It’s no secret that bookkeeping can eat up a lot of your time, even if you’re using an automated bookkeeping software like QuickBooks or Wave. Bench and QuickBooks Live are two virtual bookkeeping services that can do your monthly bookkeeping for a low cost and with high accuracy, so you can spend more time on your business.

Bench is one of the biggest players in the virtual bookkeeping game, but then QuickBooks launched it’s QuickBooks Live virtual bookkeeping program, which is proving to be strong competition.

In this article, we’ll give an overview of the Bench and QuickBooks Live virtual bookkeeping services. We’ll walk you through the pros, cons, and their major differences. Both are excellent services, but the purpose of this guide is to help you figure out which is the best choice for your company.

Bench Overview

Bench launched in 2013 and is now the largest online bookkeeping service in the United States for small businesses. Their team has over 100 professional full-time bookkeepers who guide business owners through the ins and outs of their finances.

When you enroll with Bench, you are assigned a team of three dedicated bookkeepers, one of whom will be your account manager. Over a phone call, your account manager gets to know you and your business so that they can customize your account for accurate expense tracking.

Every month, your bookkeeping team will send you totally accurate financial statements for you to review. At the end of the year, you will receive a Year End Financial Package, which includes all of the data that your CPA will need to file your taxes

Remember, Bench is almost completely hands-off. Sometimes your bookkeeper may reach out to ask you about a transaction. Otherwise, Bench takes almost all bookkeeping tasks off of your plate.

Related: Full Review of Bench Bookkeeping

Bench Features

Bench Proprietary Bookkeeping Software

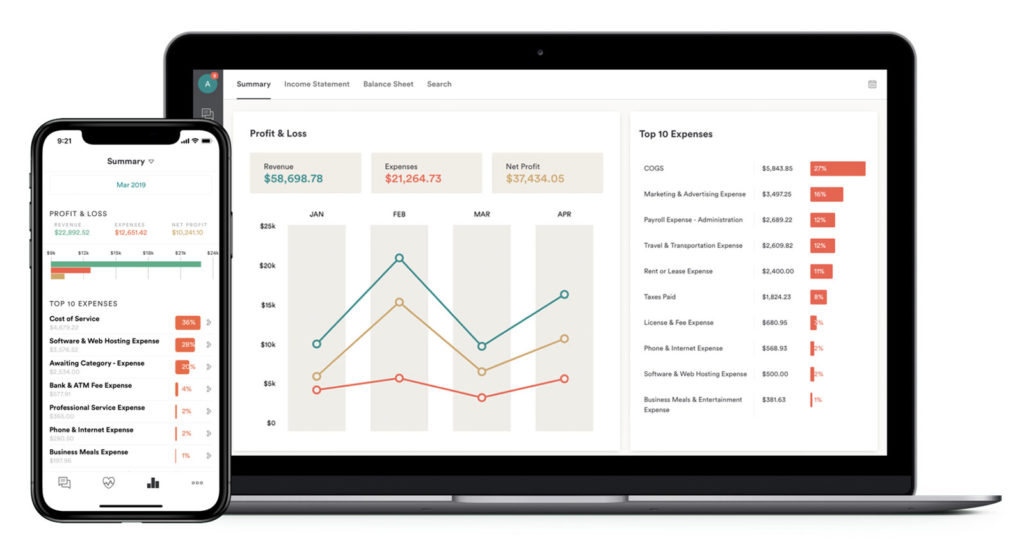

You can access your financial information any time by logging into your account on the Bench website. Bench bookkeepers use proprietary bookkeeping software to track your income and expenses. The best part of this is that while you can access and review your books at any time, you don’t ever have to.

The Bench software is user-friendly and intuitive, even for those who lack financial literacy. Large charts and graphs make at-a-glance understanding possible. The two financial statements that need referencing the most- the income statement and the balance sheet – have their own tabs for easy access.

How does the Bench software work? During the onboarding process, your account manager will help you sync your bank and merchant accounts so that read-only data imports automatically into your Bench account. Your bookkeeper never has access to your actual bank account. So rest assured, your personal information is well protected.

The Bench App

Sometimes you’ll need to upload digital copies of bills and receipts (in fact, it’s always a good practice to keep this documentation). The Bench App allows you to take photos of these documents and upload them to the Bench software for your bookkeeper to review. Concerned about security? Bench software uses bank-grade security and 256-bit encryption.

The Bench App also allows you to get in touch with your bookkeeper or check your financials on the go. Keep in mind, the app is only available for iOS users, though Android users can get by with the mobile browser.

Bench Add-On Services

Bench Tax Filing

Although Bench was created as a bookkeeping service, they have become an accounting service. The Bench Premium plan includes access to a licensed tax professional.

Bench Premium makes Bench a one stop shop for small business owners. Because Bench already has all of your itemized transactions, you’ll only need to send in a few extra documents to get your taxes filed. This can save hours of headaches.

