Alternative business loans can be help businesses that are having difficulty securing adequate financing through traditional bank loans. Alternative lenders offer greater flexibility and often have shorter approval times allowing you to access funds quicker.

The most popular types of alternative business loans — P2P, short-term loans, equipment loans, invoice factoring, and merchant cash advances — have surged in popularity as versatile and often more attainable lifelines.

Navigating the landscape of business financing can be complex for many entrepreneurs. With so many products available, choosing the right one for your business is crucial. To assist in this important decision, we reviewed dozens of providers and settled on the seven best alternative lenders. This guide is designed to help you select the solution that’s best for your business needs.

What are Alternative Business Loans?

An alternative business loan is something outside of the range of traditional financing you would often find at a conventional bank. These loans are typically not provided by banks but by a variety of other financial institutions, including online lenders, credit unions, and even individuals through peer-to-peer lending platforms.

Alternative lending came about largely as a result of the 2008 financial crisis. Banks tightened their lending standards, leaving many small businesses out in the cold when it came to accessing credit. Bank financing takes an average of 90 days to secure, regardless of the amount or solution you’re seeking.

In response, non-bank alternative lenders began to emerge, offering more flexible, technology-driven loan products that catered to the underserved small business sector.

Best Alternative Business Loans

| Alternative Lender | Best for |

|---|---|

| Bluevine | Quick funding |

| Riviera Finance | Customer service |

| National Business Capital | High approval rate |

| Fundbox | Minimal documentation |

| Fora Financial | Flexible credit requirements |

| Funding Circle | Online term loans |

| OnDeck | Fast approval |

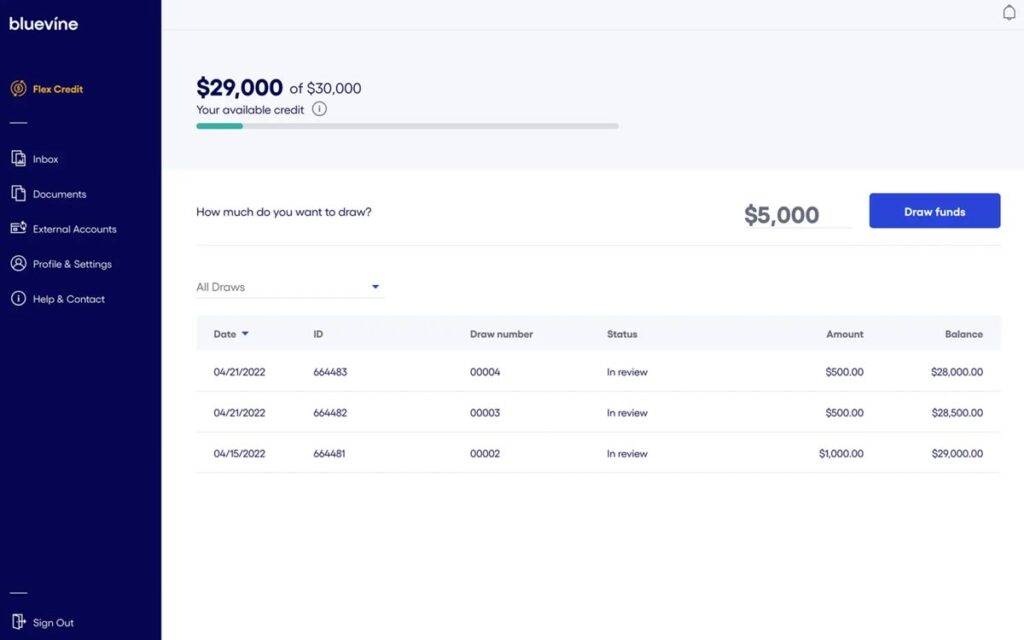

1. Bluevine

Bluevine offers business lines of credit up to $250,000 with a minimum credit score requirement of 625, catering to small business owners in need of quick funding. They are recognized for their straightforward application process, rapid decision-making, and the ability to fund businesses within 12 to 24 hours in most cases.

To qualify for a Bluevine Flex Credit account, your corporation or LLC must be in business 24+ months, have no bankruptcies in the past three years, and be in good standing with your Secretary of State.

The APR starts at an appealing rate of 6.2%, although it can vary significantly—from approximately 20% to 50%—based on your creditworthiness and the specifics of the loan term. The upside is that they do have pretty flexible repayment terms, offering six or twelve-month options, with no prepayment penalties.

