Bench bookkeeping is an online accounting service that manages bookkeeping and taxes for businesses. Through the synergy of online accounting software and an experienced team of in-house bookkeepers and licensed tax professionals, Bench will keep your books balanced, clean, and ready for tax season.

This review of Bench bookkeeping will help you understand how Bench differs from other virtual bookkeeping services, like Quickbooks Live.

You’ll also learn about the problems Bench addresses, which features they are best known for, their plans and pricing, all about their integrations and add-on services, and where they fall short.

What Is Bench?

Bench is the largest online bookkeeping service in the United States for small businesses. They launched in 2013 as an affordable bookkeeping option for businesses that can’t afford dedicated in-house bookkeepers, but who need and want to understand their financial position.

As one of the 30 fastest growing tech companies in North America according to DeLoitte, Bench has proven its ability to simplify business bookkeeping.

Bench accomplishes its goal of making “understanding finances simple, effortless, and affordable for everyone” with the automation of proprietary bookkeeping software, and a team of hundreds of full-time bookkeepers are available to reconcile accounts and answer client questions.

The bookkeeping team is what makes Bench different from automated online bookkeeping software. With traditional online services users have to log in, set up, and manage their own accounts – Bench bookkeepers will do all this for you.

How Bench Works

When you sign up with Bench, the company will assign a dedicated bookkeeper to your business. Over a phone call, your bookkeeper will ask questions about you and your business.

This helps the bookkeeper understand how to categorize your transactions and customize your account to your industry in a way that will make taxes a lot easier to process, and financial statements a lot easier to understand.

During this call, your bookkeeper will also link your bank accounts, merchant accounts, and credit card accounts with the Bench bookkeeping software. This ensures that each transaction is automatically imported and tracked by the Bench software.

In terms of safety, Bench uses bank-grade security and 256-bit encryption to protect your data and personal information.

Sometimes, you’ll need to show bills and receipts to Bench. Rather than physically mailing them to Bench’s Vancouver headquarters, you can use their receipt scanning app, which will upload them directly to your account.

Every month, your bookkeeper will send you financials including an Income Statement and Balance Sheet. You will also receive visual reports that detail your revenue, expenses, and historical performance.

You have access to your financial reports and transaction data on your account dashboard, but you never have to log in, if you don’t want to.

The Bench Premium service also includes access to a licensed tax professional and they will help with your year-end filing — more on this below.

Whenever you have questions for your bookkeeper, you can get in touch by booking a call, or sending a message through the Bench mobile app on iOS, or the mobile browser on Android.

Exclusive Offer: Save 30% off your first 3 months with Bench

Problems That Bench Addresses

1. Inaccurate Bookkeeping

Most business owners and entrepreneurs don’t have the financial literacy to accurately manage their own books, which can lead to a misrepresented financial position, as well as costly sessions with a CPA at tax season.

The auto-sync with user bank accounts ensures that no transactions are missed, and the bookkeeper ensures that each transaction is accurately categorized.

2. Time-Consuming Bookkeeping

Your dedicated bookkeeper for your business will handle the time-consuming aspects of bookkeeping for you.

While much of the tedious aspects of bookkeeping are eliminated by the software, the bookkeeper will manually reconcile your accounts and categorize your transactions. As the business owner, you don’t have to spend time on any of it.

3. Expensive Bookkeeping

According to salary.com, the median annual cost of an in-house bookkeeper is over $40k. For many small businesses and startups, this salary falls far outside of their budget.

Bench offers most of the features of an in-house bookkeeper at a flat price that is well below average. If you want to compare Bench’s prices with other virtual bookkeeping services, check out our comprehensive guide on the top 100+ bookkeeping pricing packages.

Bench Bookkeeping Features

Bench aims to give business owners more time to focus on what they care about, and less time crunching numbers. Here, we’ll take a look at the distinctive features of Bench’s service that enable effective online bookkeeping.

