In this article, we will discuss how eCheck payment processing works, how merchants benefit from accepting payment by eCheck, and the best services you can use for your business. We will also cover the issues with eChecks you need to be aware of.

Processing an electronic check may be more affordable than other forms of payment processing. You can overcome many of the risks of fraudulent or bounced checks with the use of eCheck (electronic check) processing and verification services.

Processing Checks & Electronic Checks

Processing Paper Checks

When you deposit a paper check, your bank sends it to a clearing unit such as the Federal Reserve bank. If your client or customer has sufficient funds in their checking account, the clearing unit transfers the check amount to your bank.

As you’re undoubtedly aware, the transfer process usually takes several business days and will be delayed by bank holidays, if the check is large, or if the checking account is based in a different state or country.

eCheck Payment Processing

eChecks – or electronic checks – speed up this process. An eCheck uses electronic fund transfers (EFTs) to move money between banks via the Automated Clearing House (ACH).

The check payer’s bank receives the notification of the request, verifies that funds are available, and then debits their customer’s account and credits your business account.

Electronic Check Authorization Information

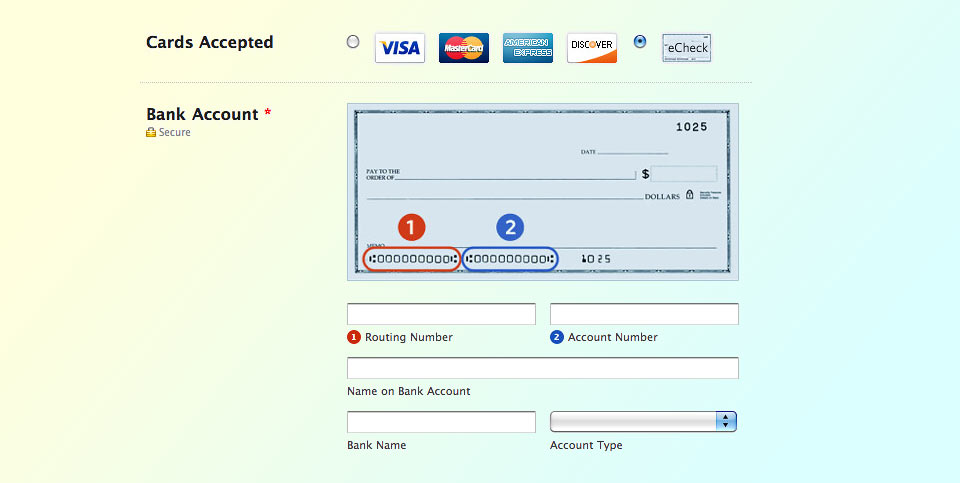

To use an eCheck, a customer must provide the name on the account, the account type, and the account and routing numbers. The information can be provided over the phone, or through a secure form on your website.

Customers are always required to authorize payment. Payment authorization for eChecks can be done through a signed contract, a recorded voice approval, or by a payment agreement on the merchant’s website.

How Long Does an eCheck Take to Clear?

Since electronic checks use ACH to transfer money, the time it takes for funds to clear — or become available — in the transferees account is based on the ACH transfer process.

Once an eCheck payment is authorized, you can initiate or schedule a transfer through your payment processing provider. When the customer’s bank confirms funds are available, they are transferred via ACH.

Because of the ACH process, an eCheck usually takes 3-5 days to clear and show up in your bank account.

eCheck Business Payment Verification

In order to enhance check-related security and mitigate the risk of fraud, business checking accounts often utilize measures such as “positive pay” and its alternative, “reverse positive pay”. They are common services offered to commercial clients as part of a suite of treasury management or fraud prevention tools.

Here’s how they work:

Postitive Pay

The positive pay system requires businesses to send details including check number, payee name, and payment amount to their banking institution for each check issued. Should any discrepancy arise between these details and those presented on an actual check — perhaps due to fraudulent activity — the system flags the item for review, resulting in rejection unless manually approved.

This proactive measure is key in preventing unauthorized transactions. Positive pay services have become particularly prevalent among U.S. companies looking to safeguard their accounts payable processes.

Reverse Positive Pay

Conversely, reverse positive pay shifts the onus from the bank to the business itself. In this scenario, while the bank still alerts the company of all checks presented for payment, it is ultimately up to the business’s discretion to approve or reject those checks based on correctness and legitimacy. This approach allows for more direct control by a company over its finances; however, it also carries the burden of more hands-on involvement in transaction verification.

This tandem of security strategies presents businesses with robust options to protect their financial resources against check fraud and ensure only valid transactions are processed through their accounts.

Who Should Accept eChecks?

eChecks are especially useful for businesses that accept large payments. Fees on credit card payments can be as high as 4.5%, and that doesn’t include the other costs associated with your merchant account.

Cost to process an eCheck depends on the provider, but the average rate falls between $0.10 and $1.50.

This is a great value if you are processing larger checks. Processing fees for a $10,000 eCheck payment will cost you less than a cup of coffee, while the processing fees for a $10,000 credit card payment could set you back over $350.

Recurring Payments With eChecks

eChecks can also allow businesses to accept recurring payments. Recurring payments together with the low processing fee make eChecks a great option for businesses like property management, mortgage lenders, and auto finance companies.

Likewise, eChecks are a good payment solution for subscription-based services. Gyms and fitness centers, item-of-the-month clubs, or mobile phone processors are just a few of the businesses that can benefit from autopay and autorenewal via eChecks.