Typically, repayments are scheduled on a weekly or monthly basis, depending on the terms agreed upon at the onset of the loan. Because a Bluevine Line of Credit uses simple interest, if you pay off your balance early, you can reduce the amount of interest you have to pay.

While Bluevine’s speed of service and lack of prepayment penalties are significant advantages for businesses in need of immediate capital, there are considerations to weigh. The costs associated with Bluevine’s line of credit, including interest rates and fees, can be higher than those of traditional bank loans, particularly if you are after a longer-term financing option.

Be aware that while Bluevine can help businesses in most industries and states, some are not allowed including: Nevada, North Dakota, South Dakota, and U.S. territories.

Alternative Loans Offered

- Business Line of Credit

- Business Credit Card

Bluevine Highlights

| Loan Amounts | Up to $250,000 |

| Minimum Credit Score | 625 |

| Estimated APR Range | 6.2% to 50% |

| Revenue Requirement | $40,000 in monthly revenue |

| Underwriting Process | Connect bank accounts & QuickBooks |

| Credit Check | Soft Pull |

| Approval Time | 5 minutes |

| Collateral Required | Personal guarantee |

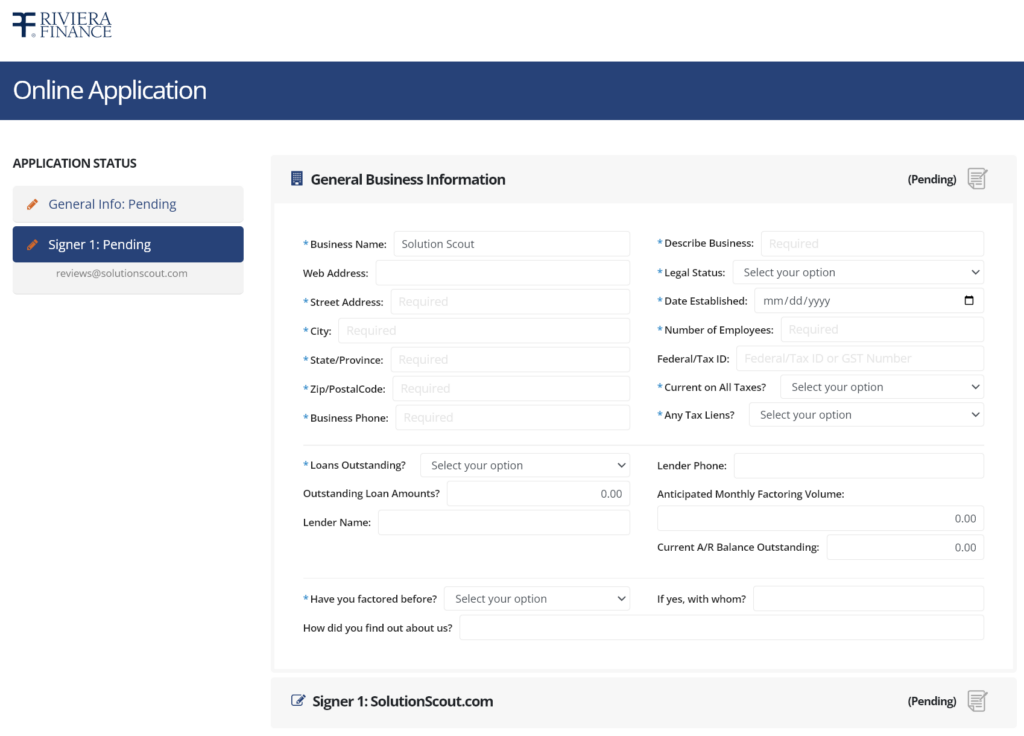

2. Riviera Finance

Riviera Finance is a well-established financial services provider offering invoice factoring solutions primarily to small and medium-sized businesses. For over 50 years, Riviera Finance has been recognized for helping companies manage their cash flow by converting their accounts receivable into immediate working capital.

With invoice factoring, the focus is not on your creditworthiness, but rather on the creditworthiness of your customers. Unlike traditional lenders that only provide business loans and lines of credit, Riviera Finance buys your outstanding invoices, providing immediate cash flow to help manage your business operations. Typically, they can advance up to 95% of the invoice value.