Software

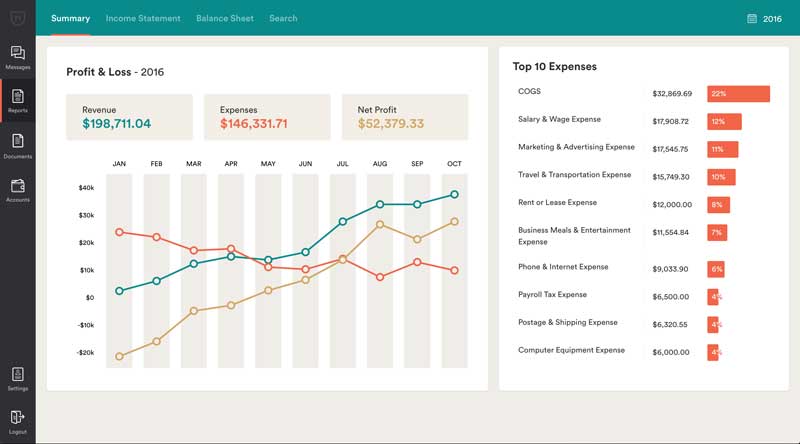

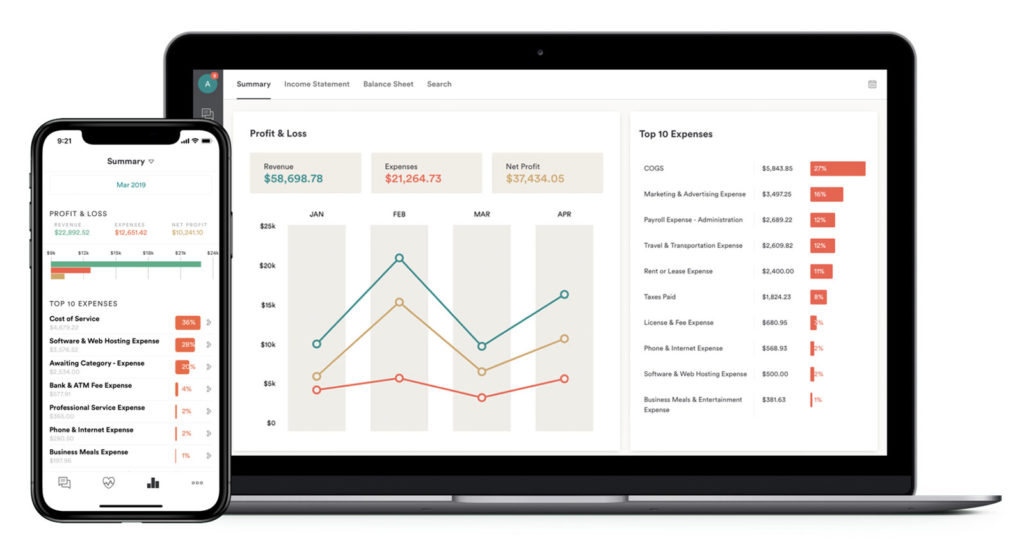

Bench uses a proprietary software that is user friendly, even for those that are not computer savvy or financially literate. It has an intuitive layout and delivers financial information in easy-to-understand charts and visuals.

Notably, monthly and yearly income comparisons are visualized on a line graph, and the top ten expenses from each month are always displayed on the home page.

Two of the most useful general purpose financial statements – the income statement and balance sheet – have their own dedicated tabs.

Transactions can be searched for via keyword or date. Each transaction can be flagged and labeled by you, or by your bookkeeper if it needs clarification.

Essentially, Bench has distilled its bookkeeping platform into at-a-glance summaries. The data in the bookkeeping software is pulled in read-only format from your bank, credit, and merchant accounts.

Users should note that because Bench uses proprietary software, it is not compatible with Quickbooks or with any other online bookkeeping software. This isn’t an issue unless you decide to switch bookkeeping services, in which case data transfer could prove to be more of a hassle than if Bench used a common software.

Should you decide to switch, you may have to manually transfer the data yourself or pay another service for assistance.

Customer Service

Bench’s greatest strength lies in its customer support. All Bench plans include support.

Specifically, you will be assigned a team of three dedicated bookkeepers, one of whom will be your account manager.

When you reach out for support, Bench will try to connect you with your account manager, though sometimes you’ll be put in touch with one of the other two bookkeepers. Your bookkeeping team will always be up-to-date on your business and financial status.

If you need to get in touch with your bookkeeper or tax professional, you can either schedule a phone call or send a message via the app. Usually, you will be able to call within a day, and in-app messages sent during hours of operation usually receive a response within a matter of minutes.

Furthermore, information regarding specific transactions can be communicated on Bench’s platform through labels and notes.

Cash Basis Accounting

Bench primarily uses a cash-based bookkeeping method, rather than an accrual-based accounting method.

Cash-basis bookkeeping means that money is not recorded until it is paid or received, whereas accrual based bookkeeping means that money is recorded when an income or expense is incurred.

For example, if you send an invoice due to be paid in one month, a cash-based bookkeeping method would not record that income for thirty days. An accrual-based bookkeeping method would record that invoice as soon as the invoice is sent.

Cash-basis bookkeeping is useful for knowing exactly how much money your business actually has on hand. But for companies that have a lot of inventory, or for those that process large invoices and accounts payable, accrual accounting is necessary to get a clear picture of a financial position.

For businesses with over $5 million in revenue, accrual-basis bookkeeping is required by the IRS. If your business grows, you may have to switch to accrual-basis accounting system.