Pros and Cons of eCheck Payment Processing

Are eChecks a good fit for your business? As with any other form of payment, eChecks have advantages and disadvantages. Here are a few considerations that you should take into account before deciding if eCheck processing is right for you.

Pros of eCheck Payment Processing

- Low Transaction Fees. While debit cards draw money directly from the customer’s bank account, they use the same processing networks as credit cards. An eCheck bypasses those processing networks. Quickbooks estimates that eCheck payments can reduce processing fees by as much as 60%.

- More Secure Than Paper Checks. eChecks aren’t just cheaper and more convenient for businesses, but they are also safer for customers. A paper check contains the account holder’s name, financial institution, routing number, and bank account number. It then passes through several hands while being processed, raising the risk of identity theft. On the other hand, eChecks use encryption to prevent data theft.

- Can Reduce Instances of Declined Cards for Recurring Payments. Credit and debit cards expire and are often lost or stolen. Checking account information is more stable. According to GoCardless, failure rates on recurring card payments vary but are generally over five percent, while the failure rate on eChecks is typically under one percent.

- Collect Payments from People Without Credit or Debit Cards. Even today, there are some people that choose not to use a debit or credit card. eChecks allow you to collect payments from those who forgo card payments.

- Convenient for B2B Payments. While personal checks are becoming increasingly rare, business-to-business transactions frequently involve paper checks. Using eChecks can speed processing times and reduce mailing costs.

Cons of eCheck Payment Processing

- Slower Than Other Forms of Payment. Getting the customer authorization for an eCheck can be more complicated and labor-intensive than simply swiping a card. And once you deposit an eCheck, you may have a long wait before the funds arrive in your account. Funds from a debit card or online payment services like Paypal and Venmo are usually available within a few minutes, whereas an eCheck generally takes 3-5 business days to clear.

- No Weekend or Holiday Processing. Because eChecks rely on ACH processing, they are not processed on weekends or holidays. If you deposit an eCheck on Monday, you may see funds by Thursday. If you deposit on the Friday before a bank holiday you may wait a week before the funds become available.

- eChecks Can Bounce. There are a number of reasons why your customer’s eCheck might be declined. They may have insufficient funds, or there could be a mistake on the part of the customer’s bank. Customers may provide an inaccurate bank or routing number, or employees may make typographical errors. Straightening out a bounced eChecks can be time-consuming. And, bounced checks can result in chargeback fees, or non-payment for your goods and services.

You can mitigate the risk of a bounced check by using a check verification service. A check verification service runs your customer’s personal information against a database of bounced checks. This verifies that the customer has an active bank account and an accurate routing number.

- May Not Work for “High Risk” Clients. Some businesses are more prone to chargebacks and payment complications than others. According to Securion Pay, those businesses may include everything from adult services providers and weapons sellers to antique dealers and travel agencies. If you are able to find an eCheck processor at all, you will pay a premium for their services.

Cost of eCheck Payment Processing

So what can you expect to pay for eCheck processing? Different eCheck processing companies have different terms.

eCheck payment processing fee structures

- Flat fee: You will pay a flat amount for eCheck processing, regardless of the size of the eCheck. Flat fee eCheck fees usually range from $0.30 to $2.50 per transaction.

- Percentage fee: Also known as a variable fee structure. A percentage fee structure charges a specified percentage of the total amount of the eCheck. This amount can range anywhere from 0.5% to 3%.

- Flat fee + percentage fee structure: You will be charged a flat fee per eCheck processed, plus a percentage of the total amount of the check. For example, you could be a flat charged $2, plus an additional 0.5% of the total check amount.

Be sure to consider the fee structure when deciding which eCheck processor to go with. If you’re processing eChecks of larger dollar amounts, you’ll probably save by going with a flat-fee structure.

Along with the per-transaction fees, some other fees may apply to the cost of eCheck payment processing:

- Application Fees: Some processors charge an application fee for the required due diligence and credit checks on your company. In exchange, they may help you set up your system to make sure it is properly integrated with their back-end hardware.

- ACH Return and Chargeback Fees: If your client’s check bounces or if your client files a chargeback request with his bank, you could be charged a penalty. If this happens too often, you may find your fees and percentage rate increased. Or you may be in danger of your processor dropping you altogether.

- High-Risk Fees: If you are a high-risk client, you can expect your payments for eCheck processing to be comparable to the price of card transactions. At Performance Card Services – a high-risk card and eCheck processor – rates and fees for eCheck processing range from 1.99% to 4.5%, plus a $0.25 to $0.49 transaction fee.

- Monthly Minimum Fees: Your eCheck processor may have a monthly minimum for fees. You may be required to pay these minimums regardless of how many checks you actually process.

- Rental Fees: You may be charged a monthly rental fee for Point of Sale (POS) equipment like check scanners and PIN pads.

- Termination Fees: If your business closes or you decide you no longer need eCheck processing services you may be on the hook for an early termination fee. Be sure that you read your contract carefully and avoid these unnecessary fees whenever possible.

- Verification Fees: Verification transactions usually cost around $0.15 to $0.35 per item. Check guarantee service charges start at around 1.5% of total eCheck revenue. While verification services are usually optional, they may be required if you are a high-risk merchant or if you have too many returned checks or chargebacks.

Want to know more about payment processing? Read Payment Processing: Everything You Need to Know.

Final Word on eCheck Payment Processing

The more payment options you have, the more potential customers you can reach. eChecks may help you expand your customer base, and can help you save money on fees collected from recurring payments.

Although eChecks may not be suitable for every merchant, they are definitely worth considering for businesses that regularly collect high-dollar-amount payments.