The application process with Riviera Finance is known to be quick and manageable with minimal paperwork involved, and decisions are often made promptly. This allows for fast access to funds, often within 24 hours after account setup and verification of invoices.

The fees associated with Riviera Finance can be higher than traditional banking solutions as costs for invoice factoring are based on a number of factors including, but not limited to, the volume of invoices, customers’ credit standings, and the time invoices go unpaid.

As per their client-oriented policies, Riviera Finance does not impose long-term contracts or monthly minimums on factoring lines, offering flexible terms that can suit various business sizes and needs once they meet company requirements.

Overall, Riviera caters to small business owners seeking financing solutions outside of classic banks. As an alternative lender, Riviera Finance specializes in freeing up cash tied in unpaid invoices through factoring services.

Alternative Loans Offered

- Invoice Factoring

- Small Business Line of Credit

Riviera Finance Highlights

| Loan Amounts | Up to 95% of Unpaid Invoices |

| Minimum Credit Score | No Minimum FICO |

| Estimated APR Range | 15% to 60% |

| Revenue Requirement | No Requirement |

| Underwriting Process | Review Invoices |

| Credit Check | Not Necessary |

| Approval Time | 2 to 3 Days |

| Collateral Required | None |

3. National Business Capital

National Business Capital stands out among alternative lenders for its ability to cater to businesses across various industries, including those in high-risk fields like cannabis. With a network of over 75 lenders, they offer a wide array of financing options to suit different needs, from small business loans and lines of credit to specialized funding solutions like equipment financing and SBA loans.

National Business Capital gives you access to a broad spectrum of loan options from $100,000 up to $10,000,000, with APRs as low as 3.25%. NBC isn’t a traditional bank, but rather serves as a bridge between businesses and lenders, primarily focusing on giving companies that struggle to find traditional financing an avenue for growth and operational support.

If your credit isn’t the best, the good news is that National Business Capital doesn’t impose a rigid minimum credit score across all its business loans. For instance, with its small business loans, you may be eligible with a credit score as low as 580. Lending criteria hinges on your income more than your credit score.

Generally, you’ll need to show a minimum of $360,000 in annual revenue and at least one year of operation to qualify for most options. However, some products have more lenient criteria for businesses at different stages of growth and financial health.