Bench Bookkeeping Plans and Pricing

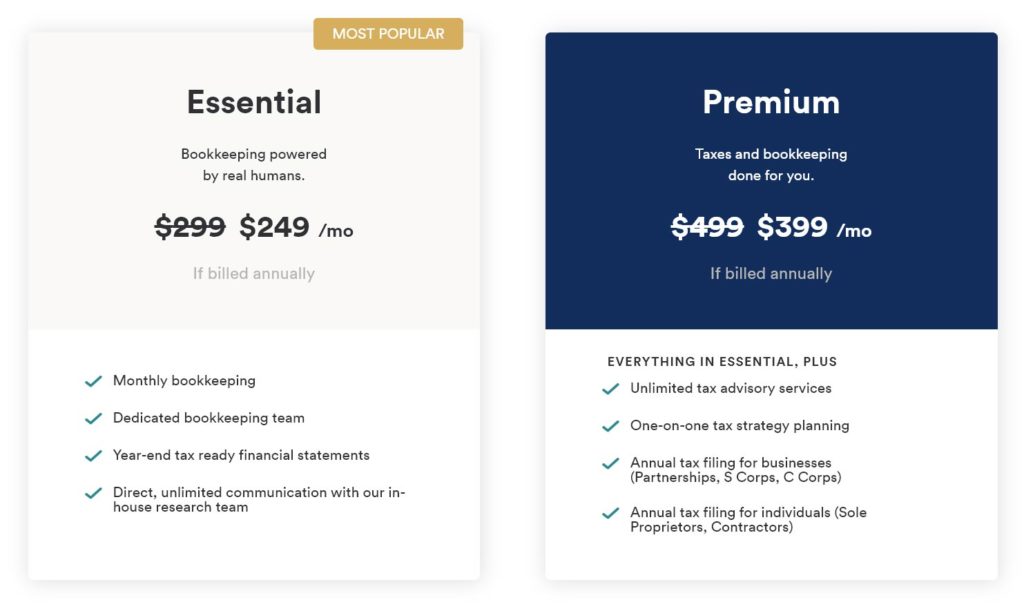

Pricing with Bench couldn’t be any simpler. There are two packages to choose from depending if you’d like help with your taxes or not. If your business requires specialized bookkeeping — such as tracking accounts payable and receivable — there’s an add on starting at only $100 per month.

| Bench Plan | Includes | Price |

|---|---|---|

| Essential | Monthly Bookkeeping | $299 |

| Premium | Bookkeeping & Taxes | $499 |

Integrations and Add-Ons

Each Bench plan provides the same level and standard of bookkeeping. However, Bench offers a few additional service packages that can be purchased as add-ons.

Bench Premium

The in-house team at Bench is primarily composed of professional bookkeepers, who can make suggestions to keep your bookkeeping stress free. However, bookkeepers cannot legally provide tax or financial advice – this is the job of a CPA or attorney.

For this reason, Bench now has their own licenced tax professionals. When you enroll in the Bench Premium service, you’ll gain year-round access to tax professionals that will answer your tax-related questions. You’ll also have a dedicated Tax Coordinator responsible for tracking down forms and organizing documentation.

At the end of each year, their partners at Taxfyle will file your return. Taxfyle experts have an average of 15 years of experience and, like all Bench employees, have passed background checks and are US-based.

The Bench Premium plan covers unlimited state filings, investments, rental income, itemized deductions, and quarterly estimates. Personal federal and state income tax filings are also included for sole proprietors in the Premium plan. You can also add on personal filing for one partner for S-corps, C-corps, and partnerships for $45 per month.

Payroll

Bench does not handle your payroll in house, but Bench software integrates with small business payroll services.

Their preferred payroll service is Gusto, which will integrate with Bench’s proprietary software, and with the popular accounting software QuickBooks and Xero (in case you switch in the future).

Bench users even get three months of Gusto for free, so there’s no risk in trying it out.

By integrating with Bench’s software, the initial Gusto set up process is easy and the interface is intuitive. Gusto services both W-2 employees and 1099 contractors, and allows you to manage employee benefits and timekeeping.

Because Bench is synced to Gusto, deductions are calculated automatically. If you need help, Gusto has payroll specialists that are available for human support.

Gusto offers the following plans:

| Gusto Plan | Per Month Fee | Additional Per Employee |

|---|---|---|

| Simple | $40 | $6 |

| Plus | $80 | $12 |

| Contractor Only | $0 for 6 months, then $35 | $6 |

Historical Bookkeeping & BenchRetro

If you neglected your books for up to two years, you can add Historical bookkeeping to any standard Bench plan.