Catch Up Bookkeeping

If you have months or even years of mismanaged books, all hope is not lost. Bench offers historical bookkeeping, where the team sorts through your messy records and recovers missing documents to get you back on track.

You’ll receive a financial summary for every month of historical bookkeeping, as well as any supporting documents that you need should you want to apply for Paycheck Protection or SBA disaster loans.

Pricing for catch-up bookkeeping is based on your average historical monthly expenses. If you’re over two years behind, you’ll need BenchRetro, which offers custom pricing.

Exclusive Offer: Save 30% off your first 3 months with Bench

QuickBooks Live Overview

QuickBooks is the biggest name in the bookkeeping software business, but QuickBooks Live is the newest and most personalized service yet. There’s really no client too big or complex for QuickBooks Live, making it an excellent option for businesses that are looking for scalability.

Like Bench, QuickBooks Live matches you with a bookkeeper. The difference is that with Live, you’ll have a single bookkeeper with specialized experience in your industry. At the very minimum, your QuickBooks bookkeeper will have at least three years of bookkeeping experience and will be a Certified QuickBooks ProAdvisor, but you could potentially be assigned to a CPA.

During the onboarding process, you’ll have a video chat with your bookkeeper, who will connect your banks and set up your chart of accounts. After that, it’s mostly hands-off for you. You’ll receive monthly PDF copies of key financial statements, and it’s optional to have your bookkeeper walk you through the report.

QuickBooks Live Features

QuickBooks Software

In order to participate in QuickBooks Live, you have to subscribe to QuickBooks Online. The cost of QuickBooks Online is not included in the cost of Live. The good news is that QuickBooks is some of the best bookkeeping software on the market. It includes a ton of features that other bookkeeping software lacks, like the ability to track expenses by project and class.

The QuickBooks app has receipt and document scanning, and lets you check your financials anytime and anywhere. While QuickBooks Online software requires a bit of a learning curve, the app is simple to use and great if you need to quickly look up a transaction.

Video Conferencing

As mentioned before, QuickBooks Live lets you communicate with your bookkeeper through video conferencing and screen sharing. This can be really cut down on miscommunications when you’re trying to review an odd transaction and need to reference documents.

Video conferencing makes QuickBooks Live stand out, it’s almost like having a bookkeeper in the room with you. Of course, you don’t have to video chat. Your bookkeeper can also be reached by email and phone.

QuickBooks Live Add Ons

QuickBooks Live is an add-on in inself, because QuickBooks is first and foremost a bookkeeping software. That said, the company offers two other virtual services that can add a lot of value to your QuickBooks Online subscription.

Payroll

QuickBooks will manage full-service payroll for your business for an additional monthly fee. There are three tiers of payroll service available, but they all include unlimited payroll runs, a calculation of paychecks and taxes, automated taxes and forms, and a workforce portal for your employees to view their pay stubs.

The most basic QuickBooks payroll plan starts at $45 per month. The Premium plan costs $75 per month, and the Elite plan is $125 per month. The more advanced plans include a few extra features, like time tracking and same-day direct deposit.

Historical Cleanup

If you’ve been a QuickBooks online user for more than two months and you enroll in QuickBooks Live, you will be charged a $500 clean up and onboarding fee for the first month of service.

So, for old QuickBooks users, it isn’t really an add on service but a compulsory fee. However, if you have a long list of messy books, this is a small price to pay for accurate financials moving forward. If you are a new QuickBooks Online user and have messy books, you can choose to take advantage of this service.

Bench vs QuickBooks Live

Which is the right choice for your business? In this section, we’ll compare the two services side by side.

Pricing

Bench pricing is flat rate and QuickBooks Live is priced based on your monthly expenses, regardless of the number of transactions you have. And for both, the quality of service is the same, no matter the tier of bookkeeping.

Overall, Bench is the lower-cost option. The minimum that you will pay for QuickBooks Live is $275 per month, whereas the minimum that you can pay for Bench is $249 per month (with annual billing).

Cost shouldn’t be the only factor that you take into consideration, but be sure that the price makes sense for your business; you don’t want to overdraw your accounts just to have a bookkeeper tell you you’ve overdrawn.

Bench Pricing

| Bench Plan | Includes | Price |

|---|---|---|

| Essential | Monthly Bookkeeping | $299 |

| Premium | Bookkeeping & Taxes | $499 |

QuickBooks Live Pricing

| QuickBooks Live Plan | Monthly Expenses | Monthly Price |

|---|---|---|

| Low-Volume | Up to $25,000 | $200 |

| Medium-Volume | $25,001 to $150,000 | $400 |

| High-Volume | $150,001 or more | $600 |

To enroll in QuickBooks Live, you must have at least QuickBooks Online Plus. Be sure that you factor in the cost of QuickBooks Online.

- QuickBooks Online Plus – $85 per month

- QuickBooks Online Advance – $200 per month

QuickBooks Online frequently has 50% off offers, so take advantage of a sale to save.