Alternative Loans Offered

- Asset-based lending

- Business lines of credit

- Small business loans

- Equipment financing

- Invoice financing

- SBA loans

National Business Capital Highlights

| Loan Amounts | $100,000 to $10,000,000 |

| Minimum Credit Score | No Minimum FICO |

| Estimated APR Range | 3.25% to 15% |

| Revenue Requirement | $30,000 Monthly |

| Underwriting Process | 6 Months Bank Statements |

| Credit Check | Soft Pull |

| Approval Time | Hours / Days |

| Collateral Required | Not Necessary |

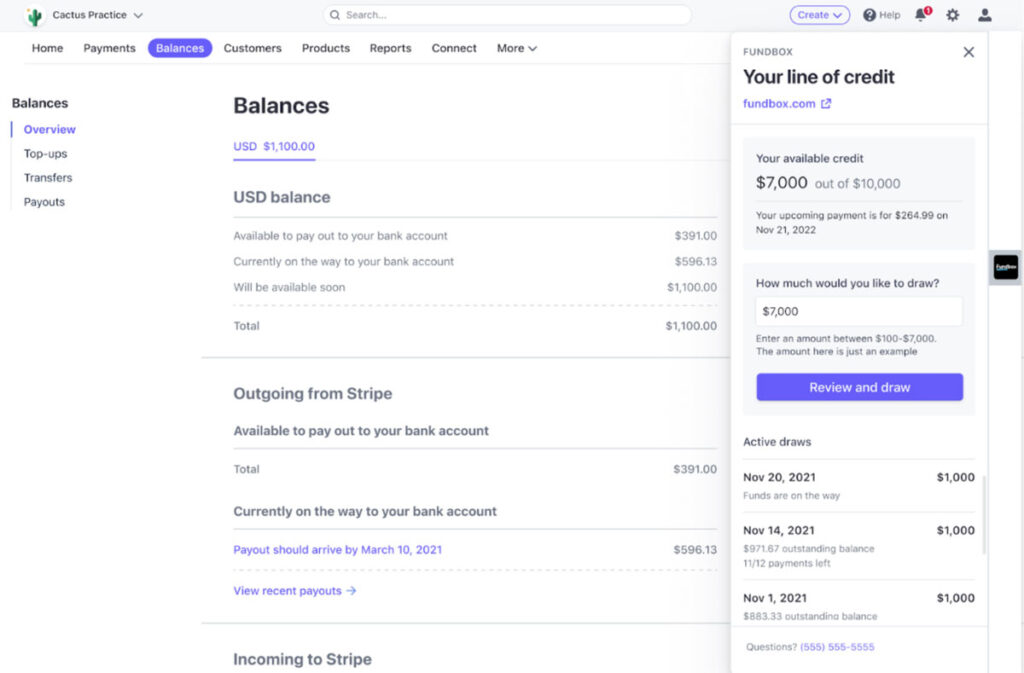

4. Fundbox

Fundbox offers a streamlined solution for quick access to working capital, making it a solid choice for startups and business owners with less-than-perfect credit. The platform is particularly noted for its simple application process, minimal documentation requirements, and the fast availability of funds—often as soon as the next business day following approval.

With a maximum loan amount of $150,000 and a minimum credit score requirement of 600, Fundbox positions itself as an accessible lender for a wide range of business needs. The company provides a line of credit that is easy to qualify for, with no application, inactivity, or origination fees, and no prepayment penalties, making it an appealing option for businesses seeking flexibility and speed in funding.

Fundbox’s APR ranges from 36% to 99%, which reflects the cost of borrowing over a year and includes any associated fees. This rate is on the higher side, especially when compared to traditional bank loans, but it is the trade-off for the convenience, speed, and lower credit requirements they offer.

Fundbox also provides vendor credits, known as “net terms,” which can be a cheaper option than lines of credit for covering immediate or unexpected expenses. This type of financing, which uses your accounts receivable as collateral, is advantageous for handling costs like taxes, broken equipment, or outstanding balances with contractors.

Despite its advantages, Fundbox has some limitations to consider. The platform has relatively short repayment periods (a maximum of 24 weeks) and requires weekly repayments, which might not work if you need longer-term options. Additionally, the higher APR compared to some other financing options means that the total cost of borrowing can be significant if you don’t pay it off quickly.

