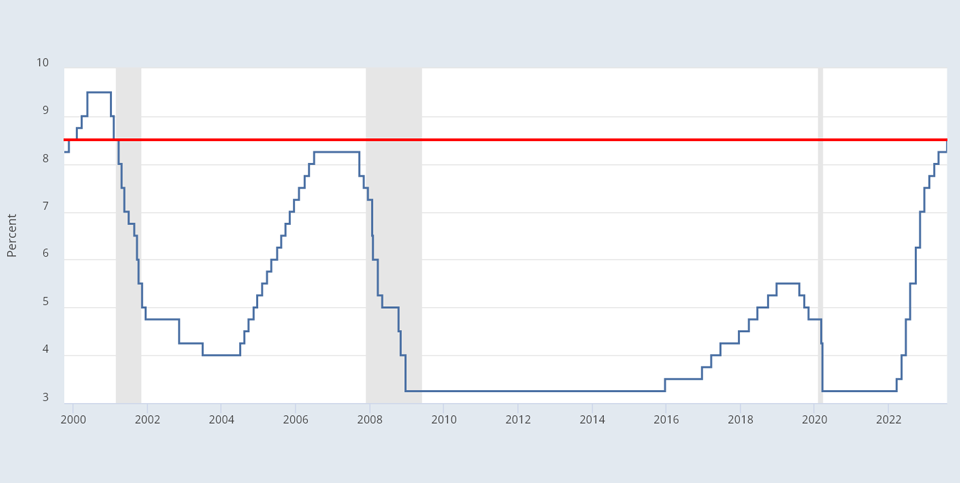

Business loan interest rates are complicated at best, though the current prime rate of 8.5% tends to set the foundation. Other factors influencing the average interest rate for business loans reach far beyond your own creditworthiness or business profitability to include external economic conditions and lender-specific policies.

As a business owner stepping into the new normal that is 2024, it is essential to understand the financial landscape – especially if you are considering taking out a business loan.

Current Business Loan Rates

| Loan Type | APR Range | |

|---|---|---|

| Bank Loan | 5.85% to 14.22% | Learn More |

| SBA Loan | 13.5% to 16.5% | Learn More |

| Online Term Loan | 6.75% to 44% | Learn More |

| Equipment Financing | 5% to 49% | View Preferred Lender |

| Business Line of Credit | 8% to 60% | Learn More |

| Invoice Factoring | 9% to 65% | Compare Rates |

The Influence of Multiple Factors

The interest rate applied to your business loan will rarely be governed by just one factor. Its ebb and flow can often seem as unpredictable as market trends were throughout 2023 – peaks, troughs, and sometimes outright anomalies dictated much of what occurred.

As we continue down this uncertain road, let’s unravel some determinants that may impact the rates you will contend with in 2024:

Financial Health of Your Business

Clearly, lenders want assurance that their money will be repaid, with interest. A strong credit history, high credit scores, solid revenues, and a good debt-to-income ratio could be your ticket to lower interest rates.

Lender Variability

Rates vary widely among lending institutions. Traditional banks might offer lower rates than alternative online lenders, but qualifying for bank loans typically requires a stronger financial profile.

Market Conditions

Interest rates echo the broader economic climate. Inflation rates, federal policy decisions, and economic growth projections all play a part. The wild swings of 2023 have taught us that predicting these movements requires a flexible outlook.

Average Interest Rates for 2024

Navigating interest rates in 2024 requires eagle-eyed watchfulness. They’re not only affected by the general health of the economy but also by the aforementioned individual factors surrounding your business.

It’s impossible to state a definitive ‘average’ interest rate that applies across the board due to such variation. However, you can expect diverse rate ranges across different lending options:

- Traditional Bank Loans

- SBA Loans

- Online Lenders

- Microloans

- Invoice Factoring

Each one caters to different needs and comes with its own average interest value that could indicate what your business might face. Even within these categories, rates can diverge significantly.

While statistics and averages from 2023 do give us an insight, forecasting for 2024 requires making sense of not past patterns but real-time data as it unfolds over time. Financial institutions regularly adjust their prime lending rates to align with economic trends and central bank policies, which directly affects how much business loans cost for consumers.

Light at The End of the Tunnel

The metaphorical light comes in both securing favorable loan terms and preserving financial stability through smart planning:

Research is Critical: Before you sign up for any loan, shop around rigorously for interest rates from multiple lenders – including small local banks and credit unions – which might offer more competitive terms.

Leverage Relationships: Building a relationship with a bank could possibly result in better terms due to mutual trust and understanding.

Understand Economic Influences: Keep abreast of economic forecasts, especially announcements by the Federal Reserve or economic patterns affecting interest rates across the board.

Consider Fixed vs Variable Rates: Fixed rates prove predictable over time while variable rates tend to ebb and flow with market conditions. Your decision will depend largely on how much risk you’re able (or willing) to assume as well as projections for rate movements for the duration of your loan term.

Final Thoughts on Business Loan Rates for 2024

The key takeaway is to choose the best type of financing for your situation, however consider that we can’t provide pinpoint accuracy regarding what to anticipate for specific business loan interest rates without knowing more about your business and the type of loan you’re considering.

An informed borrower who closely monitors both the financial health of their business and macroeconomic factors will steer their company through complex waters onto firmer ground.