Accrual Basis Accounting

Bench and QuickBooks Live both primarily use cash basis accounting, rather than accrual. With cash basis accounting, money doesn’t get recorded until it is paid or received, so accounts payable and receivable are not recognized in the statements until cash changes hands.

Accrual accounting gives a more accurate picture of your financial position overall, but cash accounting is a more accurate representation of the cash that you actually have on hand.

Bench offers a specialized bookkeeping service for an extra $100 per month for businesses that need to track accounts payable and receivable. This is not full accrual basis bookkeeping. Instead, basic accrual adjustments are recorded, but at the end of the year your bookkeeping is adjusted back to cash basis accounting.

On the other hand, QuickBooks Live does not offer accrual basis accounting, nor is there an option to have your bookkeeper track accounts receivable and accounts payable. However, QuickBooks Online will allow you to toggle between the accrual and cash basis calculations. The only caveat is that you’ll have to enter accounts receivable and accounts payable yourself.

Communication

Bench and QuickBooks Live both offer unlimited customer support and meetings with your bookkeeper. You have to schedule meetings ahead of time, and meeting times are limited to the bookkeeper’s hours of operation.

With Bench, you can contact your bookkeeper via a direct message on the Bench website or app, or by email in order to schedule a call. In app messages typically get a response within a few minutes, and you can get a call within a day of scheduling. One benefit of Bench is that you and your bookkeeper can leave notes on transactions, thus avoiding back-and-forth texts.

With QuickBooks Live, you can direct messages or email your bookkeeper, and you have the choice of a phone call or a video call and screen sharing. QuickBooks outright limits you to one scheduled appointment at a time, whereas Bench does not specify whether you can schedule multiple appointments at a time.

With both Bench and QuickBooks, you’ll be able to develop a relationship with your dedicated bookkeeper. If you like to feel as though your bookkeeper is in the room with you, then QuickBooks Live is the best choice on this front.

Scalability

Bench bookkeeping is straightforward and will work for most small businesses with basic bookkeeping needs. Users can connect up to 15 merchant, bank, credit, and loan accounts for free. However, you’ll need to contact Bench for a custom price should you need to connect more accounts.

QuickBooks Live lets you connect an unlimited number of accounts. QuickBooks Online Plus also allows you to add up to five users. If you have a larger business team and accounts, QuickBooks may be the way to go. QuickBooks is more scalable overall. And you won’t have to change your pricing plan until your monthly expenses exceed $25,000.

Both Bench and Quickbooks Live are “lightweight” bookkeeping, but QuickBooks Live can do a little more heavy lifting. The QuickBooks software is far more customizable than Bench and has more features.

Bench lacks any sort of API that allows you to combine financial and nonfinancial data. With QuickBooks, you can integrate non financial information- like inventory- with your bank statements for a comprehensive picture of your business.

Integrations

Bench integrates with a handful of third party apps, including payment processors such as Stripe, Square, Shopify, PayPal, and Amazon. It also integrates with payroll company Gusto, and Bench users get to try Gusto free for three months.

Gusto Payroll Plans

| Gusto Plan | Per Month Fee | Additional Per Employee |

|---|---|---|

| Simple | $40 | $6 |

| Plus | $80 | $12 |

| Contractor Only | $0 for 6 months, then $35 | $6 |

QuickBooks has been around for a long time and integrates with just about every third party payroll and payment processing app, including the ones mentioned above. You can customize QuickBooks for your industry with industry-specific CRM, scheduling, inventory, and time tracking apps.

Because QuickBooks has so many more integrations, it’s a lot easier to move your data to and from this platform than it is with Bench.

If you have industry-specific bookkeeping requirements, or if you want all of your data in one place, then QuickBooks may be a better option.

Contract and Free Trial

Bench offers a one month free trial, whereas QuickBooks Live does not. If you’re not sure whether a virtual bookkeeper is right for you, then we recommend that you give Bench a try to see if it fulfills all of your requirements. If it doesn’t, you can hop onto a free 30 minute consultation with a QuickBooks Live specialist.

In fact, every new Bench user gets a free trial. During the trial, a bookkeeper helps you set up your accounts and will adjust your expenses.

Bench and QuickBooks are no contract, so you can switch plans or cancel at any time. Bench does offer a discounted price if you pay annually, so you may feel inclined to not cancel your account once you’ve paid for the year.

Keep in mind, if you are an existing QuickBooks Online customer, you still must pay the $500 onboarding free. So QuickBooks Live requires an upfront investment, and Bench does not.

Bench vs QuickBooks Live: Which is Best?

Whether Bench or QuickBooks Live is the better option depends mostly on your budget and the complexity of your business.

With QuickBooks Live, you might pay a bit more, but you get more scalability, customization, integrations, and personalization.

Bench offers very straightforward bookkeeping and software. It’s a less costly option for small businesses that just want to make sure that their books are done right. There’s no risk in signing up with a free trial of Bench to make sure it fits all of your bookkeeping needs.

Choosing the right virtual bookkeeping solution for your business will give you a great return on investment. It will help maximize your tax deductions, save you time, and help you run your business more effectively.