular keyboard shortcuts:

| a = bank accounts | i = invoices |

| b = bills | p = purchase orders |

| c = contacts | q = quotes |

| d = dashboard | r = reports |

| e = employees |

There are additional shortcuts for jumping to commonly viewed screens, or to add new items in Xero.

Tips for Success

With it’s powerful bookkeeping tools and customizable layout, Xero can be an excellent user experience… but you have to prepare and do your due diligence.

Here are some tips for having a successful Xero experience, from setup to long-term use.

Take advantage of the free trial

There is literally no risk involved in Xero’s free trial because you don’t have to enter your credit card information. Use the free trial to make sure that Xero is the right fit for your business.

- Does it connect to all of your bank and merchant accounts?

- Does it integrate with your preferred payment processor?

Make a list of your specifications and then put them to the test.

Make sure your bank will integrate with Xero

Larger banks including Chase, Wells Fargo, and Bank of America will integrate so transactions will automatically import into your Xero account. But some smaller, local credit unions may lack the functionality to integrate with bookkeeping software. Speak to a customer representative at your financial institution to be sure.

Define your chart of accounts ahead of time

It can take a long time to define a chart of accounts that is set up intuitively and appropriately for your business. If you set up your chart of accounts beforehand, you’ll have an easier time learning how to navigate through Xero’s chart of accounts.

Prep your imports in a PDF

When you’re setting up your Xero account, you have the option to import data including inventory, contacts, and your chart of accounts from a PDF. This can save you a tone of time during the setup process and will reduce errors.

Of course, make sure that you double check the data for typos and misplacement once it’s uploaded. There’s a chance that information can get scrambled during the upload process.

Make a schedule for account maintenance

Even with automated imports, it’s easy to fall behind in assigning new transactions to a chart of accounts. And at the very minimum, you should reconcile your accounts every month. That said, it’s a good idea to set a daily, weekly, monthly, and yearly schedule for Xero account maintenance.

When you keep up with your books, it becomes an easy and seamless practice.

Create rules for recurring transactions

Recurring transactions — like an internet bill that you pay every month — rely on rules so they are automatically categorized in your chart of accounts. This will save you time. Review the rules to ensure that they continue to go to the correct account.

DIY Bookkeeping vs Outsourced Bookkeeping

Doing your own books used to be incredibly time-consuming. It still can be. But today, bookkeeping software like Xero makes do-it-yourself bookkeeping a workable option for business owners by automating the most time-consuming aspect of the task.

That said, any business owner that forgoes hired-out bookkeeping still needs to set aside a few hours each week to make sure that the records are kept up-to-date and reconciled.

How many hours it takes you to manage your own books depends on your business. The good news is that if the DIY option becomes overwhelming, you can always switch to hired-out bookkeeping.

Benefits of DIY Bookkeeping

- DIY bookkeeping can save money. Xero’s plans start at $12 per month, whereas bookkeepers charge an average of $18 per hour. By using bookkeeping software, you’ll always know what you are going to pay. Your monthly expenses become a little more predictable.

- DIY bookkeeping makes sure that you know your financial position because you have to review your transactions. It’s not unusual for a business to hire out its bookkeeping and never actually review the financial reports. When your books are out of sight, they’re out of mind. And with DIY bookkeeping, you always have access to your books, and you always know what’s going on.

- If you already have a bookkeeper, they can actually use your Xero subscription to manage your books with the software’s collaboration feature. And should you decide to hire out your bookkeeping, having your books managed beforehand will prevent a costly catch-up bookkeeping session.

Final Word on Xero Bookkeeping

Xero is an excellent option for businesses that need comprehensive bookkeeping options and scalability. For smaller businesses, it’s best to start out with the Early plan and upgrade if you need more functionality.

Is Xero right for your business? The best way to figure this out is to make a list of your requirements and sign up for a free trial.

By learning to use all of Xero’s tools, your business can grow and thrive.