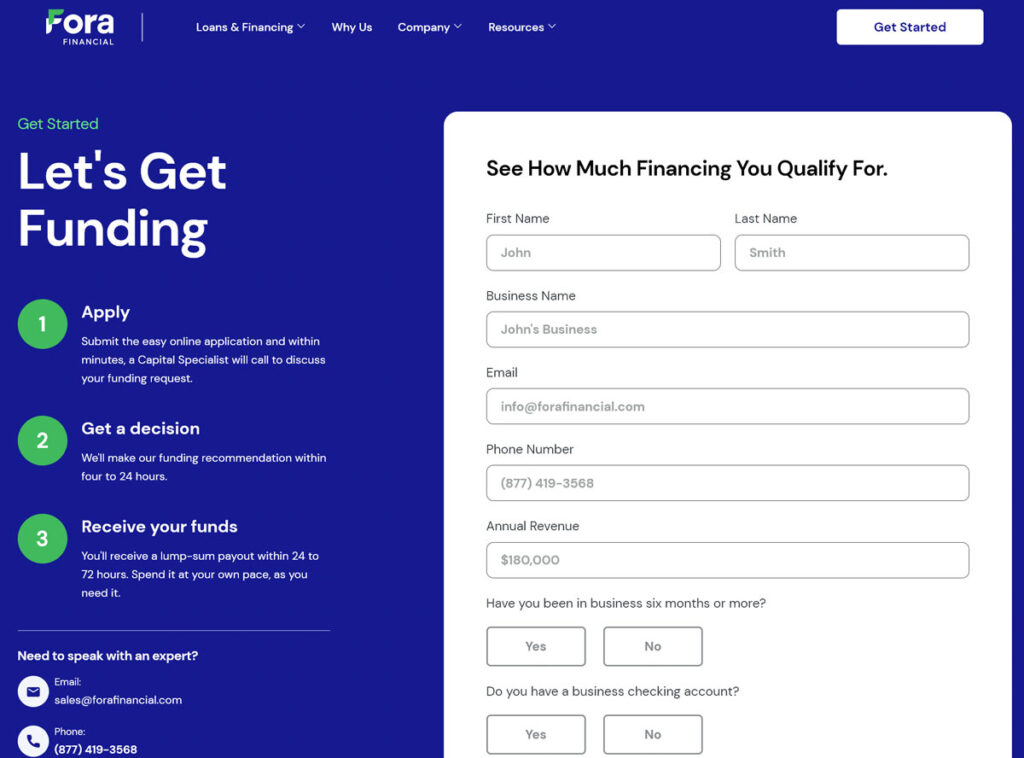

5. Fora Financial

Fora Financial stands out for its speedy funding process and flexible credit requirements. With a maximum loan amount of up to $1.5 million and a minimum credit score requirement of just 500, they have something for everyone.

Fora Financial provides two main products: short-term loans and merchant cash advances, designed to offer swift financial support to businesses. This lender is known for its rapid approval and funding process, with the possibility of receiving funds within 24 to 72 hours after approval.

Fora Financial employs factor rates ranging from 1.1 to 1.9 to determine the cost of borrowing, rather than traditional APRs. So, it can be a little confusing when you’re trying to compare to other lenders that rely strictly on APRs.

While offering flexibility and fast access to funds, loans from Fora Financial might come with higher borrowing costs than some other alternative lenders. Additionally, they charge an origination fee of roughly 3% of the loan amount, alongside a one-time wire transfer fee.

The maximum repayment term is limited to 15 months, which isn’t ideal if you’re seeking longer-term financing options. However, one huge advantage is that they do not penalize early repayment, and in fact, offer sizable discounts for prepaying.

6. Funding Circle

Funding Circle is a notable option for established businesses who have decent credit and are in search of competitive rates for online term loans. Offering a maximum loan amount of up to $500,000, this platform is a viable alternative for businesses seeking substantial funding with a straightforward application and quick funding turnaround.

You’ll need a minimum FICO score of 660 to qualify for a loan with Funding Circle. But unlike many lenders, Funding Circle does not set a minimum annual revenue requirement — though other factors such as revenue, credit score, and cash flow are considered during the underwriting process.

The APR for Funding Circle loans typically ranges from 15.22% to 45%, plus origination fees that range from 4.49% to 8.49%. This part depends on your creditworthiness. Plus, you’ll need at least 24 months of business history to qualify. If you’re a startup or a new venture, it might be less competitive than some of our other picks.

7. OnDeck

OnDeck offers a variety of financing options, including short-term loans and lines of credit. With loan amounts up to $250,000, they cater mainly to small and medium-sized businesses looking to bridge cash flow gaps, finance project expansions, or manage unexpected expenses.

OnDeck is known for its quick application process and the ability to disburse funds as rapidly as within the same day of approval, making it a go-to for immediate funding needs.

They are an accessible lender for businesses with less-than-perfect credit, but they still require a minimum credit score of 625 for most of their financing products. Additionally, businesses must have a minimum of one year in operation and a minimum annual revenue of $100,000.

The APR for OnDeck loans can vary widely, starting from around 35% and potentially reaching higher, depending on the specific loan product, term length, and your creditworthiness. While OnDeck provides an opportunity for businesses with lower credit scores to access funding, the associated costs, including higher APRs and potential origination fees than some competitors, might make you think twice.

Traditional vs Alternative Lending

| Traditional Lending | Alternative Lending | |

|---|---|---|

| Lenders | Banks, Credit Unions | Online lenders, P2P platforms, Factoring companies |

| Approval Time | Usually weeks to months | Often within a few days or even hours |

| Credit Requirements | Typically stringent; high credit scores | More flexible; may consider less-than-perfect credit |

| Collateral | Often required | May not be required; unsecured options available |

| Loan Amounts | Generally higher | Can be lower; varies by lender |

| Interest Rates | Lower due to risk assessment and collateral | Higher to offset the increased risk |

| Repayment Terms | Longer terms; typically 3 to 10 years | Shorter terms; often 6 to 24 months |

| Technology Use | Traditional application process | Utilize fintech; often completely online |

| Flexibility | Standardized products | Tailored products, flexible terms |

| Funding Speed | Slower; extensive underwriting process | Quick access to funds |

| Documentation | Extensive paperwork | Minimal paperwork; streamlined process |

Pros & Cons of Alternative Business Loans

Pros

- Accessibility: Lower barriers for qualification including credit scores and time in business.