With Historical bookkeeping, your bookkeeper will get your books back on track by helping you gather your documents, reconcile bank accounts, collect old W-9s and W-2s, then send your documents to your CPA.

BenchRetro is available for businesses who have over two years’ worth of overdue books. For each year of overdue books, BenchRetro provides a Year End Financial Package so that your business can file overdue taxes and apply for loans. Each BenchRetro plan is custom, so you’ll have to book a free consultation to work out a payment plan.

Historical Bookkeeping and BenchRetro each start at $299 for each month that your bookkeeper reconciles.

Specialized Bookkeeping

Specialized bookkeeping is necessary if your business requires property tracking, third party revenue collection, or cash revenue and cash expense tracking. Specialized bookkeeping starts at $100 per month in addition to your standard plan.

Other Integrations

Bench’s software integrates with popular payment processors including Stripe, Square, Shopify, PayPal, and Amazon. When you integrate your Bench account with a payment processor, all of your transactions will automatically sync to Bench.

Bench Highlights

Affordability

Relative to most bookkeeping services, Bench is affordable. On average, bookkeeping pricing packages will cost between $200 to $400 per month.

Until mid-2021, Bench was one of the lowest cost online bookkeeping services. Though their base pricing has creeped up, Bench still gives you a comprehensive but no-frills bookkeeping service for less than most. If you can get by with basic bookkeeping, then Bench is an excellent option.

Bench App

The Bench app has proven to be helpful to business owners that are constantly on the go. It allows you to view financials and message your bookkeeper at any moment.

The app is a great tool to have on hand when making purchases as you can scan receipts and simplify your expense reporting process.

Where Bench Falls Short

Cash Basis Accounting

Bench provides most clients with a modified form of cash basis bookkeeping, in which the transactions are recorded as soon as money has been deposited or charged to your bank or credit card.

However, Bench does provide some clients with accrual basis accounting. Bench is vague regarding whether you pay extra for accrual accounting, but it does state that in some cases they will develop a modified bookkeeping plan if you require it.

Customization

Bench is not customizable. With the affordability factor comes a lot of standardization, including in the Bench account dashboard and its ability to generate ad hoc financial reports.

With Quickbooks bookkeeping software, you can tailor the dashboard to your businesses needs.

Lack of API

Bench does not have an API, which would allow you to combine your non-financial data with the data that syncs with your Bench software.

If inventory tracking is important, then you might prefer a software that integrates both financial and non-financial data.

Related: Bench vs QuickBooks Live Virtual Bookkeeping

Bench Alternatives

Bookkeeper360 is worth consideration if you’re looking for more add-ons and customization. They are a full-service back office accounting solution that can even include HR and payroll.

| Bookkeeper360 Reconciliation | Accounting Method | Monthly Price |

|---|---|---|

| Monthly | Cash | Starting at $399 |

| Weekly | Cash | Starting at $549 |

| Monthly | Accrual | Starting at $549 |

| Weekly | Accrual | Starting at $749 |

Bookkeeper360 is different than Bench in that uses either Quickbooks or Xero bookkeeping software, which makes switching to another service easier, should you ever decide to do so.

Their service is easily scalable and is a good choice for small and medium-sized, growing businesses that want to outsource their bookkeeping, accounting, HR, and payroll with a single provider they trust.

Special Offer: 20% off your first 3 months with Bookkeeper360

FinancePal is a virtual bookkeeping service that provides an array of fully customizable options that any small business may benefit from, including transaction recording, income statement preparation, balance sheet preparation, payroll, and small business tax preparation services.

FinancePal has dedicated bookkeepers, CPAs, and tax specialists available to serve your business.

| FinancePal Bookkeeping Plan | Average Monthly Transactions | Monthly Price |

|---|---|---|

| Small Business | Up to 50 | $150 |

| Custom | More than 50 | Custom |

Since FinancePal’s service is fully customized and tailored to your business, there is no fixed pricing. However, their pricing starts at only $150 per month, making them one of the most affordable bookkeeping services.

Should You Hire Bench?

Bookkeeping is an absolutely essential business activity. If you cannot afford an in-house or dedicated bookkeeper, then Bench is an excellent alternative.

If cost is an issue, note that excellent free bookkeeping software is available, if you’re willing to take on all the work yourself.

For a very affordable price, Bench will manage the absolutely necessary bookkeeping such as categorizing transactions and managing receipts. Tax service and payroll integration are available as add-ons, and will raise your monthly payment. However unlike Bookkeeper360, Bench will not help with tasks such as invoicing, sending out 1099s, or paying sales tax, and there is limited customization available.

Exclusive Offer: Save 30% off your first 3 months with Bench

Whether Bench is a good choice for your business depends on what your business needs are. If you’re looking to save time and have your books done quickly and accurately, then Bench will get the job done.