- Simple Application: Easier, less demanding application processes compared to banks.

- Quick Funding: Faster approvals and potential for same-day funding in some instances.

Cons

- Higher Costs: Can come with higher interest rates for some borrowers, especially with Merchant Cash Advances (MCAs) and Peer-to-Peer (P2P) lending.

- Short-Term Repayment: Often require repayment within a short period, sometimes with frequent payment schedules.

- Collateral and Guarantees: May need collateral or personal guarantees from the business owner.

- Debt Cycle Risk: The ease of rollover loans might trap businesses in continuous borrowing.

- Limited Support: Smaller, nontraditional lenders might offer less customer support than established institutions.

How Alternative Lenders Work

Alternative lenders are known for their innovative underwriting processes. Instead of relying solely on credit scores and historical financial statements, alternative lenders use various other data points, such as real-time cash flow captured through merchant accounts and accounting software, length of time in business, and equipment value, to evaluate a business’s financial health.

Loans will have different requirements and means of verification depending on the type.

Types of Alternative Business Loans

P2P Lending

Peer-to-peer lending represents one of the earliest forms of alternative loans, allowing individuals to lend money directly to businesses through an online platform, without the need for a traditional financial middle man.

Short-Term Loans

These are characterized by their quick approval process, which can be as fast as a few hours. The trade-off for this convenience is typically higher interest rates.

Short-term loans are best suited for businesses needing immediate capital to take advantage of time-sensitive opportunities or to manage unexpected cash flow issues.

Business Lines of Credit

A line of credit gives a business access to funds up to a certain limit, which can be drawn upon when needed and paid back over time. Common assets used as collateral might include real estate, inventory, or accounts receivable.

The approval process for secured lines of credit involves assessing the value of the collateral, and repayment terms are agreed upon based on the risk assessment and the business’s financial stability.

Equipment Financing

These are very similar to secured lines of credit, but they are specifically designed to finance the purchase of new or used equipment. They often cover up to 100% of the equipment’s cost, with the equipment itself serving as collateral, which can make approval easier than unsecured loans.

Invoice Factoring

With invoice factoring, businesses sell their accounts receivable at a discount to a third party, known as a factor, in exchange for immediate cash.

Invoice factoring is best suited for businesses that have long invoice payment cycles but need cash more quickly to operate.

Merchant Cash Advance

A merchant cash advance provides businesses with a lump sum of capital upfront in exchange for a percentage of their daily credit card sales, plus a fee. MCAs are known for their high cost but can be a viable option for businesses that have strong credit card sales and need quick access to cash.

Merchant cash advance usually only makes sense if you borrow what you can pay back in the next few weeks or months’ worth of credit card revenues.

Choosing a Loan for Your Business

When it comes time to make the final decision, take stock of a few variables to make sure you’re making the right move.

- Assess your business needs: Begin by identifying the specific reasons you need financing. Is it for cash flow management, expansion, or an emergency fund? The purpose will heavily influence the type of loan you should seek.

- Evaluate your credit: Understand your credit profile, as it will play a significant role in determining your loan options. Higher credit scores tend to unlock more favorable loan terms and interest rates.

- Make sure you can repay: Look closely at the repayment terms of any loan. Calculate your debt service coverage ratio to ensure you can comfortably meet the periodic payments without straining your business’s finances.

- Analyze loan terms: Loan terms, such as interest rates, fees, loan amounts, and repayment plans, can vary widely among lenders. Long-term loans usually have lower monthly payments but could cost more over time due to interest.

- Consider traditional options: As versatile as alternative lending can be, you shouldn’t dismiss traditional bank loans. Banks usually offer lower interest rates for those who qualify and may be a good fit if you have good credit history and are not in a rush to secure funding.

Are Alternative Business Loans Right for You?

Alternative business loans can be a good choice if your company needs money fast and you may not have the time for a lot of forms or a long wait for an answer. These lenders usually charge more interest than regular banks and might require collateral or a promise to pay back the loan yourself if the business can’t.

But alternative business loans could work if:

- You urgently need money

- You only want to borrow a little

- Your business makes money

- You don’t meet the conditions for a bank loan

- Banks won’t lend you money

- You’re sure you can repay the loan